July in Numbers: Back in Business [Market Report]

By Just Catamarans Licensed Broker Uliana Tikhonovoa

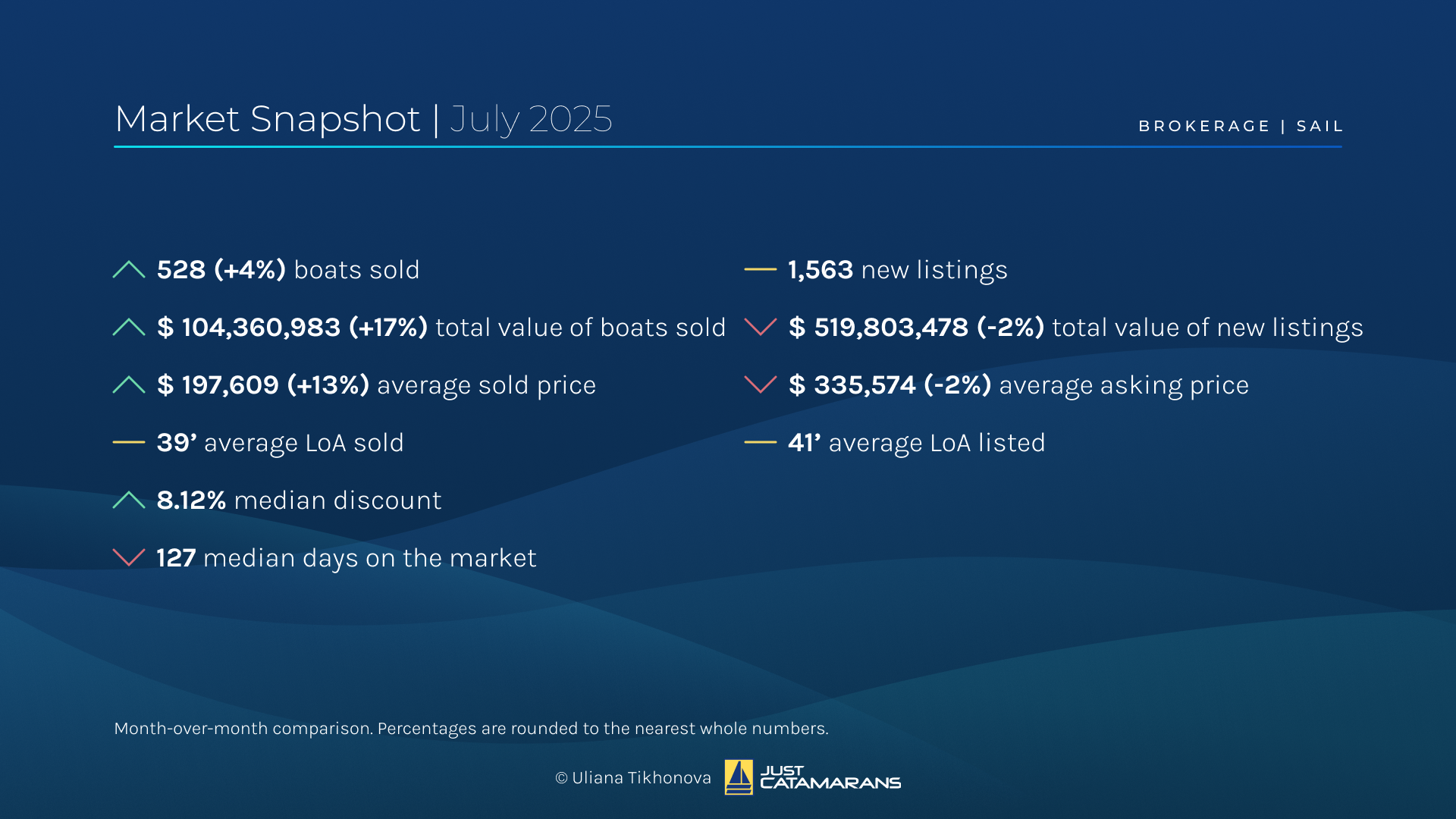

Sailing Yacht Brokerage Market Overview, July 2025.

