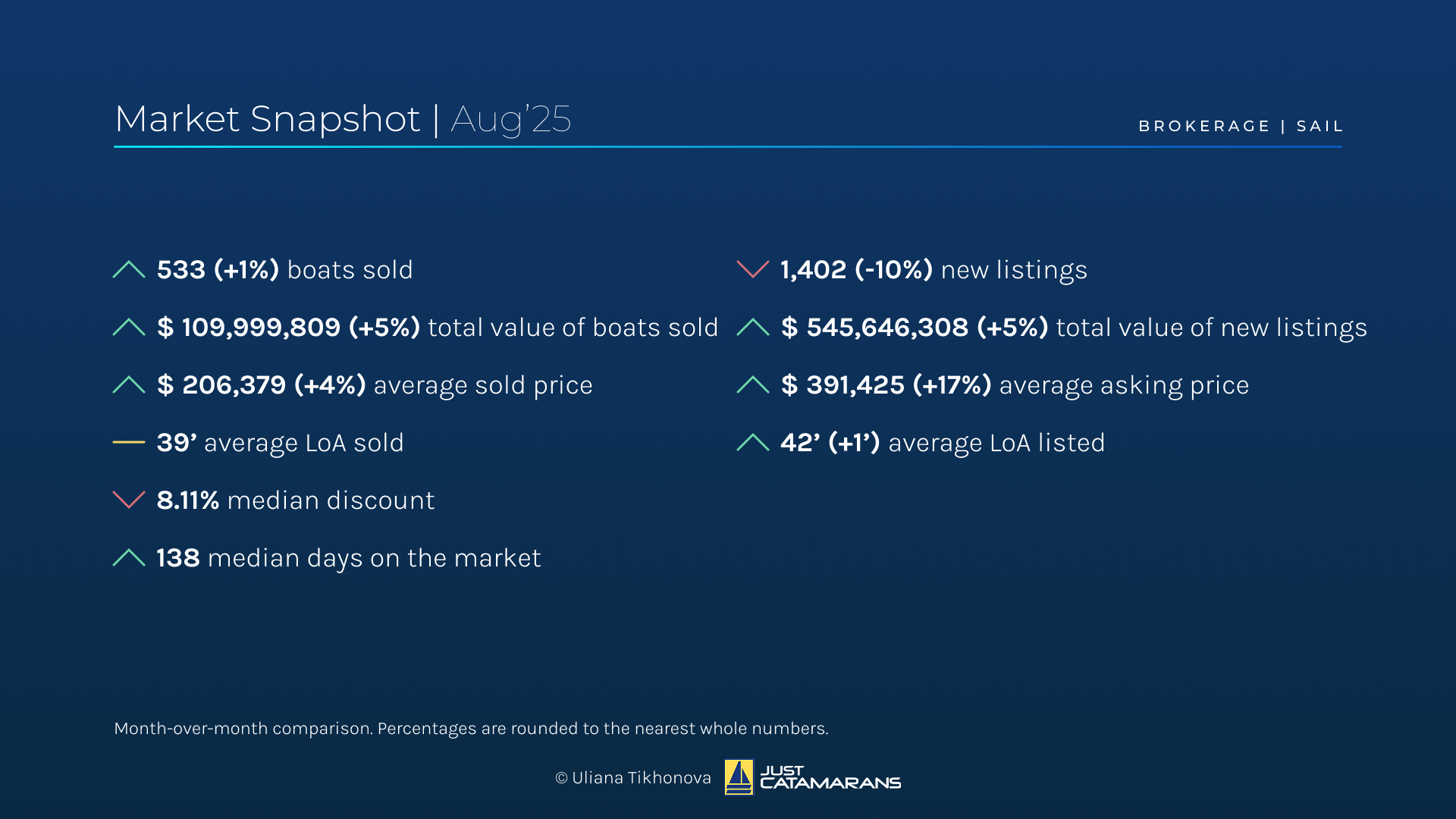

August in Numbers: Continued Growth [Market Report]

Sailing Yacht Brokerage Market Overview, August 2025.

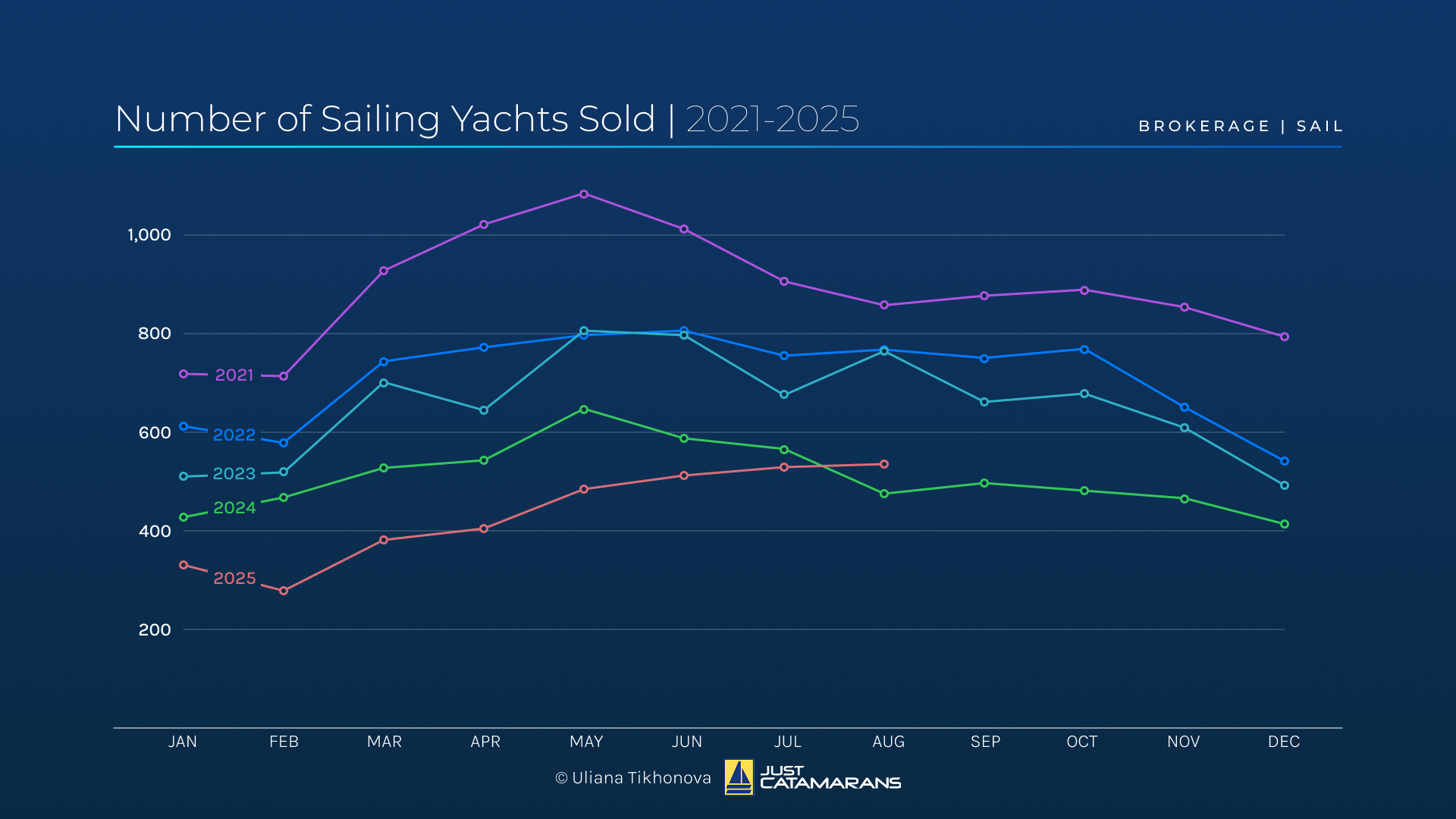

Number of Sailing Yachts Sold, 2021–2025.

