October & November in Numbers: Sales Rebound Briefly as Value Strengthens [Market Report]

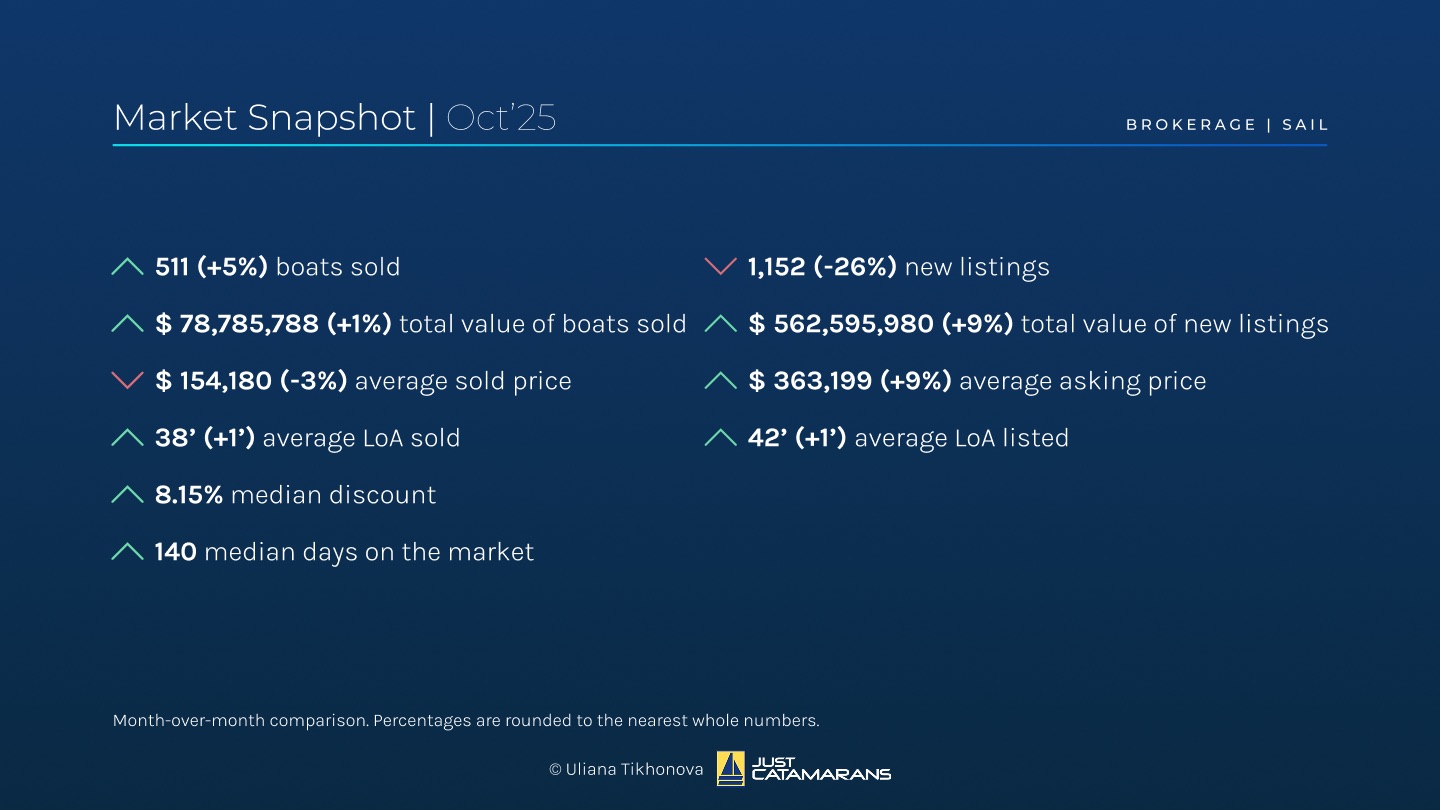

Sailing Yacht Brokerage Market Overview, October 2025.