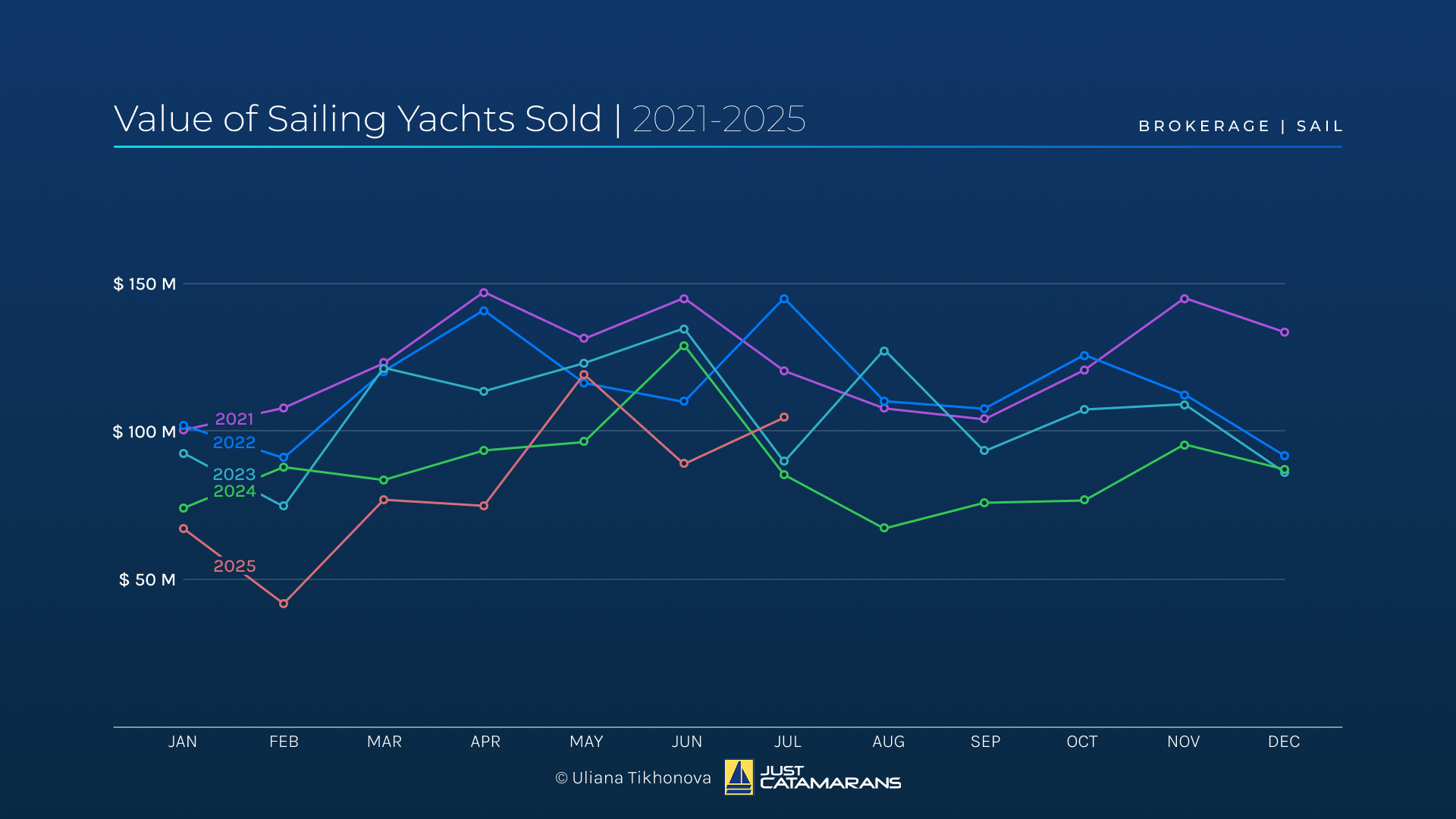

After a cooler June, the sailing yacht market softly rebounded in July, despite this month being historically quieter. Unlike the superyacht segment, which reported 42% decline compared to the total sales value in the previous month, the sailing segment not only went up by 17% in total value, but also surpassed July results of previous post-pandemic years 2023 and 2024. A decreased median time on the market indicates that inventory started to move faster.

Number of Sailing Yachts Sold, 2021-2025.

Value of Sailing Yachts Sold, 2021-2025.

The number of newcomers remained about the same, with a tiny 2% dip in both total value and average asking price of new listings, mainly attributed to monohulls.

Sailing Multihulls: Solid Gains and Wave of Luxury Inventory

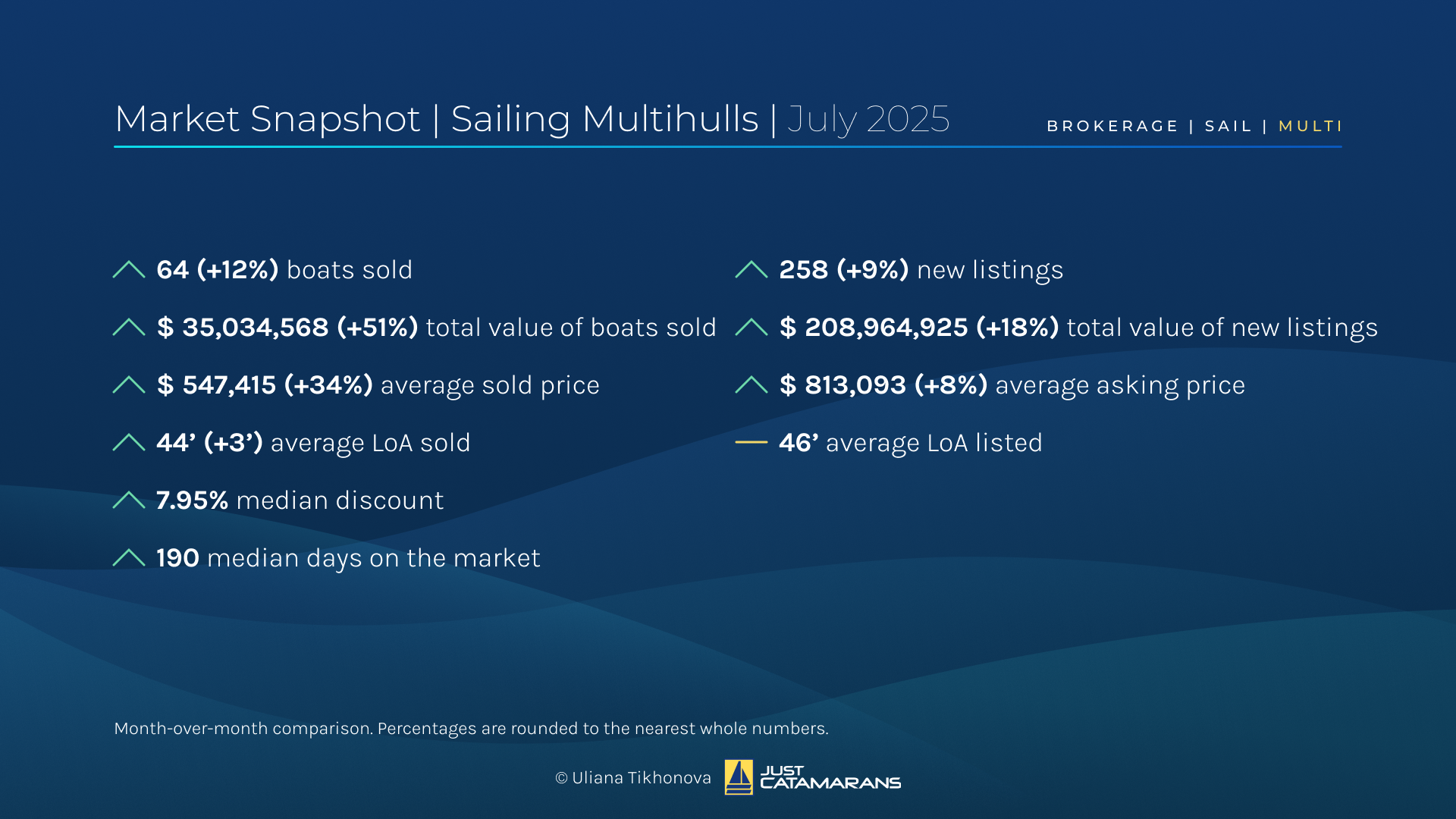

Sailing Multihull Market Overview, July 2025.