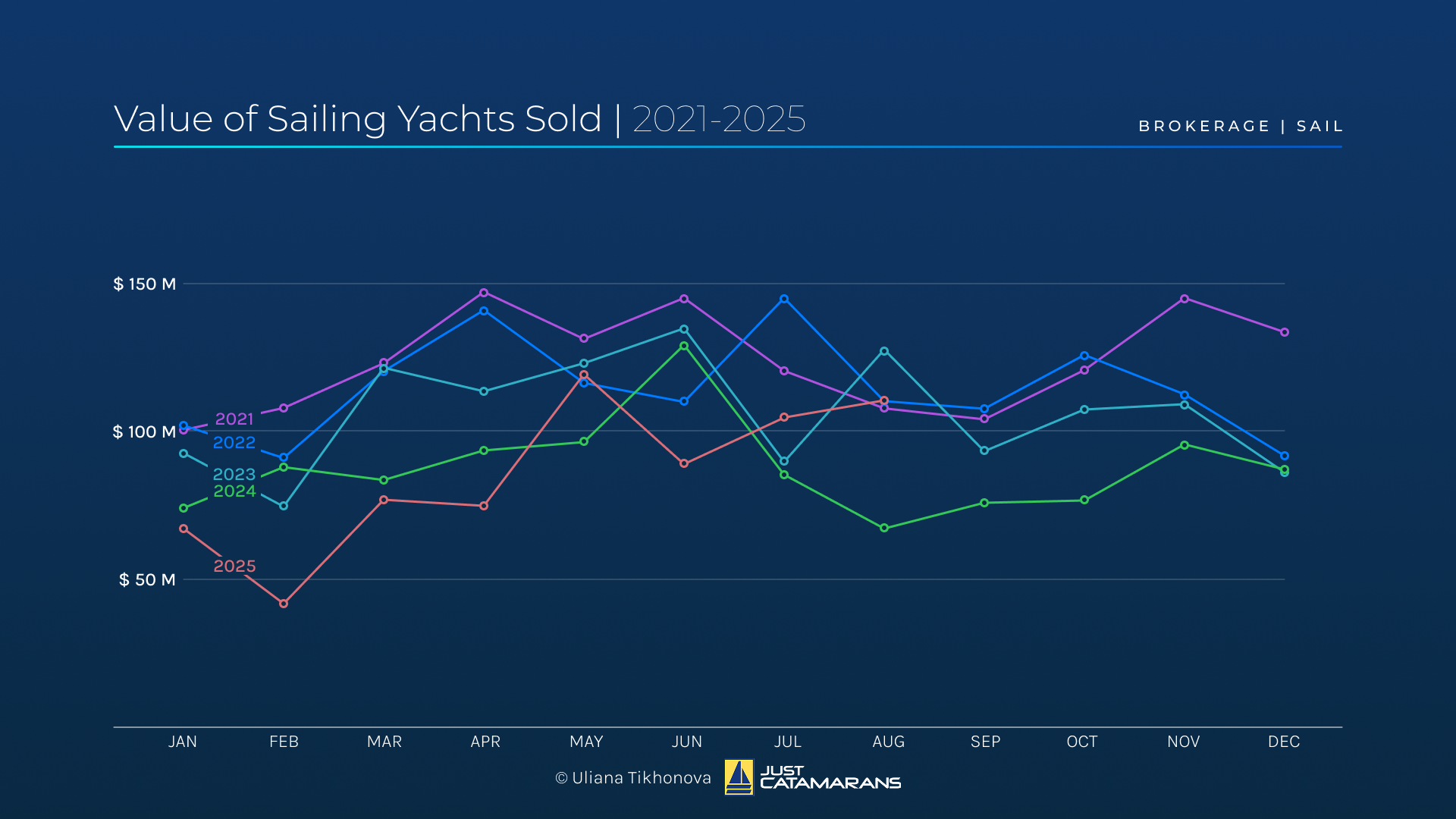

Value of Sailing Yachts Sold, 2021–2025.

An increased median time on the market, coupled with growth in sales volume, suggests that older inventory was finally changing hands. The number of newcomers dropped by 10%. Combined with the higher total value and average asking price, this points to an inflow of more luxurious vessels.

Take a deeper dive into the sailing multihull and monohull segments — and explore the newly added power multihulls — below.