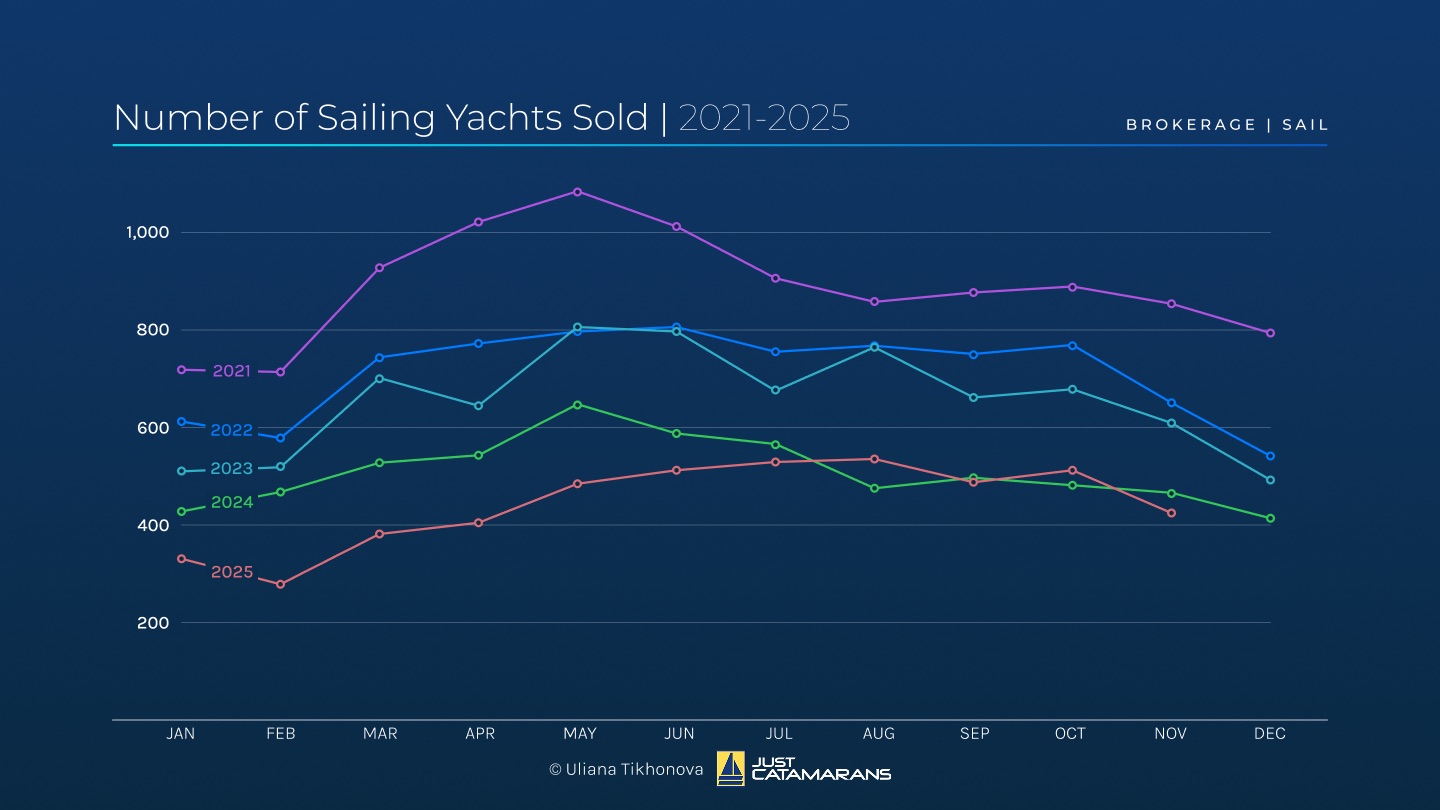

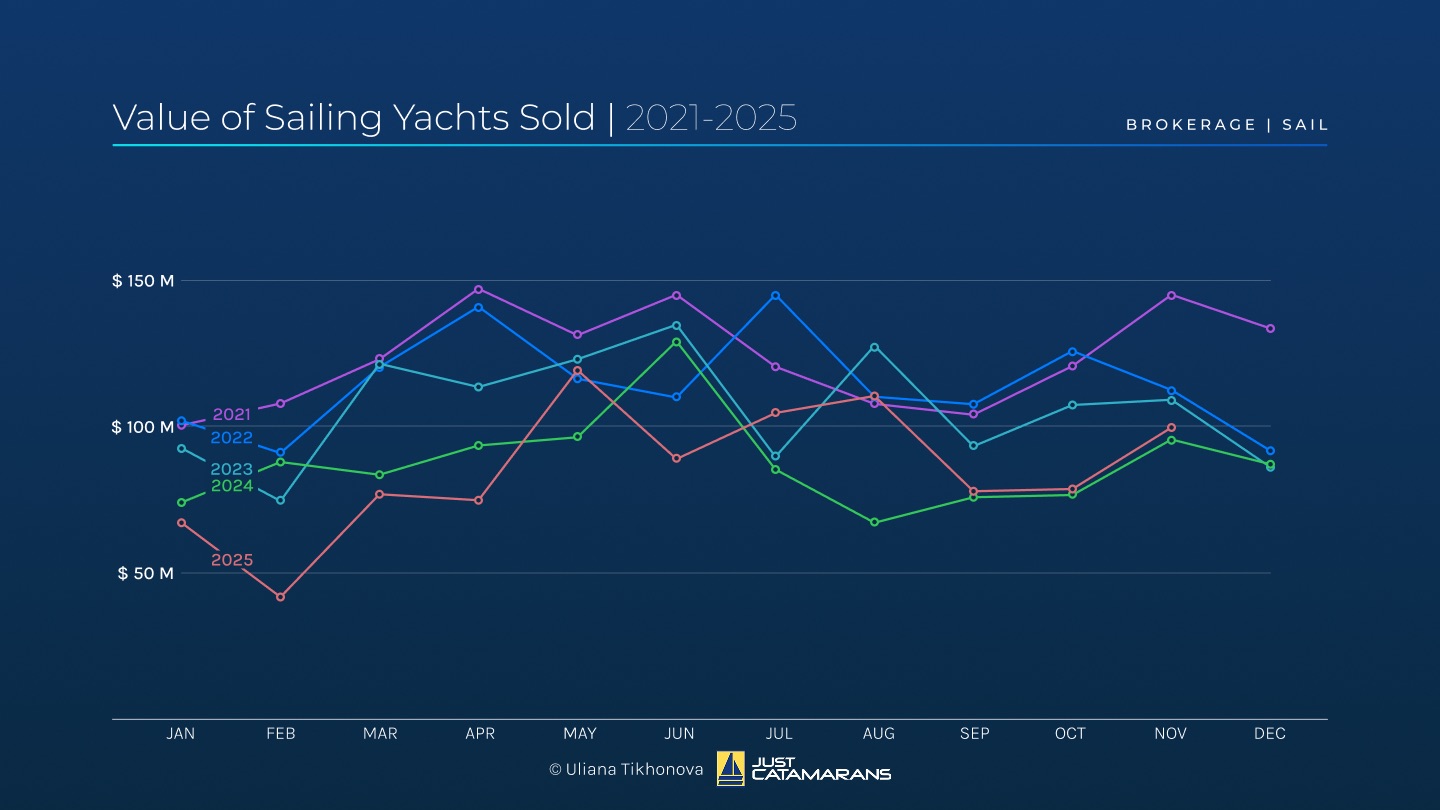

After a modest September cooldown, October brought us a mild sales boost, both in total volume and overall value. Unlike 2024, October experienced a 5% rise in total sales, echoing trends seen during the pandemic years. The total value increased slightly by 1% and stayed above the year-on-year figure for October 2024. As expected, the average sold price across all categories decreased by 3% from September, indicating that more affordable boats were changing hands this month.