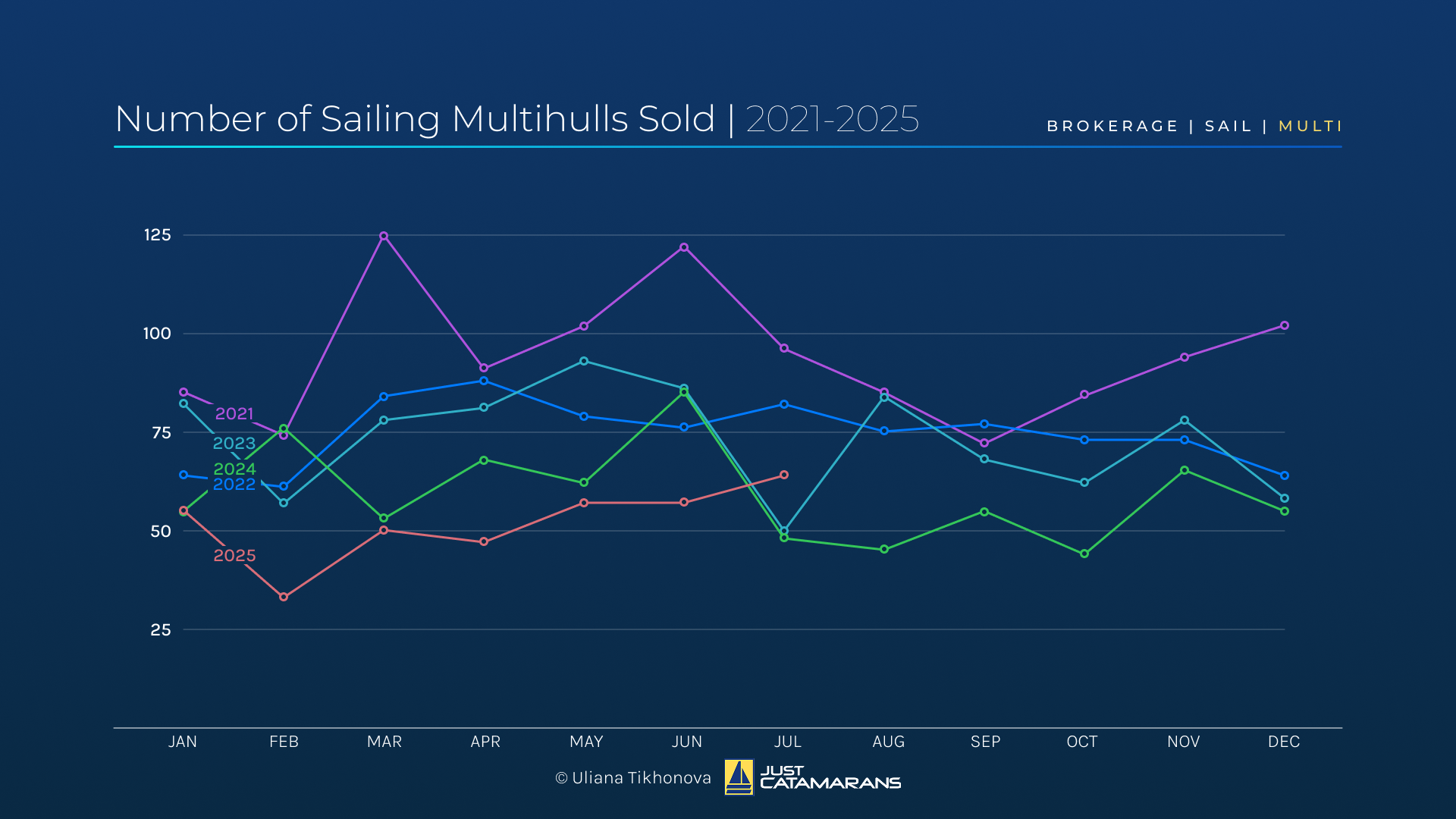

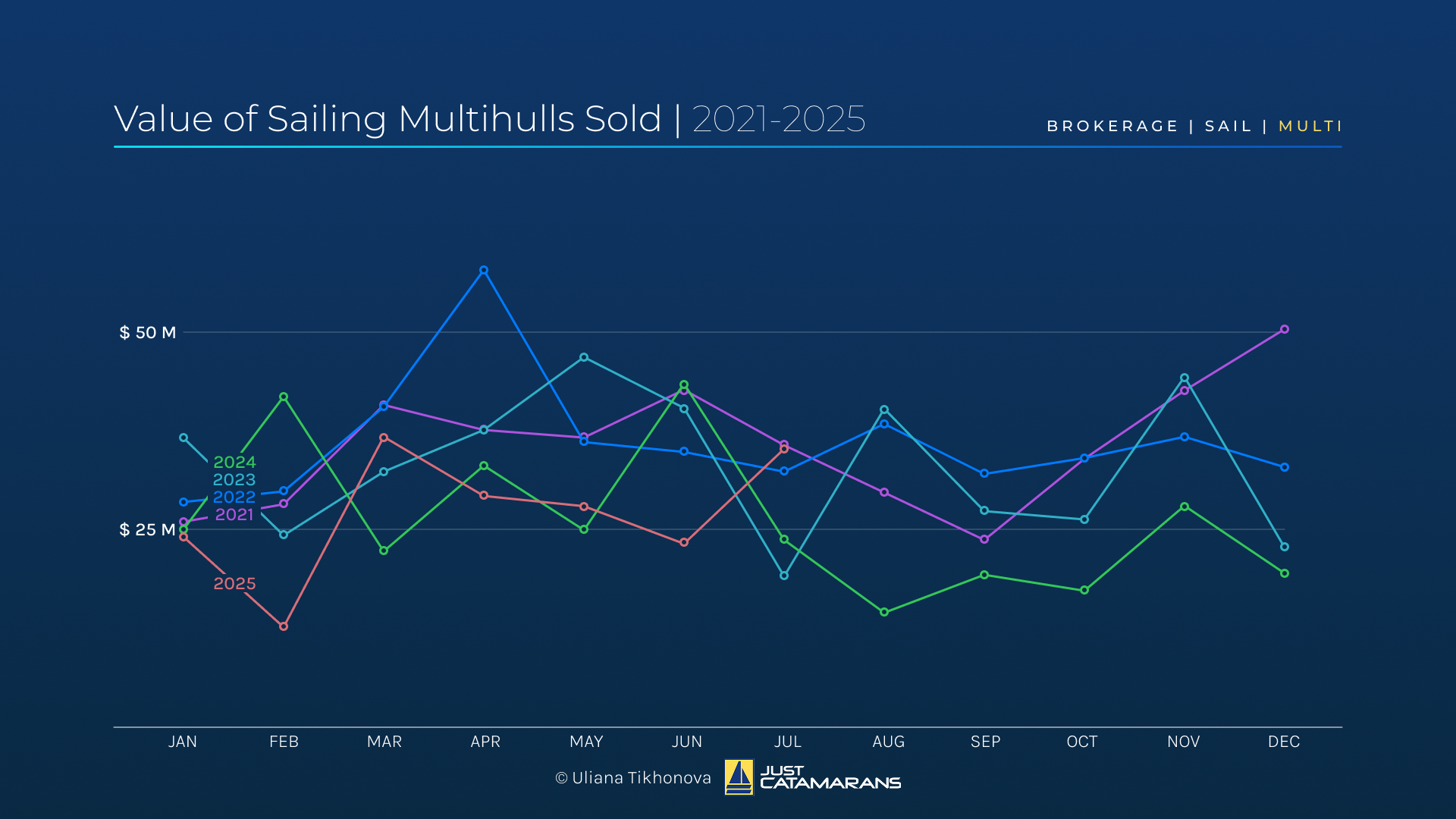

Multihulls were top performers in July, with a 12% increase in boats sold by volume and impressive 51% climb in total value, largely due to several high-profile sales. The total value of multihulls sold this month outperformed post-pandemic July figures and reached levels not seen since 2021.

The average sold price jumped 34% to nearly $550,000, with the average length rising to 44 ft, suggesting that larger and more expensive boats were changing hands this month. The median discount rose from 6% to 8%, indicating sellers’ willingness to negotiate and creating more favorable conditions for buyers.

Number of Sailing Multihulls Sold, 2021-2025.

Value of Sailing Multihulls Sold, 2021-2025.