Sailing Multihulls: Momentum with a Twist

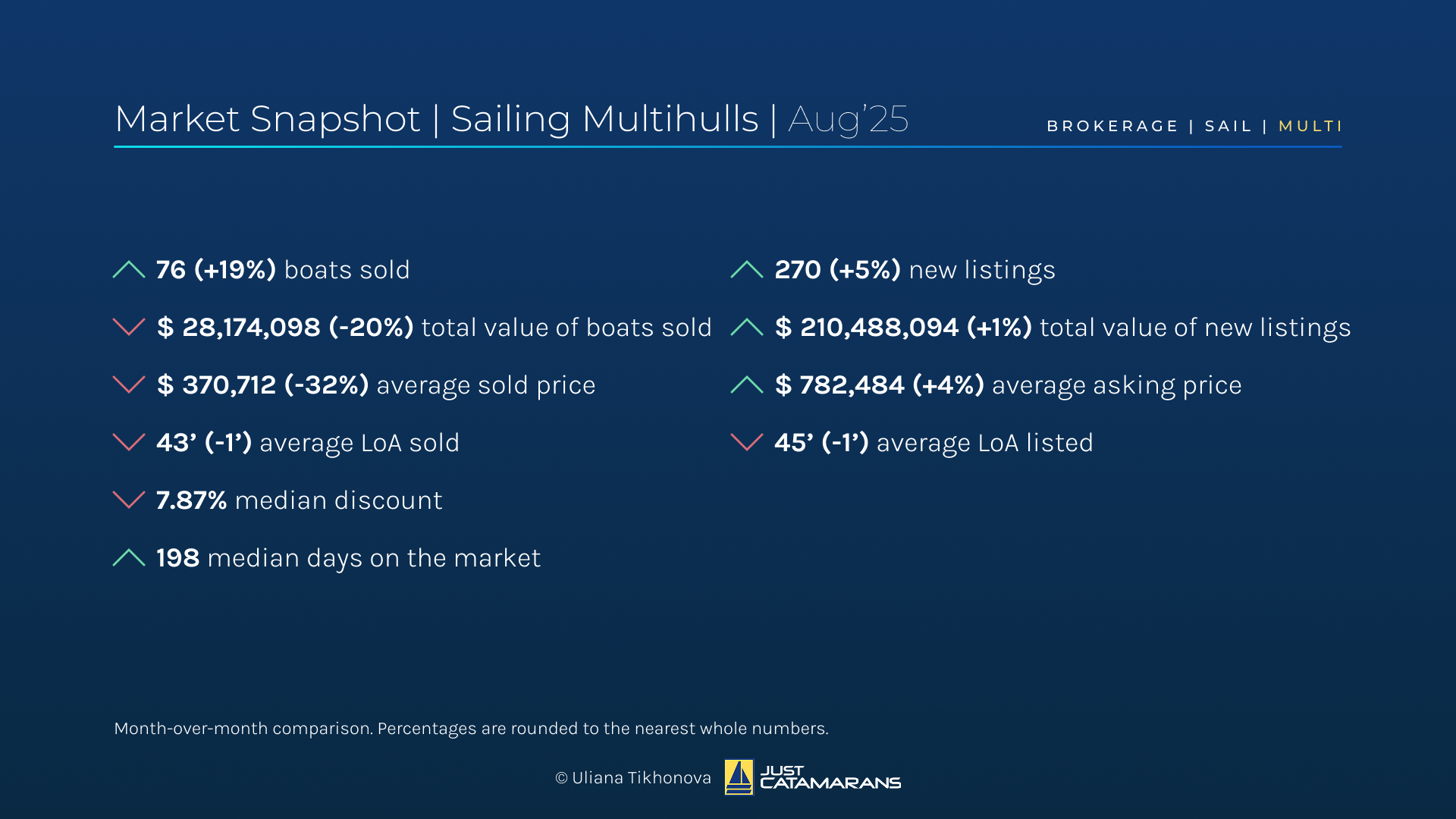

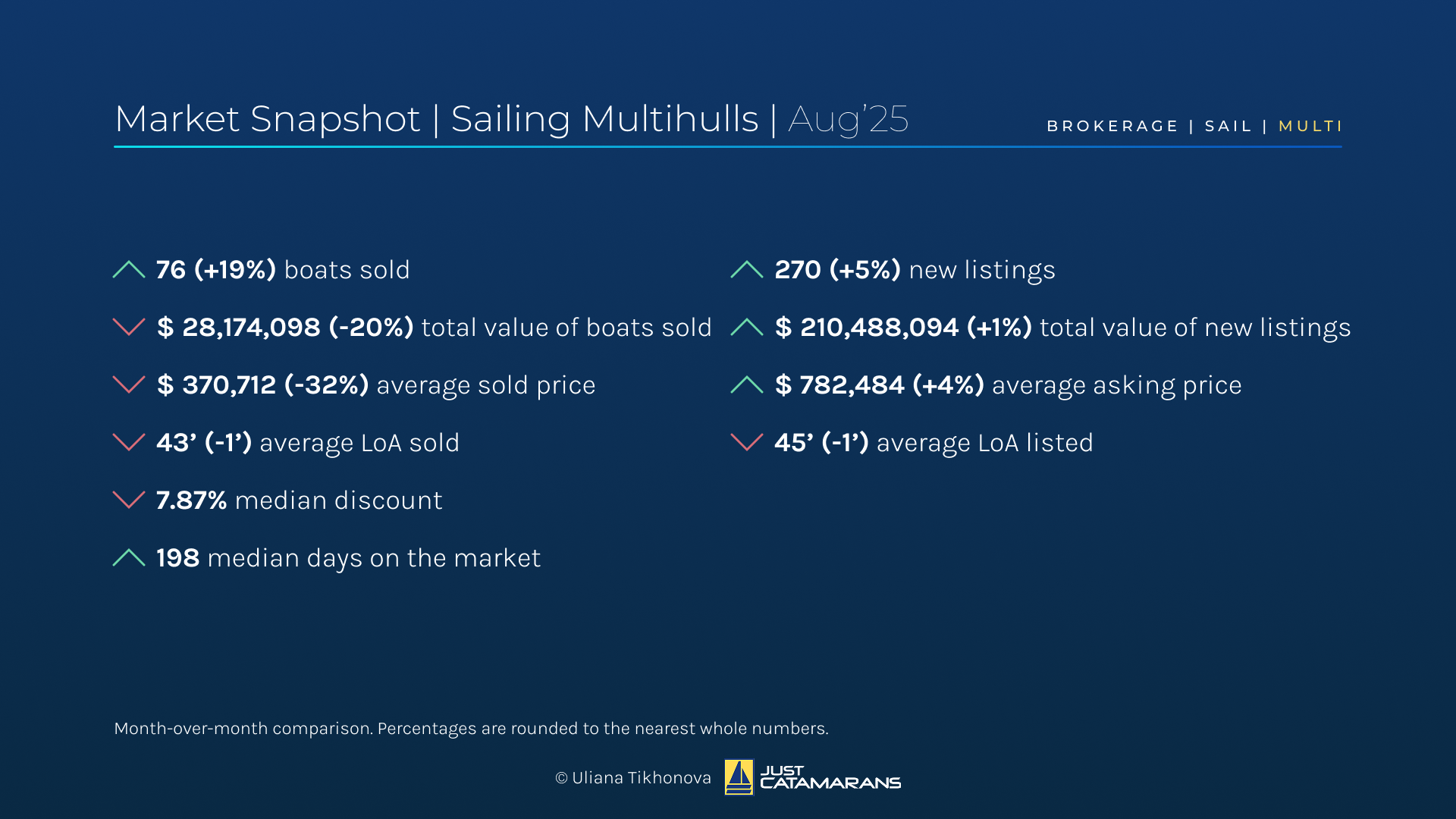

Sailing Multihull Market Overview, August 2025.

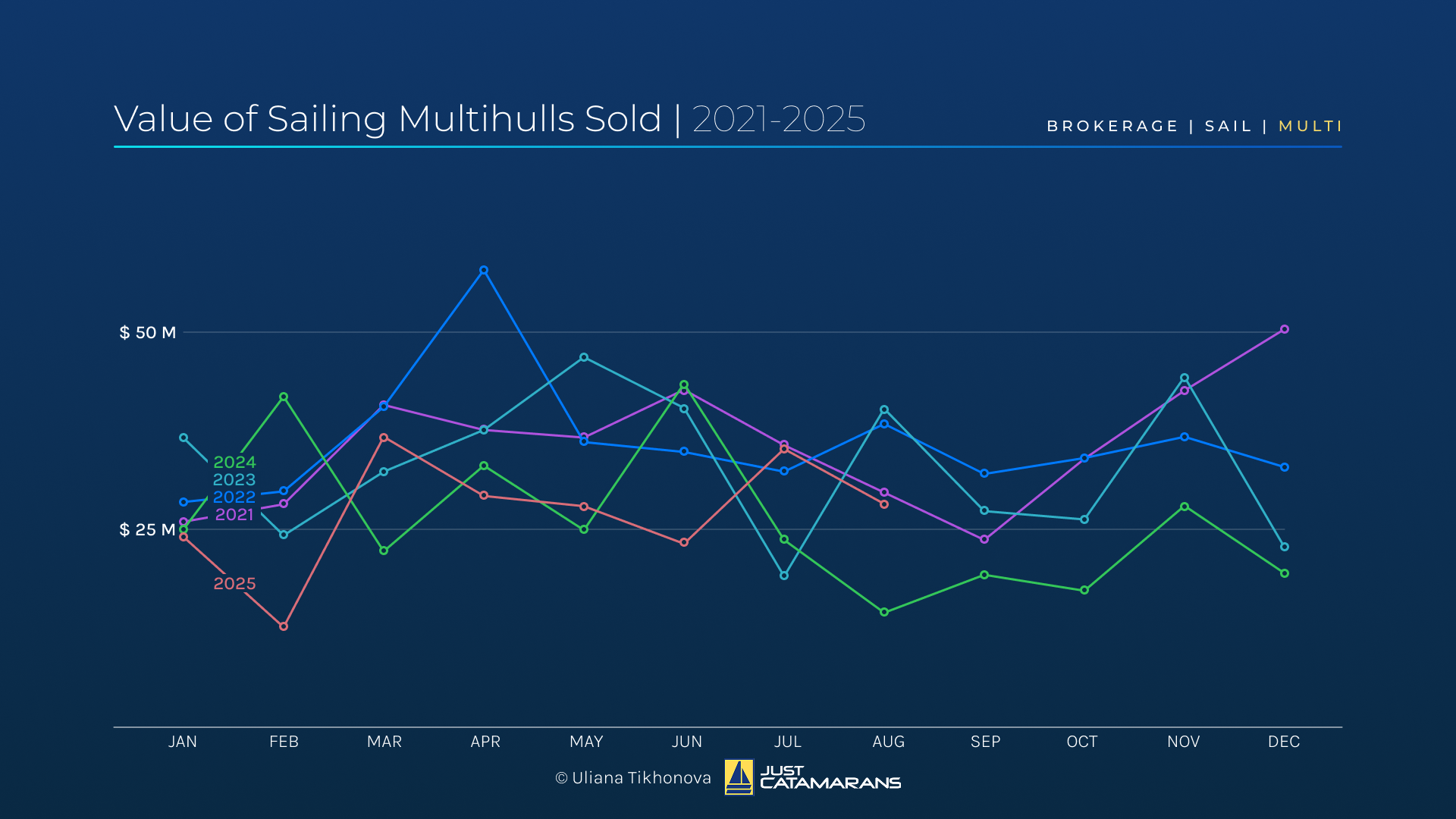

Multihulls maintained their positive trend in August, with a 19% increase in sales by volume. The dip in total value and average asking price was anticipated, as July’s results had been inflated by several high-profile transactions that did not repeat this month. Even so, August’s sales volume outperformed post-pandemic levels and aligned more closely with pandemic-year activity. Despite a 20% drop in total value, which still reached over $28 million, results were stronger than last year’s.

Number of Sailing Multihulls Sold, 2021–2025.

Value of Sailing Multihulls Sold, 2021–2025.