The number of new listings dropped significantly by 26%, which, combined with a 9% increase in total value, a higher average asking price, and boat length overall, suggests an influx of more luxurious vessels.

Sailing Yacht Brokerage Market Overview, November 2025.

However, after a promising October, November experienced a 17% decrease in the total number of boats sold, but the total value increased by 26% and remained above 2024 levels. The average sale price rose 51%, reaching $233,000, mainly due to several high-profile transactions, while the average length also grew by 2 feet.

The median discount and time on the market continued to rise, indicating that sellers are motivated, willing to negotiate, and ready to move forward.

The inflow of new listings improved by 11%, adding roughly 1,300 new vessels with a total value of $591 million. The average asking price kept climbing – up 28% this month – and hit $464,000, driven by several stunning monohulls entering the market.

Currently, the brokerage market includes around 13,500 sailboats, with multihulls’ share remaining steady at 18% by volume.

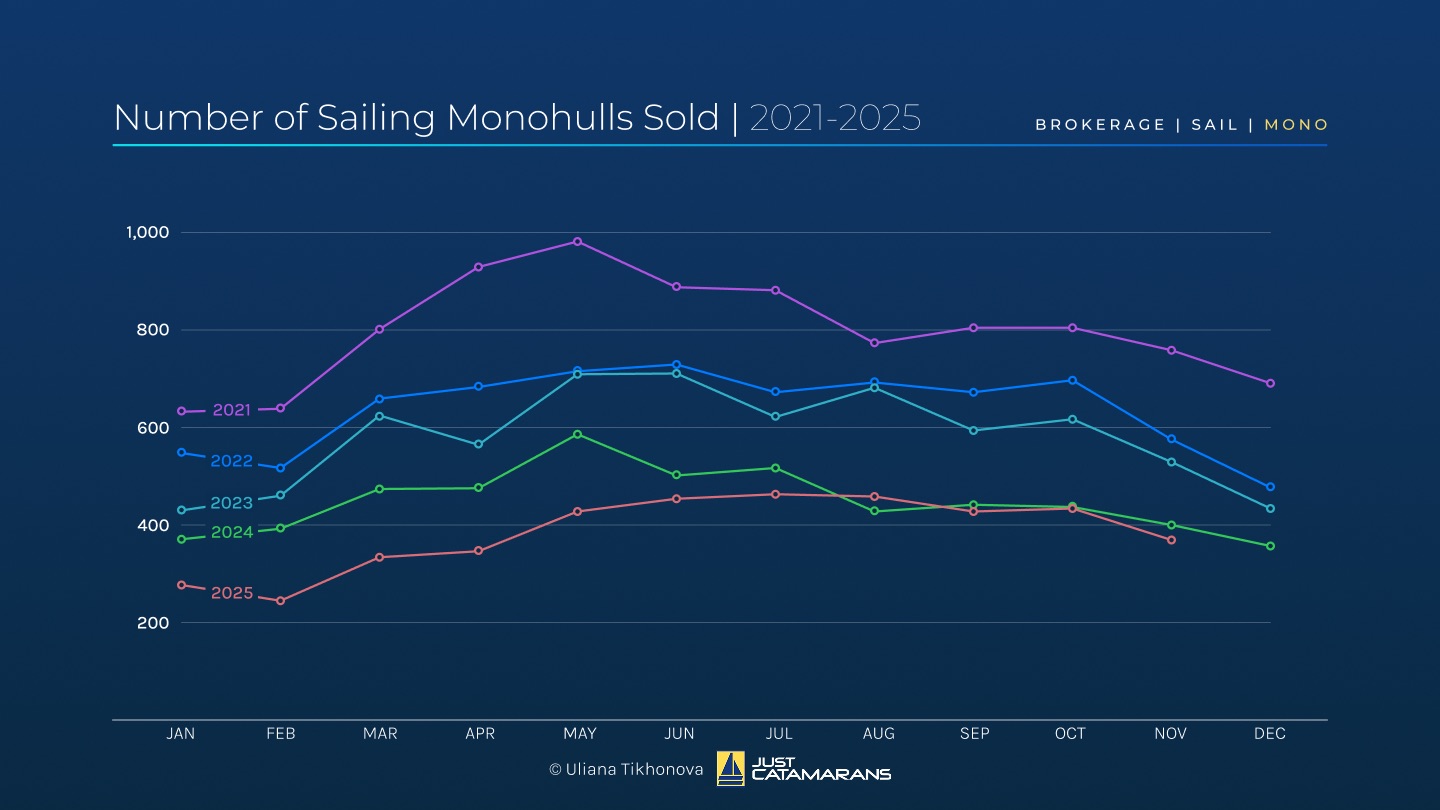

Number of Sailing Yachts Sold, 2021-2025.