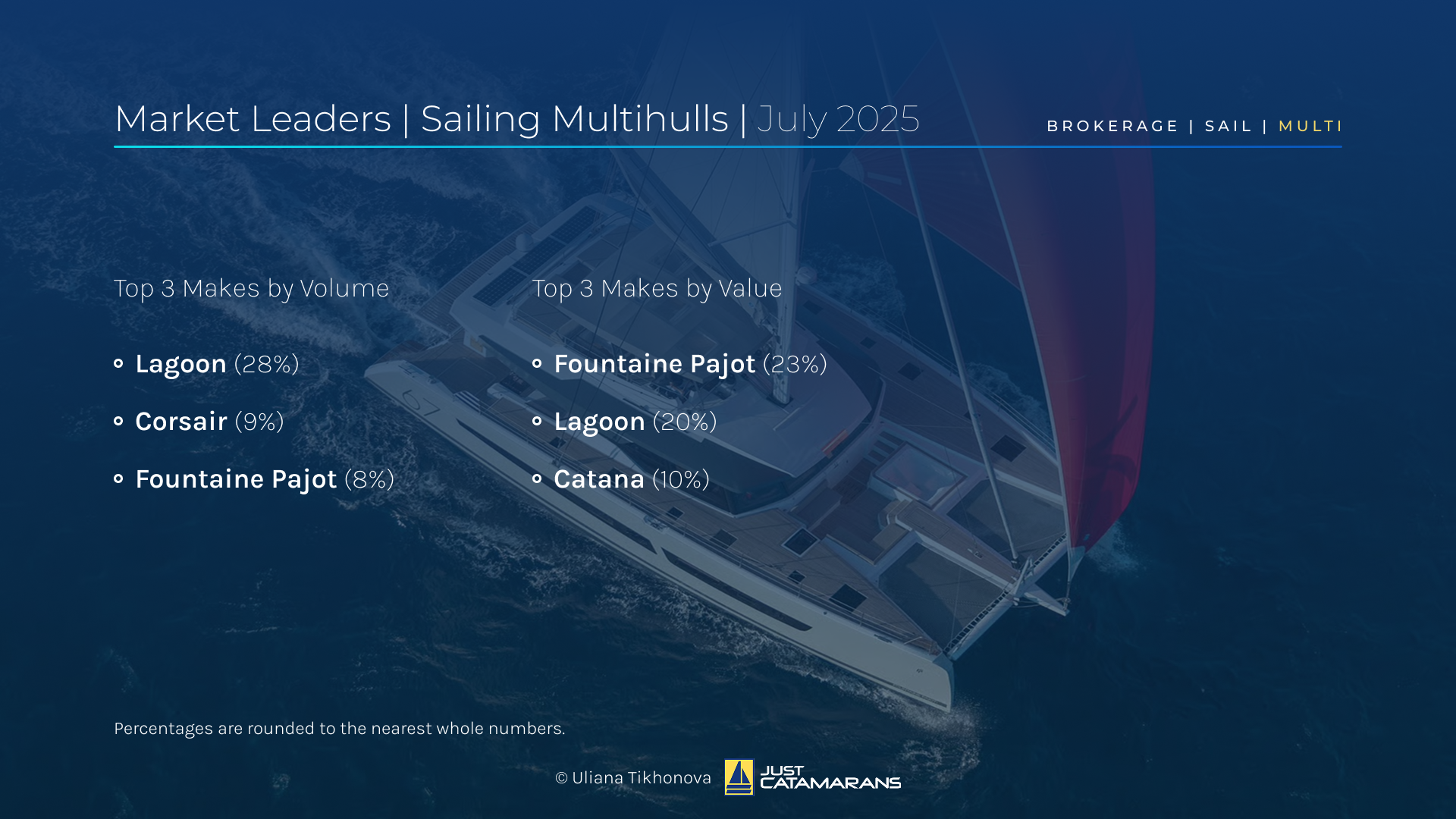

Lagoon, Corsair, and Fountaine Pajot were the top 3 brokerage performers by volume, while by total sales value Fountaine Pajot took the the lead, mainly thanks to two Alegria 67 sales (over $3 million each!), followed by Lagoon and Catana.

Market Leaders, Sailing Multihulls, July 2025. Background image: Fountaine Pajot Alegria 67, courtesy Fountaine Pajot.

Notable transactions included the Fountaine Pajot Alegria 67 4 SeaZens (2022), sold for $3.1 million after less than 3 months on the market, and the HH50 Tribute (2020)—a rare brokerage find—sold for slightly above $1.6 million by Scott Mayer of Just Catamarans.

Top left: HH50 Tribute (2020), courtesy Just Catamarans. Bottom right: Fountaine Pajot Alegria 67, courtesy Fountaine Pajot.

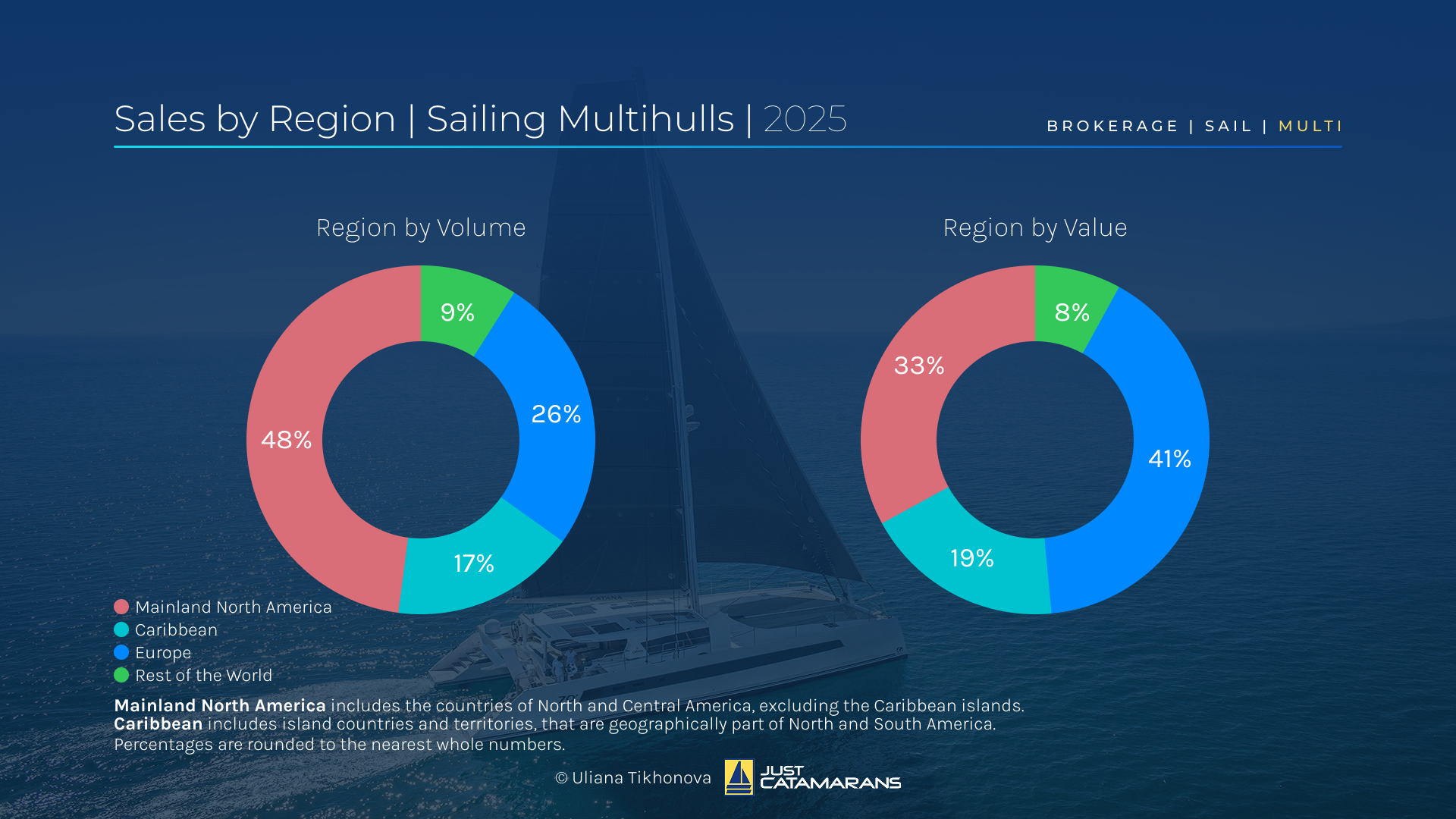

Multihull Sales Geography

Since January 2025, most of the deals were closed in North America (48%) and in the Caribbean (17%), followed by Europe (26%) and the rest of the world (9%). By value, however, Europe accounted for 41%, while the North American share was just 33% and the Caribbean 9%, with the rest of the world showing 8%, confirming the perception that boats in Europe tend to carry higher asking prices.