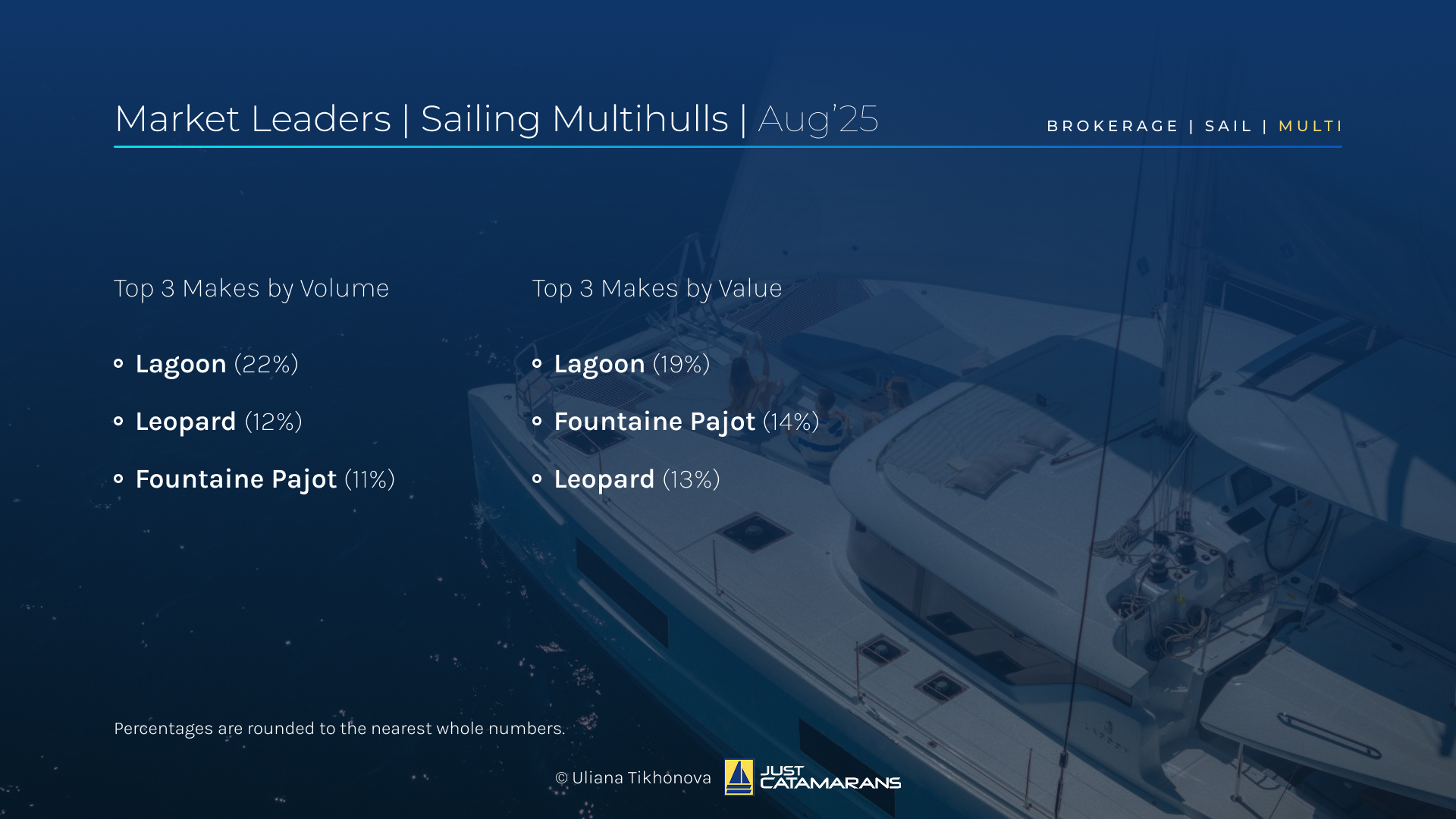

Lagoon retained first place by volume and value, while Leopard moved onto the podium for the first time and, along with Fountaine Pajot, edged Corsair out of the top three.

Market Leaders, Sailing Multihulls, August 2025. Background image: Lagoon 46 ICONIC, courtesy Lagoon Catamarans.

Top left: Matrix Yachts Silhouette 760 Kings Ramsom (2008), courtesy Next Generation yachting. Bottom right: Itacatamarans ITA 14.99, courtesy Itacatamarans.

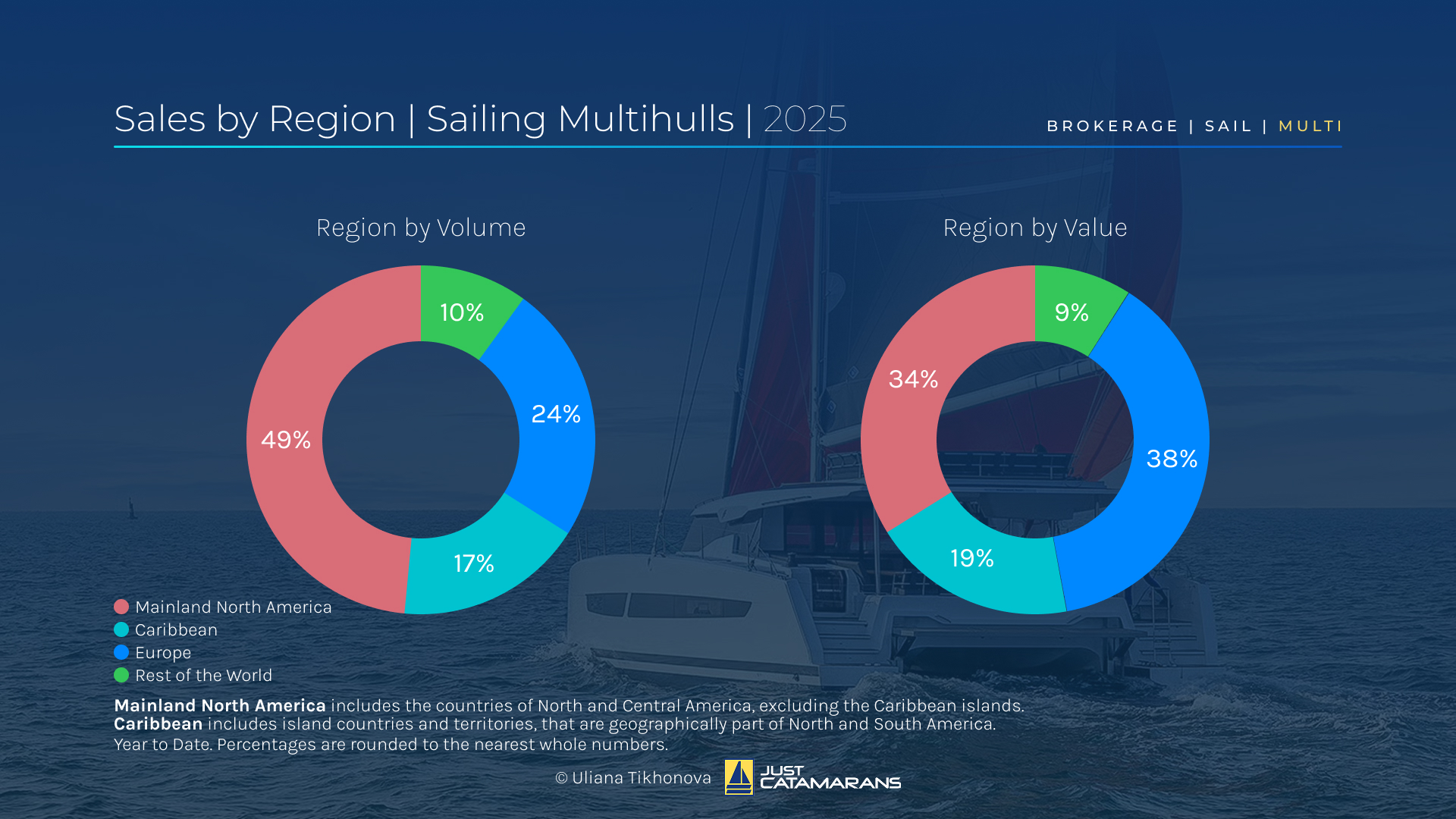

Sailing Multihull Sales Geography

Sales by Region, Sailing Multihulls, 2025. Background image: Fountaine Pajot Aura 51, courtesy Fountaine Pajot.

North America’s gains, together with the unusually active August, may be linked to tariff policies now solidifying along with new tax incentives, which appear to be pushing buyers toward the brokerage market and particularly toward vessels already imported into the United States.

Active Sailing Multihull Listings

Top left: Mystique Yachts Silhouette 80 Skye (2023), courtesy Just Catamarans. Bottom right: Gunboat 80 Highland Fling 18 (2023), courtesy PJA Yachts.