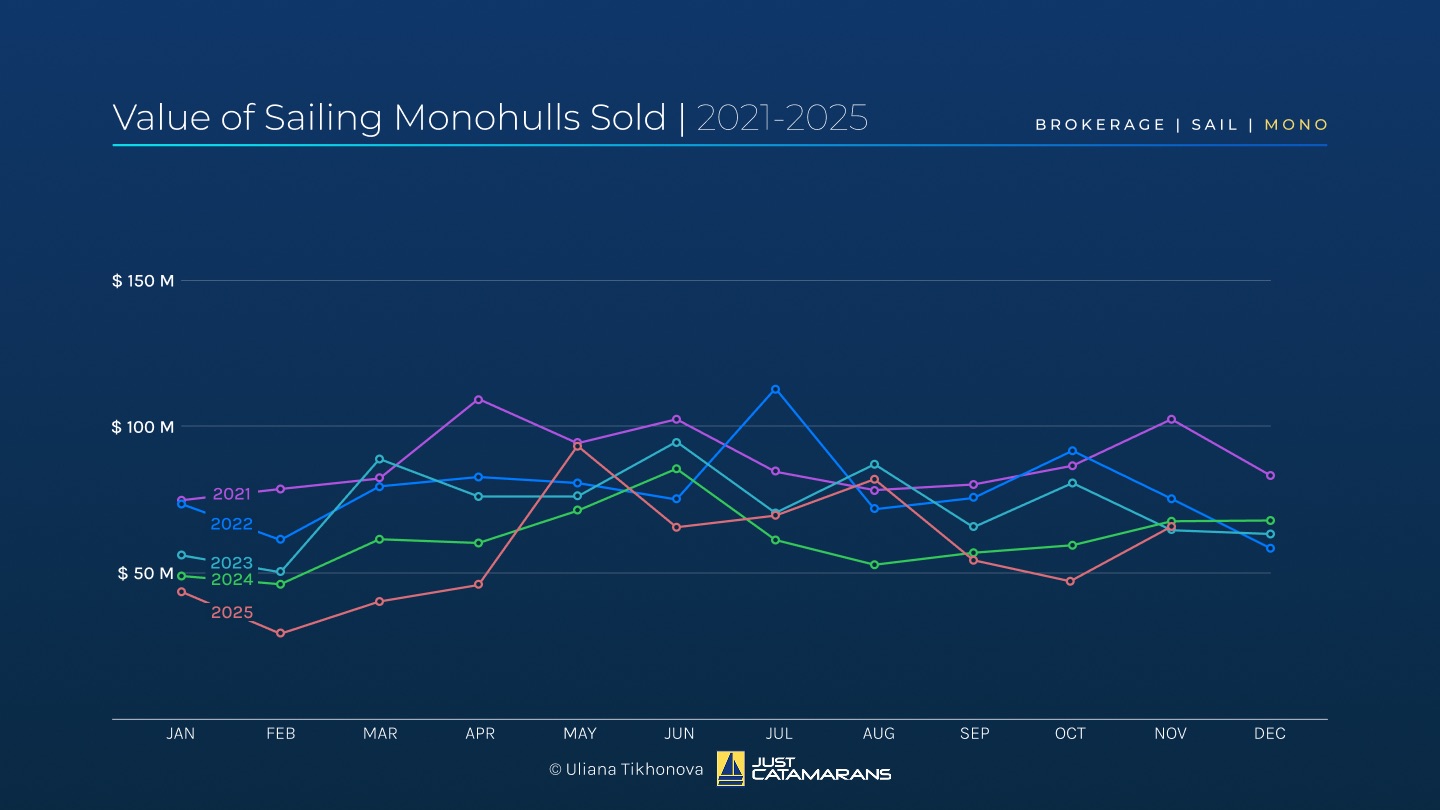

Value of Sailing Yachts Sold, 2021-2025.

Take a deeper dive into the sailing multi- and monohull, as well as power multihull segments, below.

Sailing Multihulls: Rising Values Amid Tightening Supply

Sailing Multihull Market Overview, October 2025.