Sales by Region, Sailing Multihulls, 2025. Background image: Catana 70, courtesy Catana Catamarans.

Active Multihull Listings

July brought a modest 9% rise in new listings, but a sharper 18% increase in total value, offering more capable, better-equipped yachts to buyers ready to pay an average of $813,093—up 8% from June. By the end of July, over 2,500 sailing multihulls were available, catering to a wide range of use cases, requirements, and budgets, comprising a steady 19% share of the global sailboat market.

In addition to more than ten 60-80 ft Sunreefs entering the market this month—priced between $1.3 and 7.5 millions and significantly contributing to the jump in total listing value— other notable arrivals included the HH66 Lee Overlay Partners III (2020), asking $3.1 million, and the Knysna 500SE Alora (2023), asking $1.25 million—a rare, solid blue-water cruiser. Just Catamarans proudly represents the Knysna brand for new builds, so if you’re considering a custom project, we’d be happy to guide you through the possibilities!

Top left: HH66, courtesy HH Catamarans. Bottom right: Knysna 500SE, courtesy Knysna Yacht Company.

Among the most expensive multihulls in the superyacht segment (24 meters and above), the 145-foot custom Pendennis Hemisphere (2011) continues to lead with an asking price of €46 million (about $53.8 million), while in the under-24-meter category, the Sunreef 70 Eco n+1 (2024) has become the highest-priced yacht, listed at €6.5 million (about $7.6 million).

Top left: 145-foot Pendennis Custom Hemisphere (2011), courtesy BOAT International. Bottom right: Sunreef 70 Eco n+1 (2024), courtesy Ocean Sailing House.

Sailing Monohulls: Steady Growth in Sales and Fresh Supply of More Affordable Boats

Sailing Monohull Market Overview, July 2025.