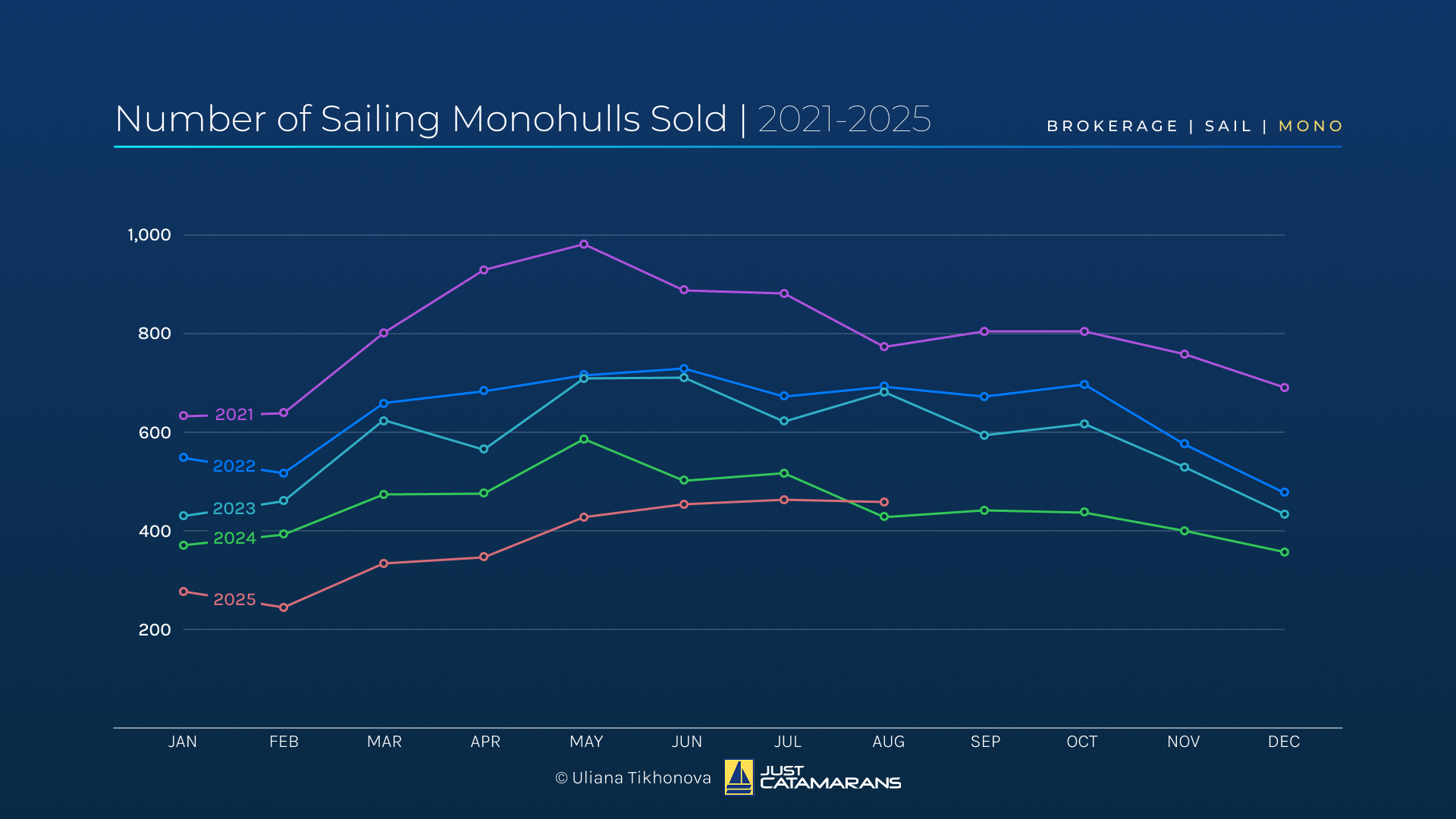

Sailing Monohulls: Holding Strong with Value Growth

Number of Sailing Monohulls Sold, 2021–2025.

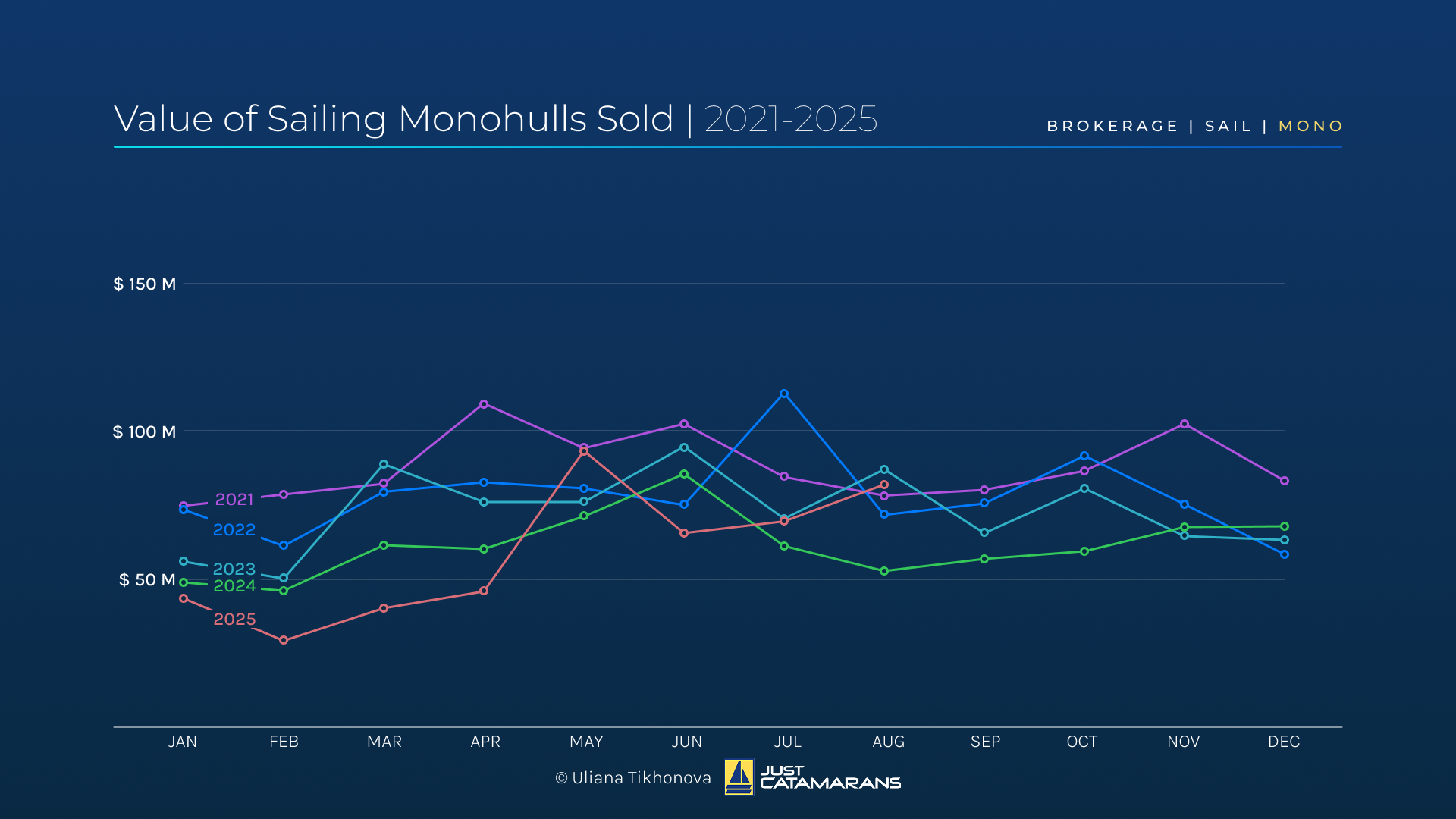

Value of Sailing Monohulls Sold, 2021–2025.

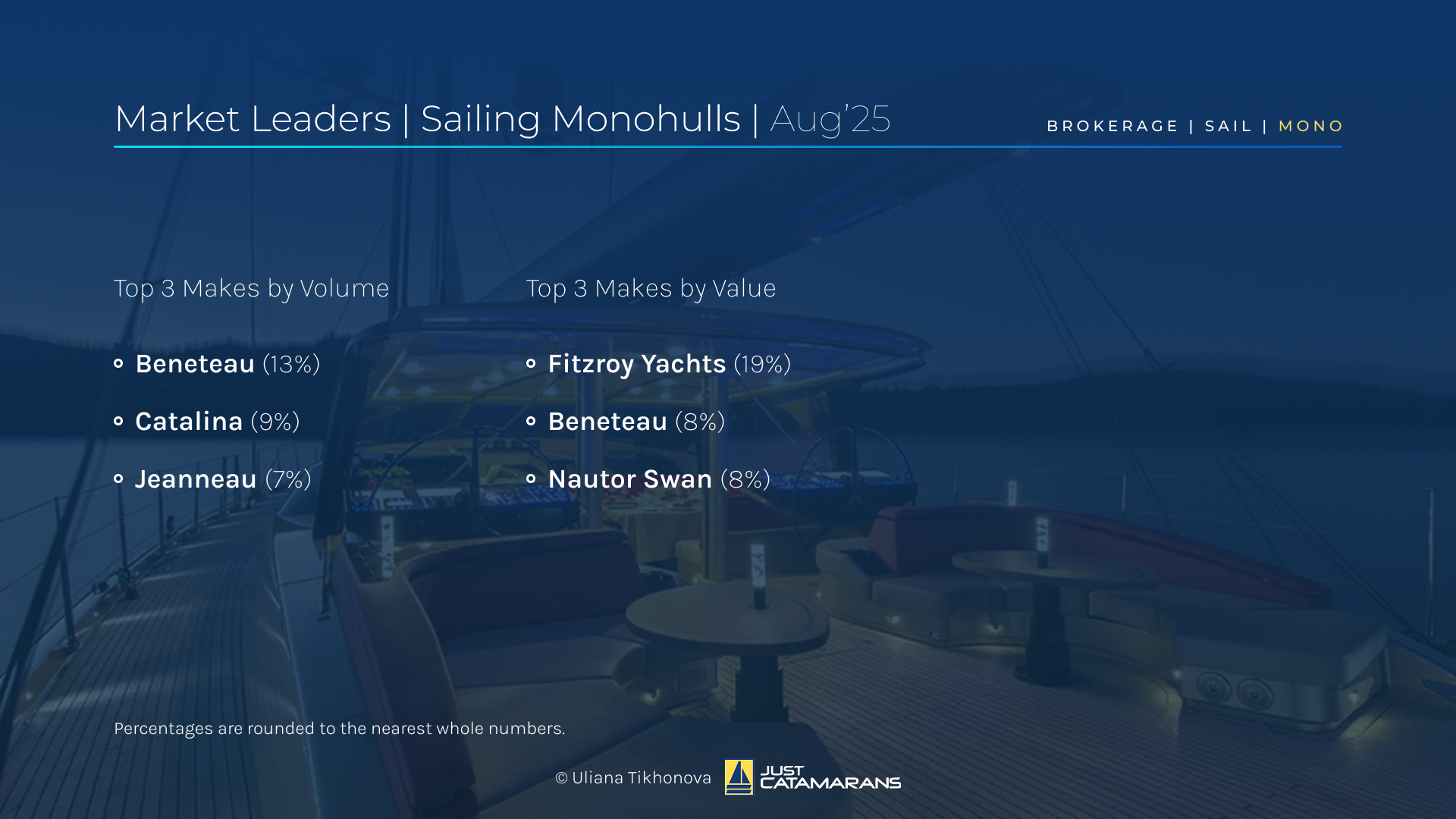

Market Leaders, Sailing Multihulls, August 2025. Background image: 123-foot Fitzroy Yachts Escapade (2014), courtesy Superyacht Partners.