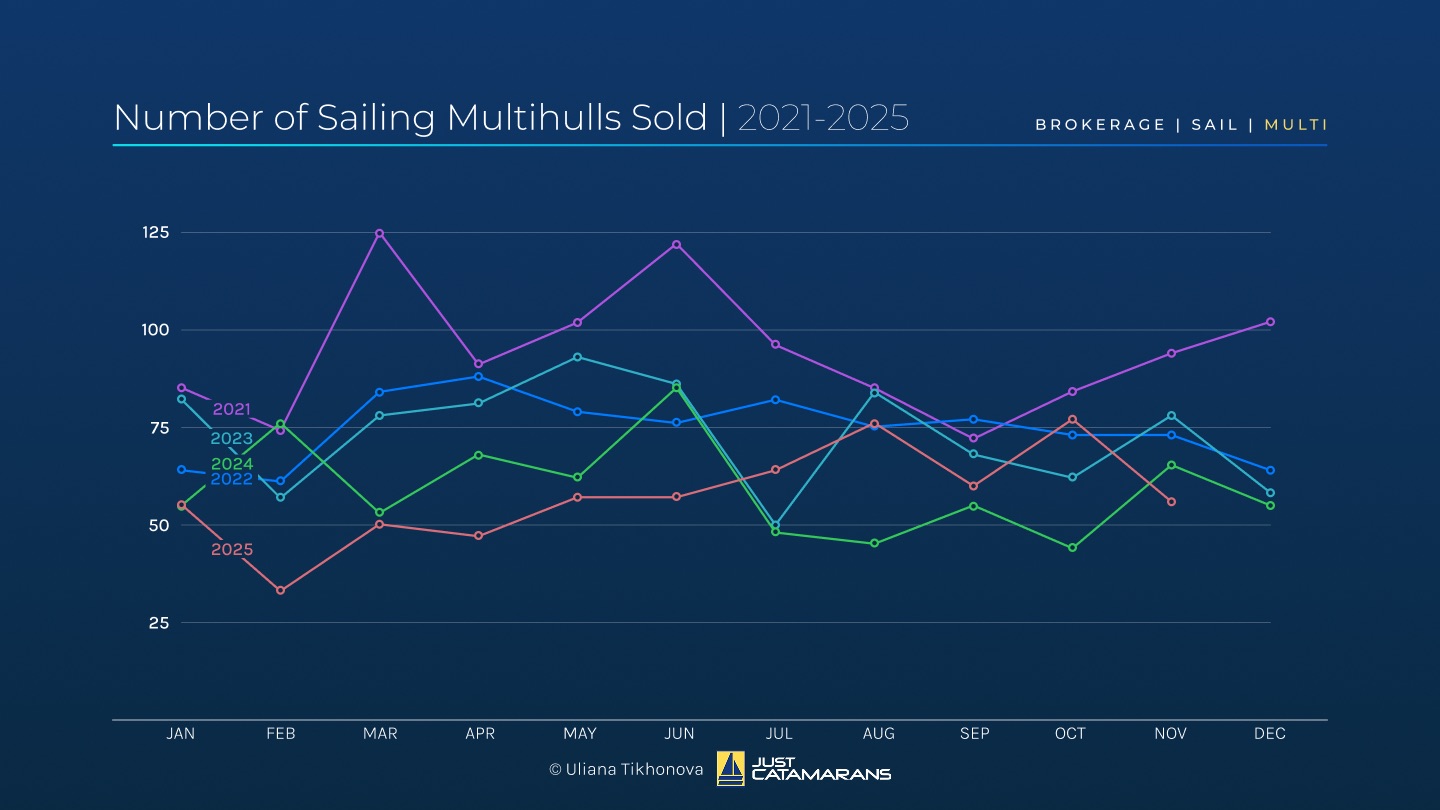

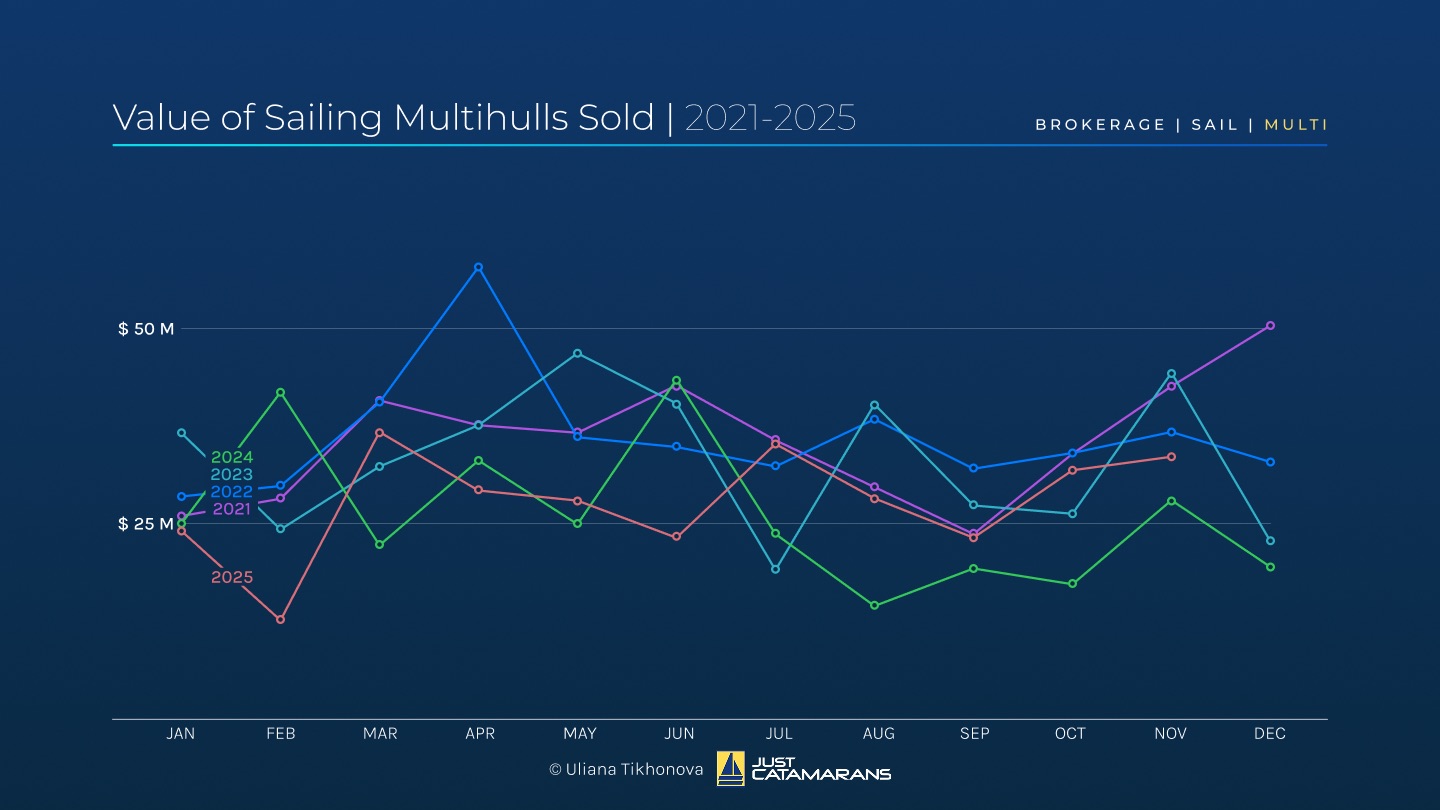

After a dip in September, multihulls regained momentum with a 28% increase in total units sold and an even stronger 37% rise in total sales value. In October, they accounted for 15% of sailboat sales volume and 40% of the total value. These trends align with 2021’s pattern, reflecting a shift in buyer preferences.

The average selling price also continued upward, now around $413,500 – a 7% increase.