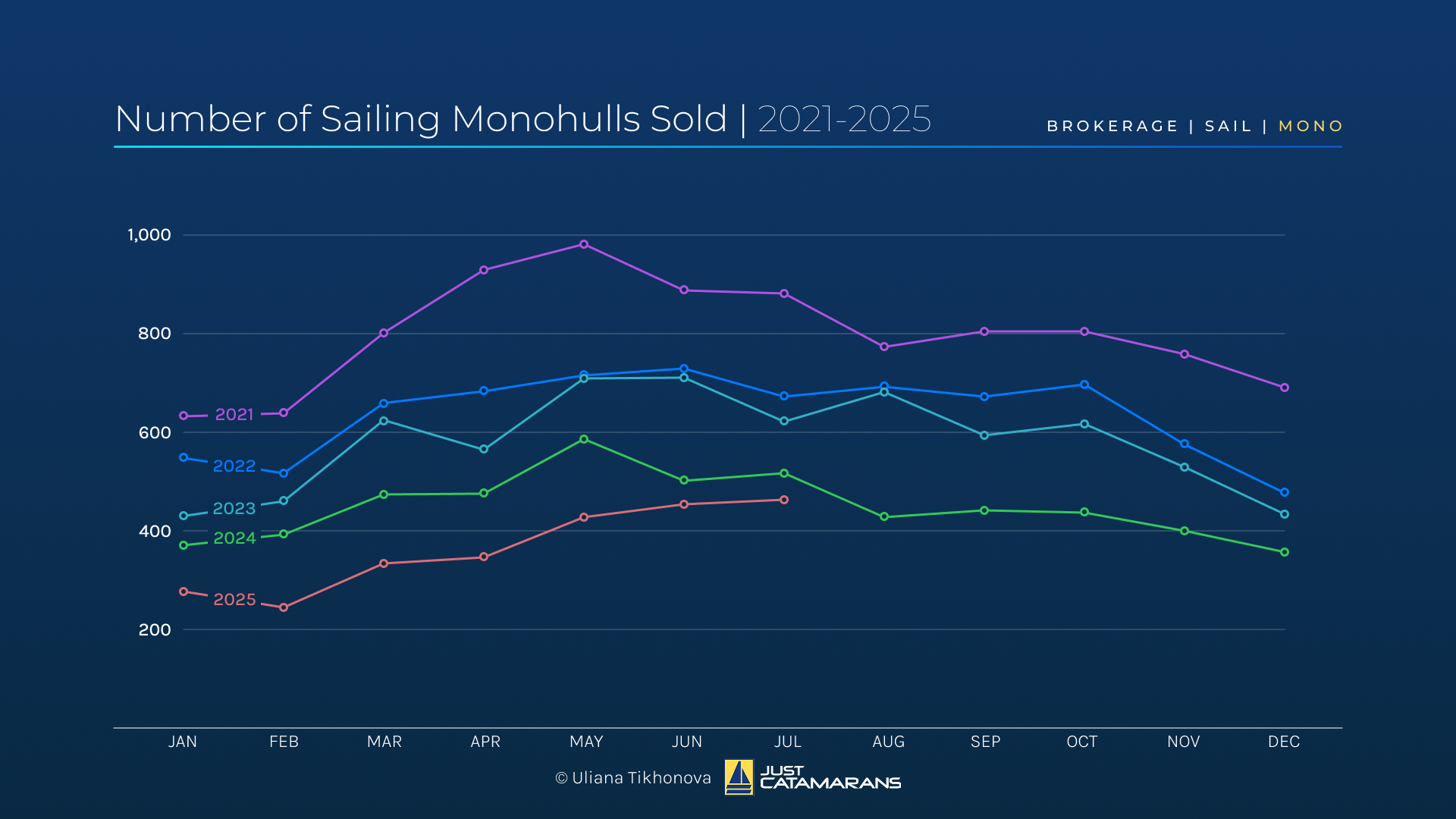

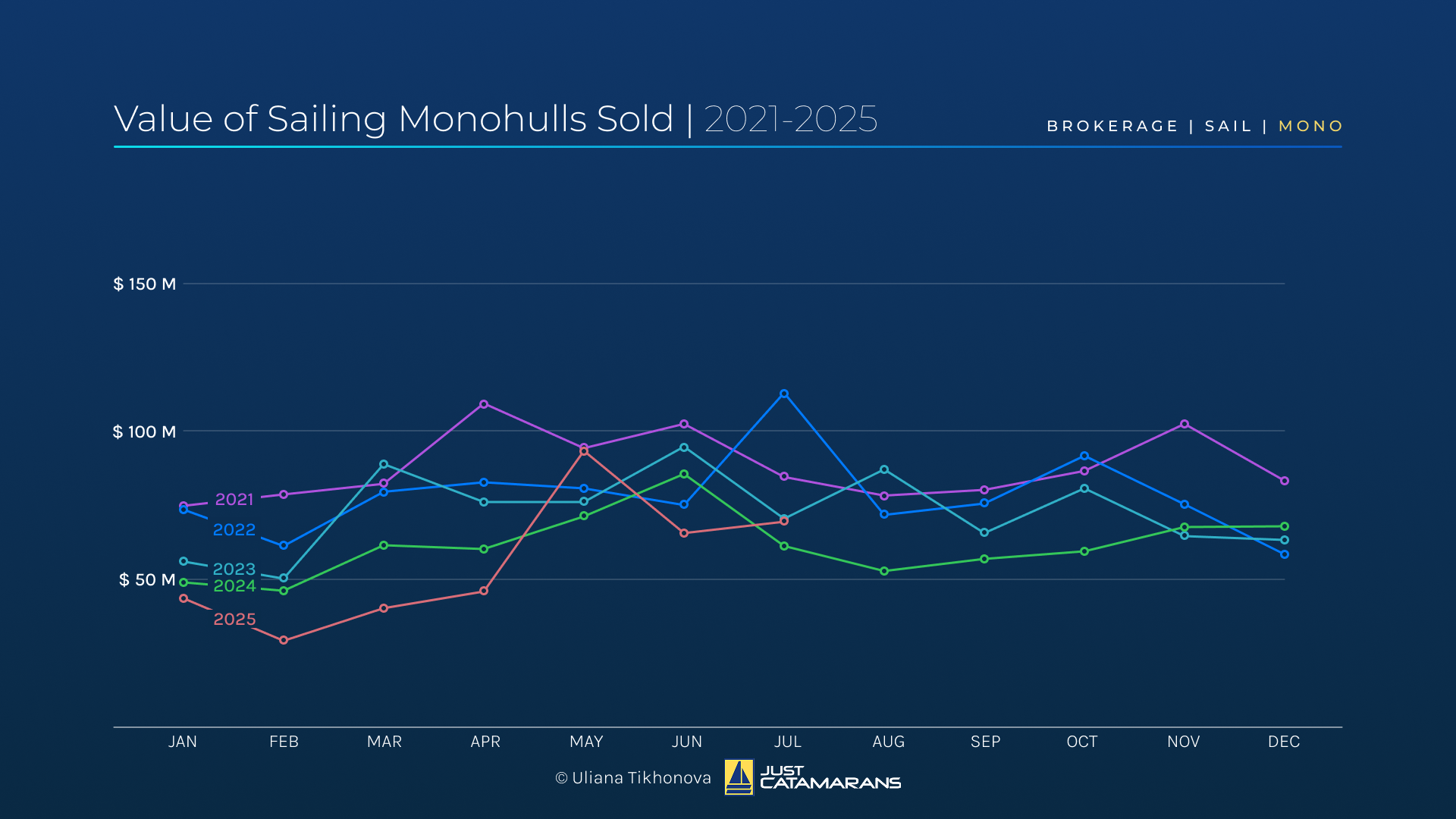

Monohulls followed the lead of multihulls, showing modest improvement in both total number of sales (up 2%) and total sales value (up 5%). While they didn’t reach the heights of the multihull market, they surpassed 2024 levels and matched the 2023 figures, generating nearly $70 million in July.

The average sold price rose 5%, closing in on $150,000, while the average length held steady at 38 ft—bringing buyers’ expectations closer to the new offers entering the market. The median discount edged slightly lower, while time on the market increased, hinting that sellers may be reaching their flexibility limits.

Number of Sailing Monohulls Sold, 2021-2025.

Value of Sailing Monohulls Sold, 2021-2025.

Beneteau, Catalina, and Hunter dominated the brokerage space by volume, while Oyster Yachts managed to secure second place in value with just three sales, edging between Beneteau and Jeanneau.

Market Leaders, Sailing Monohulls, July 2025. Background image: Beneteau Oceanis Yacht 60, courtesy Beneteau.

Notable transactions included the Oyster 675 Seabird (2021), sold for £3,195,000 (about $4.2 million), and the 93-foot Wally 94 Galma (2003), sold for €2 million (about $2.3 million).

Top left: Oyster 675 Seabird (2021), courtesy Oyster Yachts. Bottom right: 93-foot Wally 94 Galma (2003), courtesy BOAT International.