Highlights included the sale of the 123-foot Fitzroy Yachts Escapade, (2014), sold for €13.5 million (about $15.9 million), and the Nautor Swan 58 Blanche (2024), sold for €2.85 million ($3.35 million).

Top left: 123-foot Fitzroy Yachts Escapade (2014), courtesy Superyacht Partners. Bottom right: Nautor Swan 58, courtesy Nautor Swan.

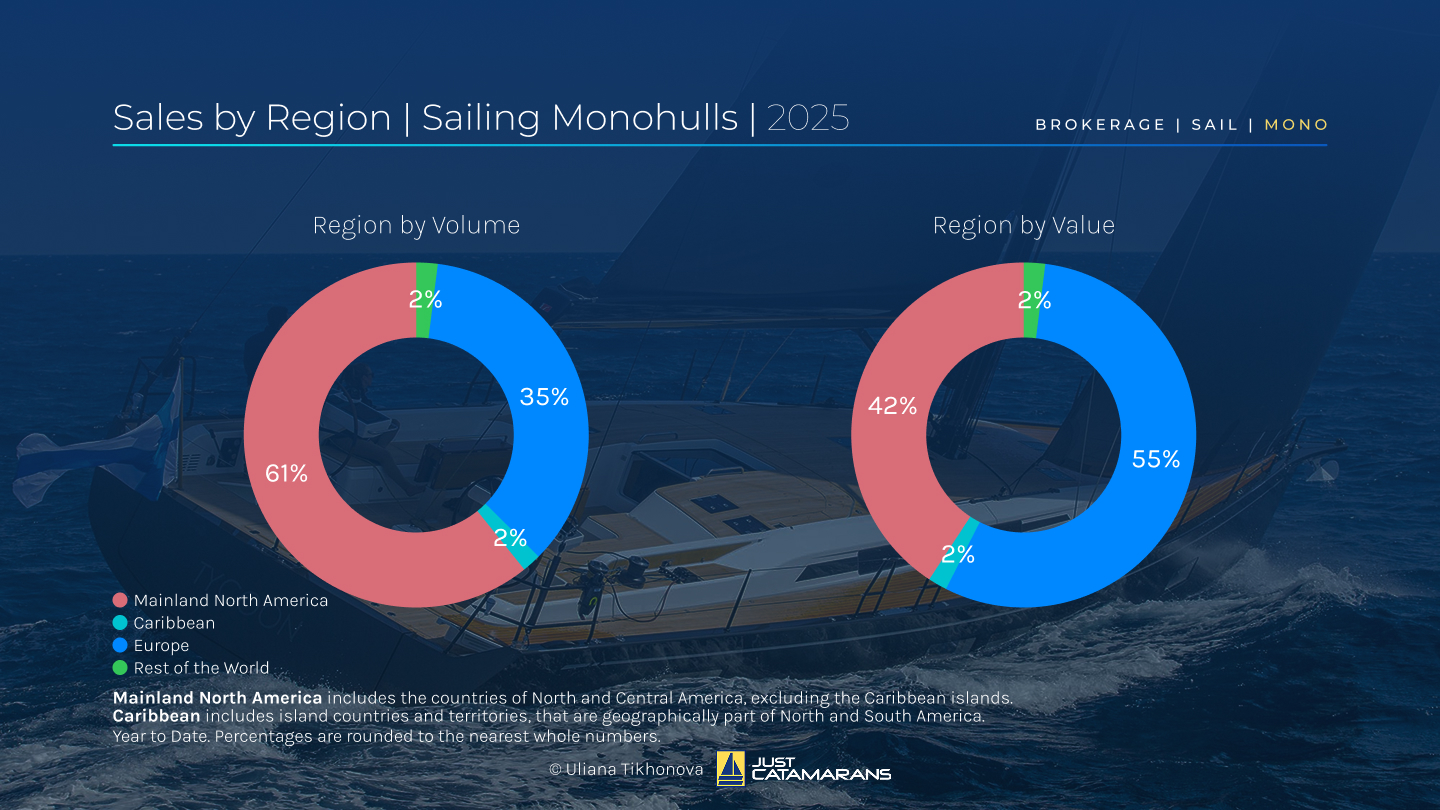

Monohull Sales Geography

Sales by Region, Sailing Monohulls, 2025. Background image: Nautor Swan 58, courtesy Nautor Swan.

As with multihulls, North America’s share grew at Europe’s expense, now holding 61% of sales by volume compared to Europe’s 25%. However, Europe strengthened its position as the high-value market, raising its share to 55% by value, largely reducing North America’s share in that regard.

Active Monohull Listings

Noteworthy additions included the 157-foot Su Marine Yachts Ltd. Sallyna (2023), listed at €19.95 million (around $23.4 million), and the Baltic Yachts Oy Ab Ltd 68 Café Racer Pink Gin Verde (2021), a performance daysailer priced at €3.95 million (about $4.64 million).

Top left: 157-foot Su Marine Sallyna (2023), courtesy TWW Yachts. Bottom right: Baltic 68 Café Racer Pink Jin Verde (2023), courtesy Baltic Yachts.

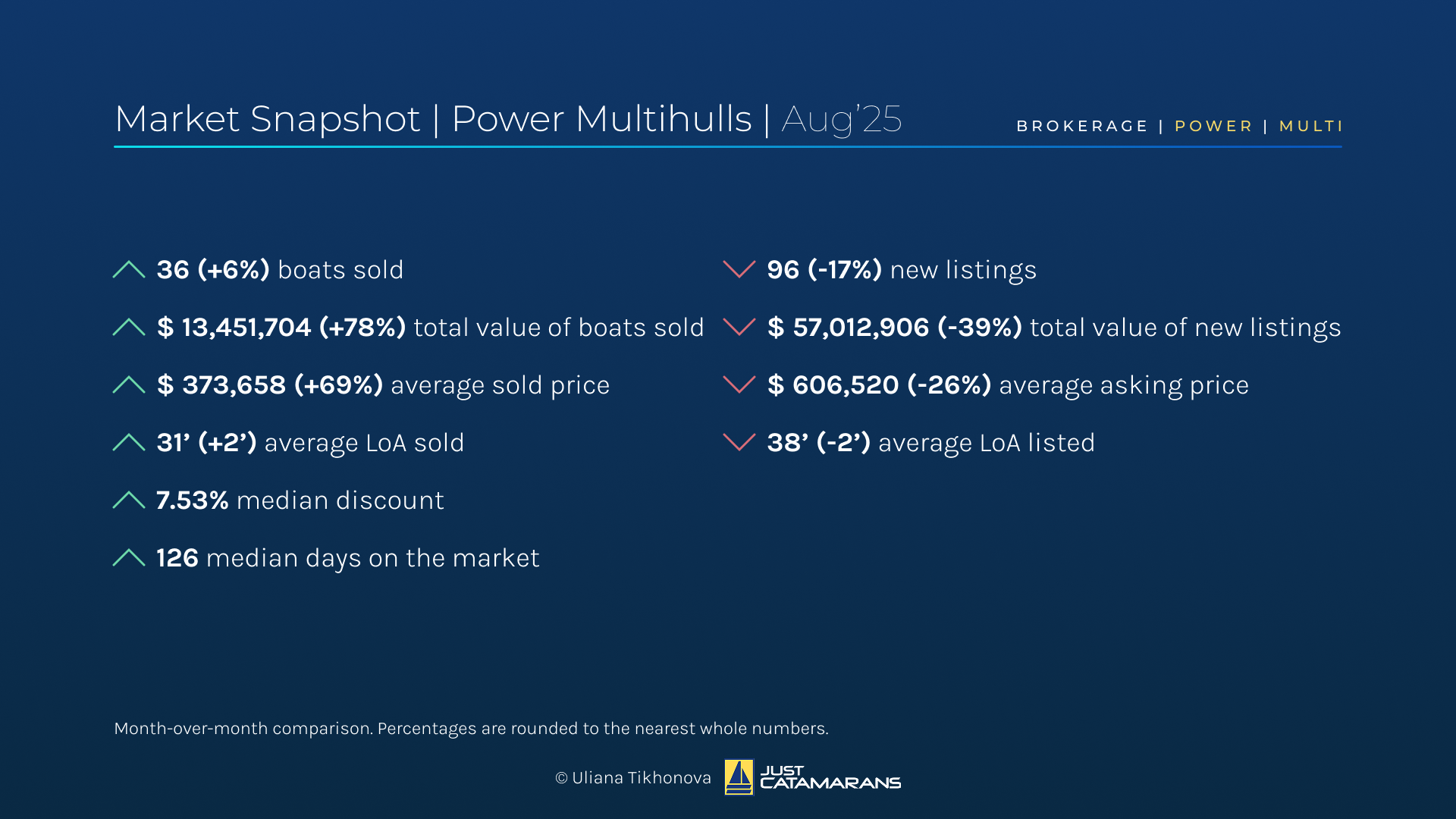

Power Multihulls: A First Look

Power Multihull Market Overview, August 2025.