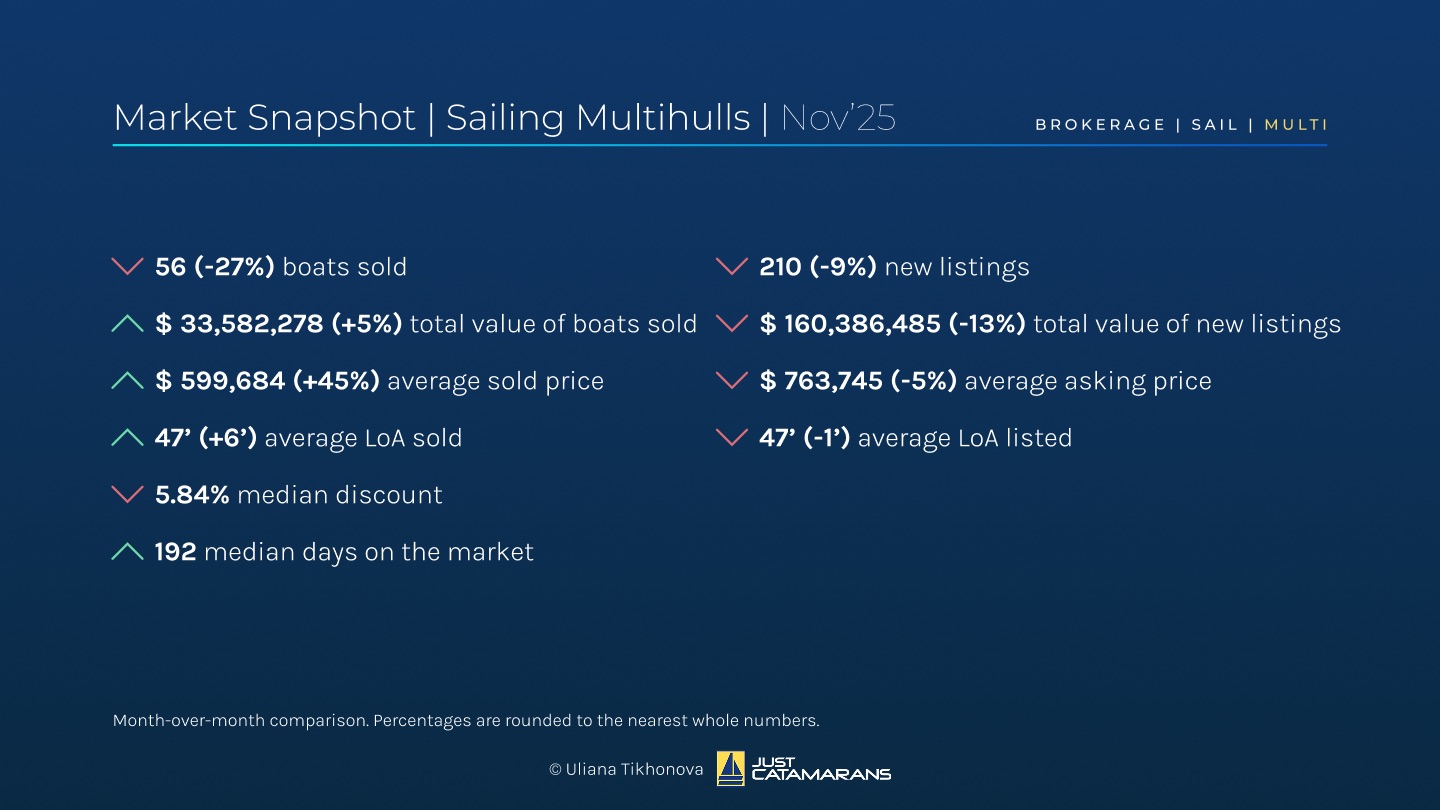

Sailing Multihull Market Overview, November 2025.

November saw a 27% decline in sales volume, but a 5% rise in total value and a sharp 45% increase in average sale price suggested a shift towards more expensive vessels, averaging $600,000.

Both October and November experienced a continuous decrease in median discounts, and while time on the market increased, strengthening sellers’ position.

Number of Sailing Multihulls Sold, 2021-2025.

Value of Sailing Multihulls Sold, 2021-2025.