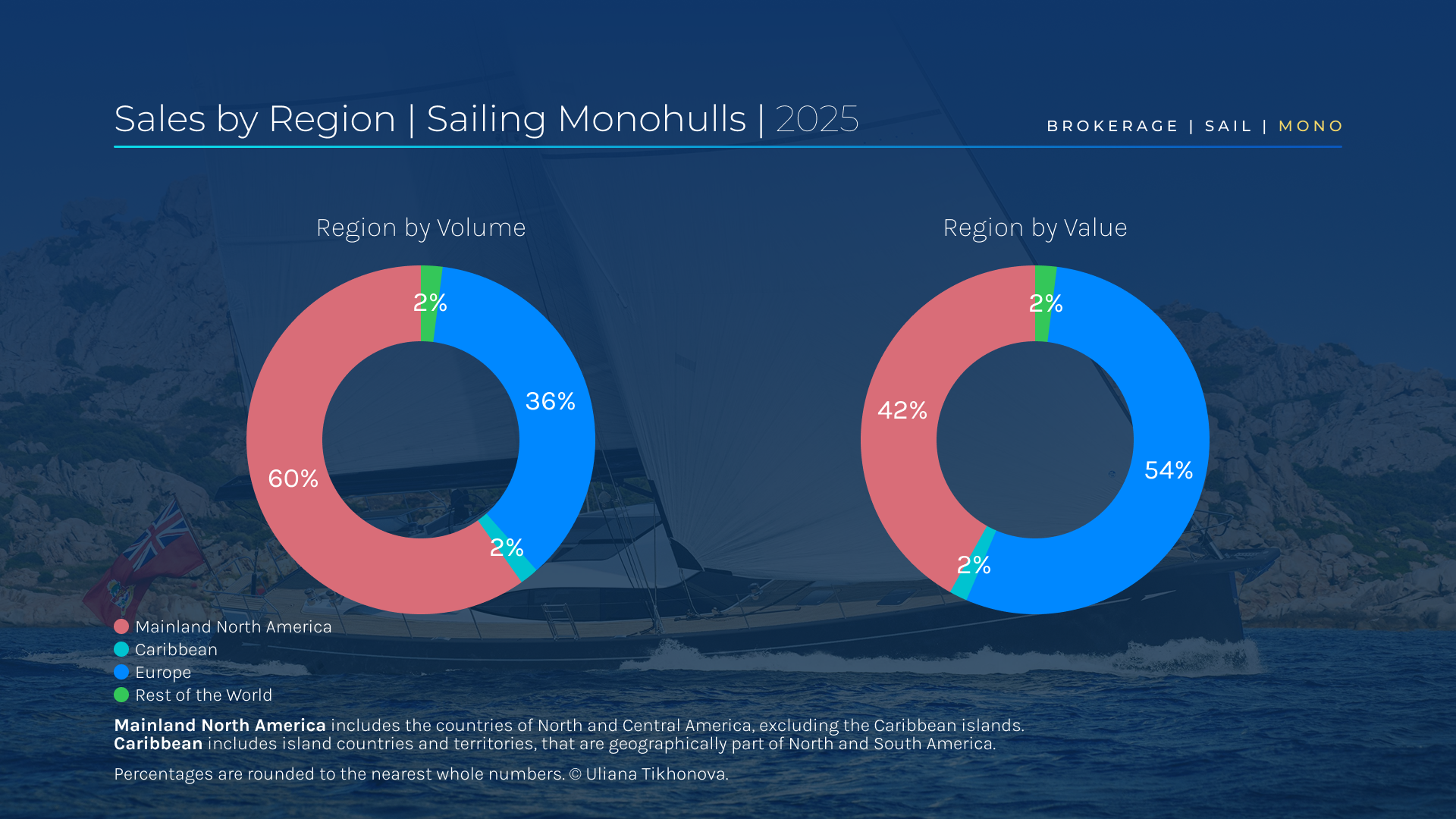

Monohull Sales Geography

Since the start of the year, North America has seen the most closings (60%), followed by Europe (36%). By value, however, Europe leads with 54%, while North America accounts for just 42%, indicating that more affordable monohulls are changing hands on this side of the Atlantic. The Caribbean and the rest of the world each made up 2% sales, both by volume and by value.

Sales by Region, Sailing Monohulls, 2025. Background image: Oyster 885SII, courtesy Oyster Yachts.

Active Monohull Listings

In July, monohulls contributed slightly less to total new listings, with an even sharper decline in total value—roughly $311 million, down by 12%. The average asking price also fell 11% to around $240,000, creating more opportunities for budget-conscious buyers. By the end of July, nearly 11,700 monohulls were listed on the global brokerage market, representing 81% of the sailing fleet.

Noteworthy additions included the 142-foot Baltic Light Displacement Sailing Yacht Canova (2019), listed at an impressive €32.9 million (about $38.4 million), and a pair of 88-foot Oysters, both asking around €5 million (close to $6 million). On the more attainable side, the Baltic 50 Eleven (2004), priced at €649,000 (around $750,000), stood out.

Top left: 142-foot Baltic Light Displacement Yacht Canova (2019), courtesy BOAT International. Bottom right: Baltic 50, courtesy Baltic Yachts.

At the very top of the market, the striking 193-foot Vitters Cruising Ketch Maximus (2023) remains the most expensive sailing superyacht (24 meters and above), listed at €79.5 million (about $93 million), while in the under-24-meter category, the 62-foot Oyster 595 C&C (2024) remains the highest-priced monohull at £4.1 million (about $5.5 million).

Top left: 193-foot Vitters Cruising Ketch Maximus (2023), courtesy BOAT International. Bottom right: Oyster 595, courtesy Oyster Yachts.

Next on the Horizon

July’s unusually active pace—especially in the multihull segment—marked a welcome shift after several cooler years. Whether this momentum carries into the high season remains to be seen, particularly with tariffs now playing a bigger role in buyer decisions.

North America remains the largest multihull market by volume, and with U.S. tariffs now in effect, there’s potential for increased activity on the brokerage market at this side of the Atlantic, as buyers explore more competitively priced options closer to home.

Let’s see what August brings!

—

If you’re in the market for a yacht—sail or power, new or pre-owned—feel free to connect with me. I’d be happy to assist in any way I can!

As always, I welcome and highly appreciate your feedback. This analysis is based on the available data, and actual numbers may differ. The analysis focuses on the brokerage market and does not reflect new builds. These are my opinions and conclusions, which may not align with yours.

Based on the available data, it appears that the actual total volume of sailboat sales is likely at least three times greater than what I use for my analysis. Still, this dataset offers a valuable opportunity to gain a representative snapshot of the brokerage market. A big shoutout to the brokers who take the time to record and report their sales—your efforts make this kind of market insight possible!

Data source: boatwizard.com