August brought a 6% increase in sales volume and a sharp 78% rise in value, generating nearly $13.5 million in sales and surpassing the August figures of the past four years.

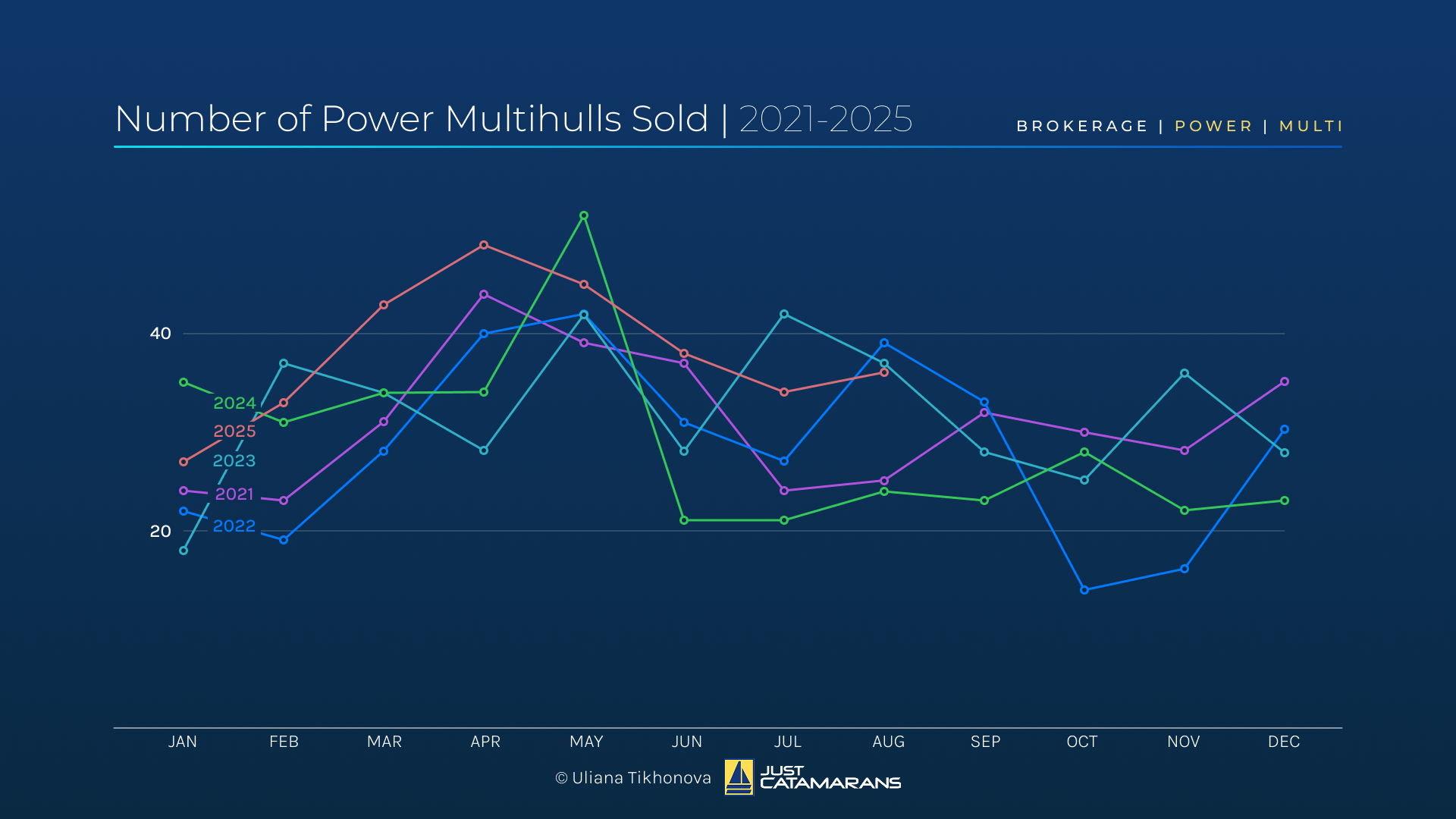

Number of Power Multihulls Sold, 2021–2025.

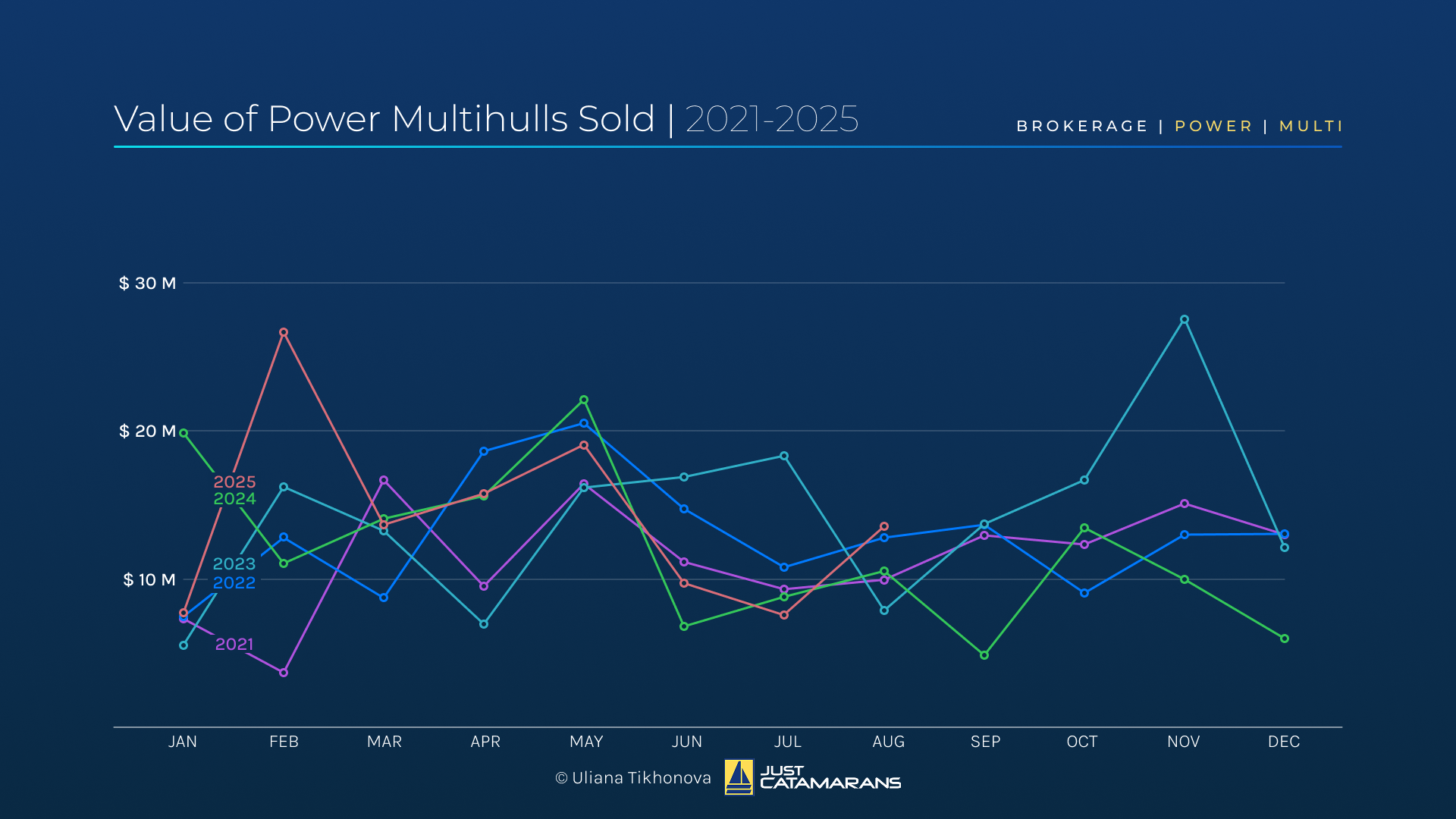

Value of Power Multihulls Sold, 2021–2025.