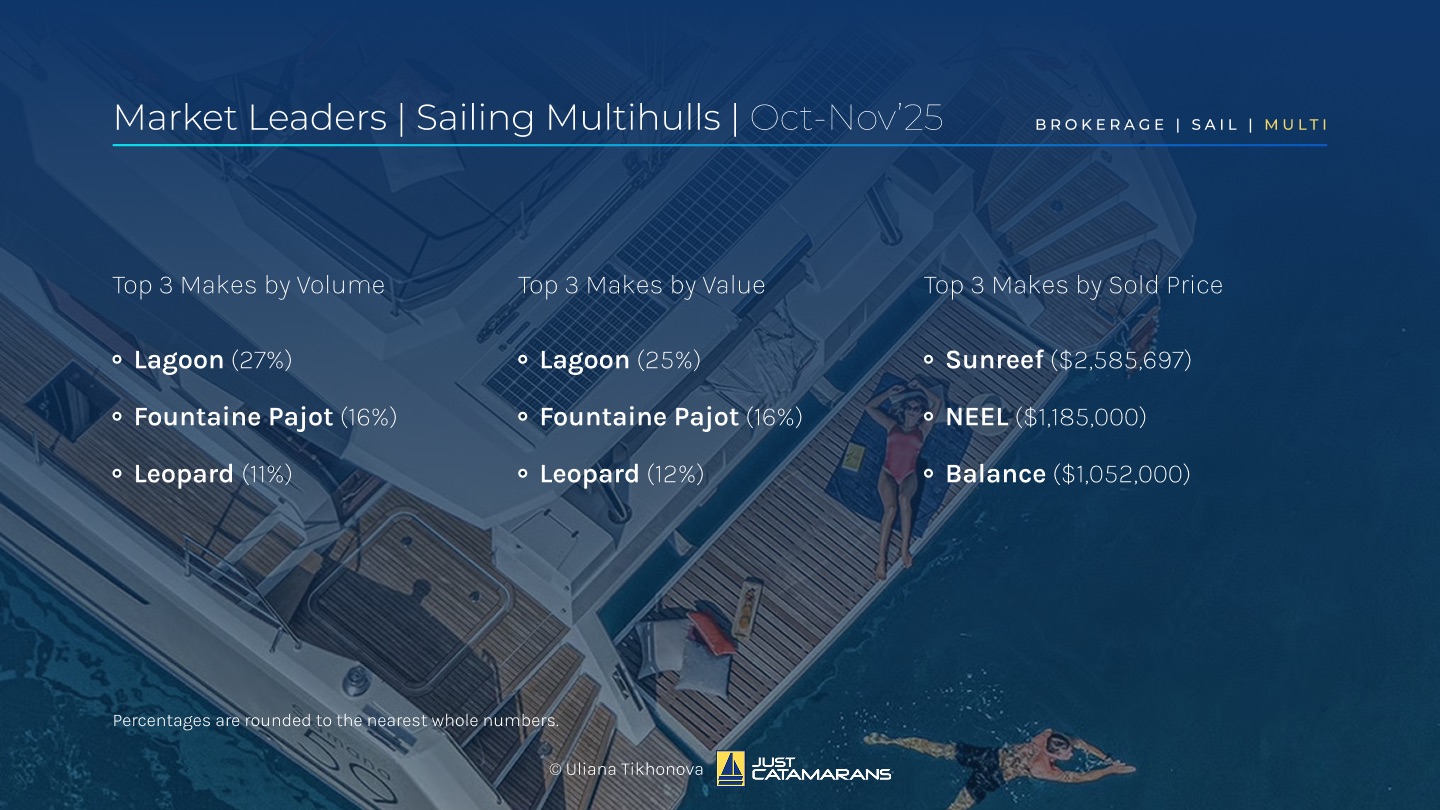

Top market performers remained consistent: Lagoon maintained its top position by both volume and value, with Fountaine Pajot and Leopard following, just like last month.

This month, I also analyzed average selling prices. Sunreef led with nearly $2.6 million, followed by NEEL at $1,185,000 and Balance at $1,052,000.

Brokerage Market Leaders, Sailing Multihulls, October-November 2025. Background image: Fountaine Pajot Samana 59, courtesy Fountaine Pajot.

Notable transactions included the fully loaded and impeccably maintained Leopard 50 Stargazer (2023), presented by Jim Ross of Just Catamarans and sold for $1.136 million, and the proven performance ocean-goer Ourtemer 55 Saga (2021), sold for €1.65 million (around $1.937 million).

Top left: Leopard 50, courtesy Leopard Catamarans. Bottom right: Outremer 55 Saga (2021), courtesy GL Yachting.

Sailing Multihull Sales Geography

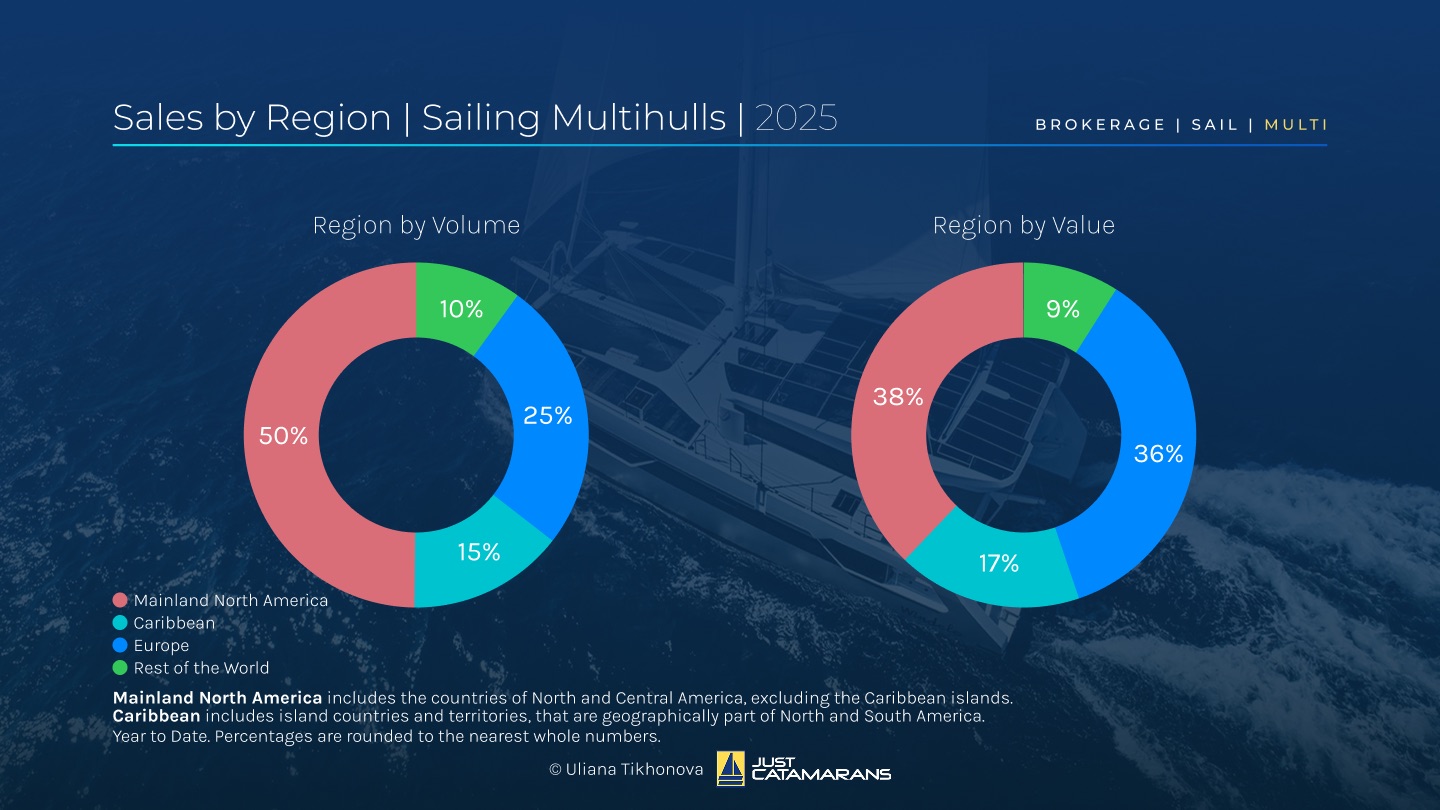

Sales by Region, Sailing Multihulls, 2025. Background image: Windelo 50, courtesy Windelo Catamarans.