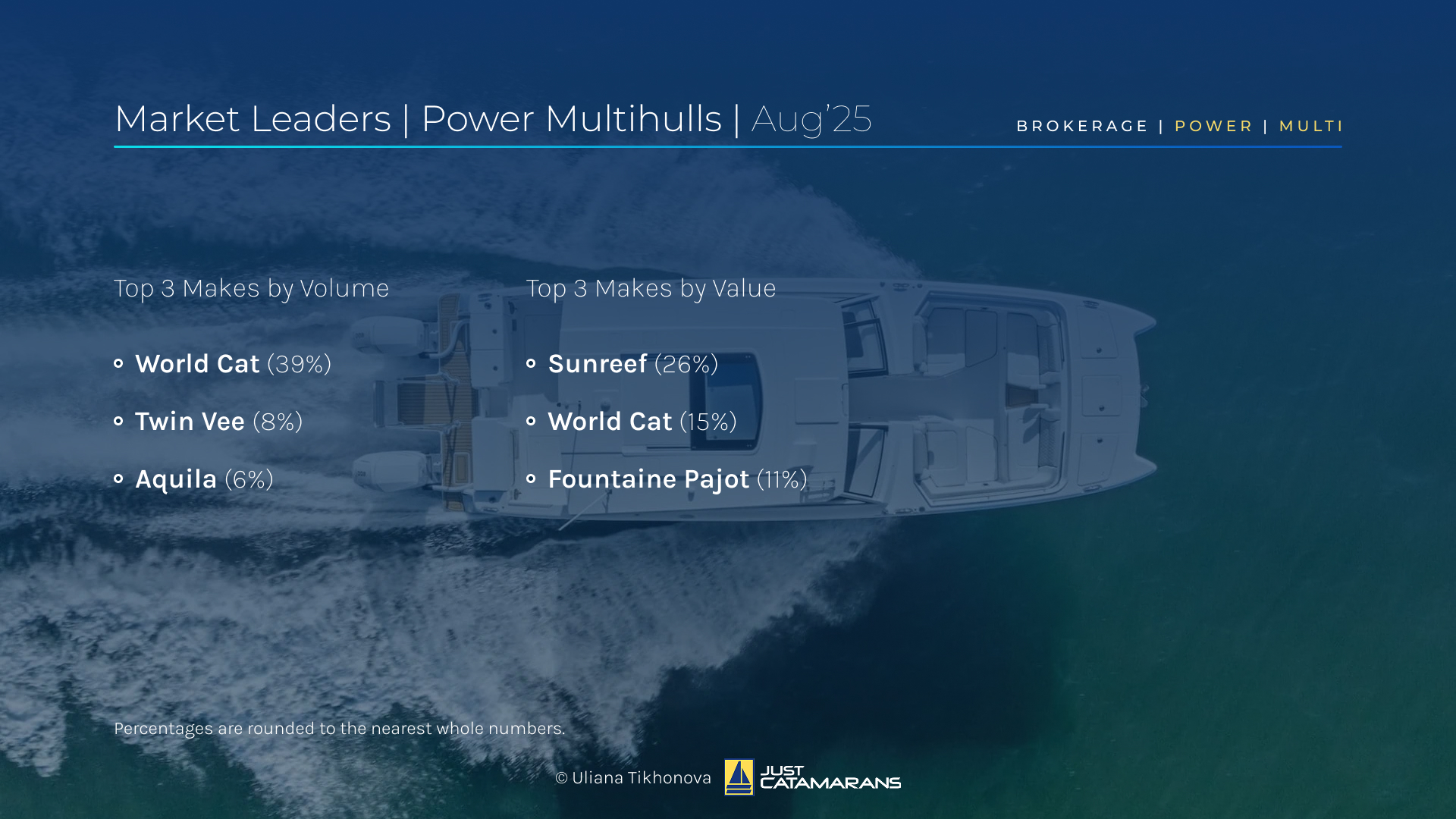

Market Leaders, Power Multihulls, August 2025. Background image: World Cat 400DC-X Island, courtesy World Cat.

Top left: Sunreef 70 Power (2021), courtesy Swell Yachting. Bottom right: K2 Marine Wright 52 Sedan, courtesy K2 Marine.

Power Multihull Sales Geography

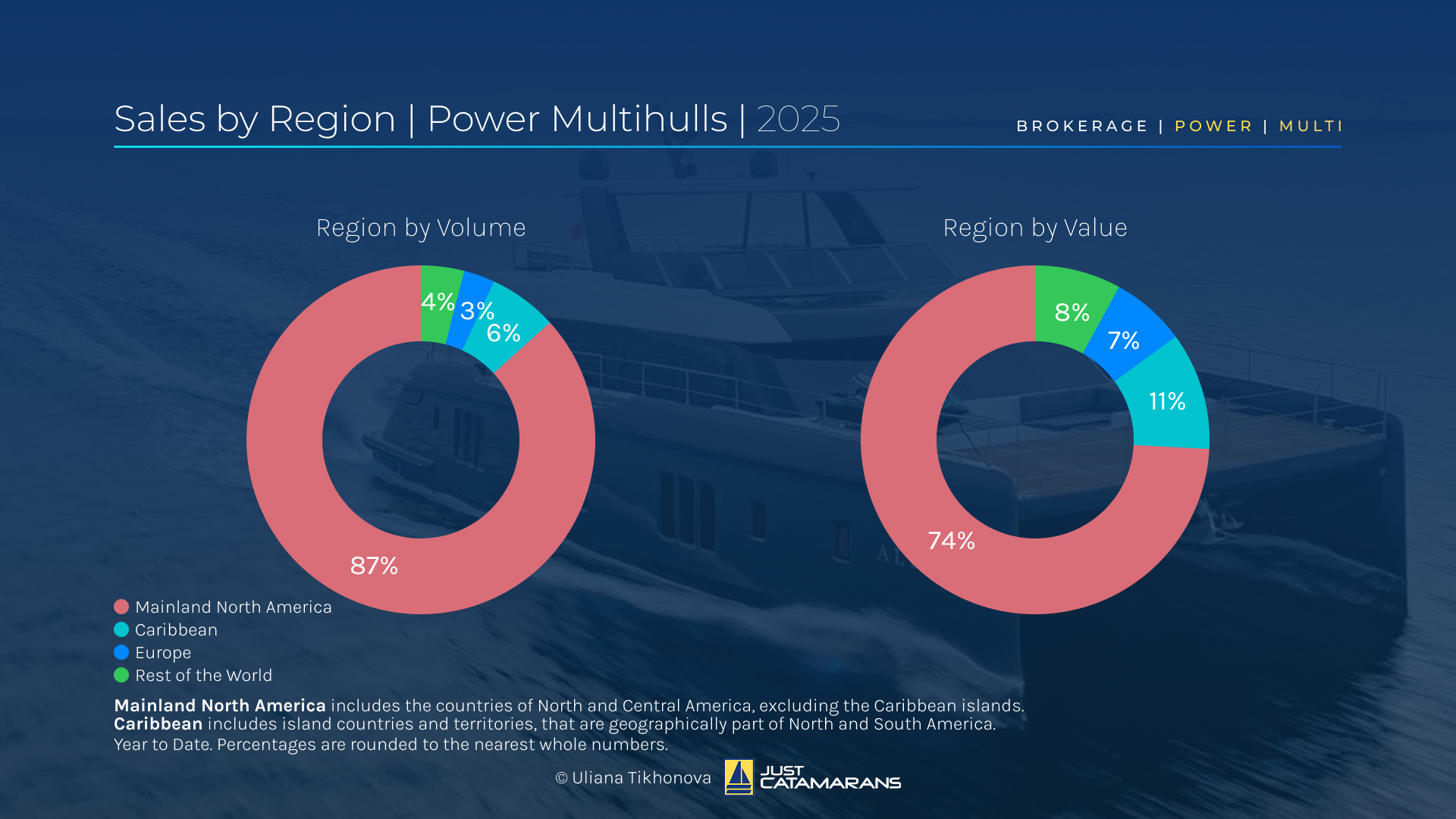

Sales by Region, Power Multihulls, 2025. Background image: Sunreef 70 Power, courtesy Sunreef.

North America overwhelmingly dominated the segment, with 87% of sales by volume and 74% by value. Larger and more expensive yachts tended to be sold elsewhere, as the U.S. market remains heavily weighted toward smaller center-console style power cats that dilute the overall value picture.

Active Power Multihull Listings

Top left: McConaghy MC 82P Bundalong (2023), courtesy McConaghy Boats. Bottom right: Lagoon 630 MY, courtesy Lagoon Catamarans.

Next on the Horizon

⸻

If you’re in the market for a yacht—sail or power, new or pre-owned—feel free to connect with me. I’d be happy to assist in any way I can!

As always, I welcome and highly appreciate your feedback. This analysis is based on the available data, and actual numbers may differ. The analysis focuses on the brokerage market and does not reflect new builds. These are my opinions and conclusions, which may not align with yours.

Based on the available data, it appears that the actual total volume of sailboat sales is likely at least three times greater than what I use for my analysis. Still, this dataset offers a valuable opportunity to gain a representative snapshot of the brokerage market. A big shoutout to the brokers who take the time to record and report their sales—your efforts make this kind of market insight possible!