As a result of October and November transactions, North America’s year-to-date market share stayed at 50% by volume and increased to 38% by value. Europe’s share grew in both volume and value, now accounting for 25% and 36%, respectively. The Caribbean’s and the rest of the world’s shares continued to decline.

Active Sailing Multihull Listings

October saw a small 1% drop in new multihull listings, while the total value stayed steady at around $185 million. The average asking price increased by 1% to about $800,000. In November, even fewer multihulls entered the market, with a sharper decline in total value – down 13% – and the average asking price fell to $764,000, though it remained above the spring averages.

The decreasing supply may level the playing field for both buyers and sellers, shifting from a pure buyers’ market toward a more balanced state of affairs. Currently, there are around 2,450 sailing multihulls available, accommodating a wide range of use cases, requirements, and budgets.

Notable new arrivals included a 124-foot custom Multiplast High Performance Catamaran Vitalia II (2003, refitted in 2015), considered to be the fastest sailboat in the world, with the asking price remaining undisclosed, and a Gunboat 78 MyCat (2016), featuring a rare forward cockpit and asking €3.95 million (around $4.6 million).

Top left: 124-foot custom Multiplast High Performance Catamaran Vitalia II (2003/2015), courtesy The Multihull Company. Bottom right: Gunboat 78 MyCat (2016), courtesy Rapide Yacht Group.

If Gunboat is beyond your budget, consider Windelo – a trailblazer in eco-friendly performance boats. Their forward cockpit is a real highlight, providing protection from weather and unobstructed flow. Feel free to reach out to discuss new builds and our brokerage options – we have some excellent choices!

Sailing Monohulls: Softer Prices Offset by Elite Sales

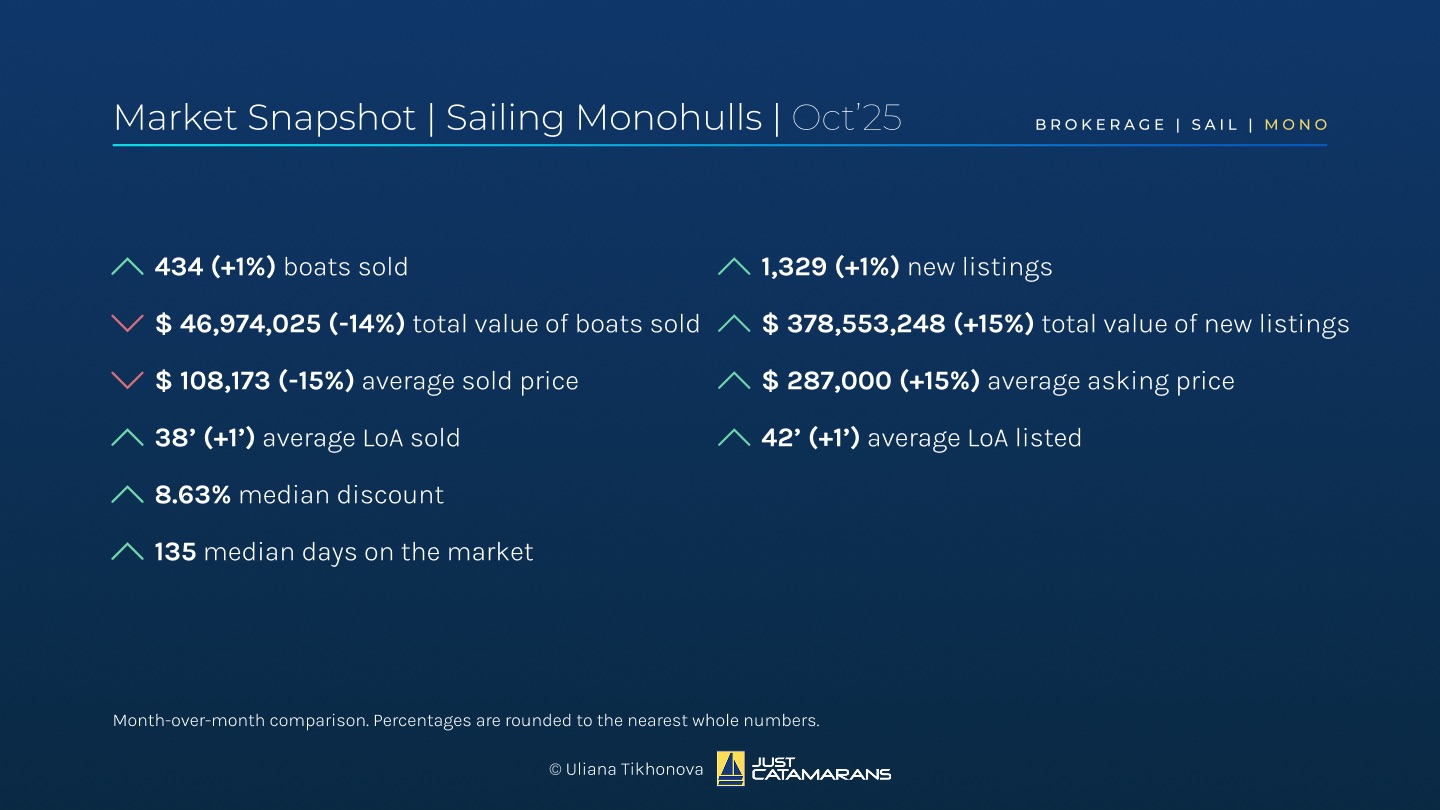

Sailing Monohull Market Overview, October 2025.

In October, monohulls experienced a slight 1% rise in sales volume. However, unlike multihulls, the total value declined by 14%, and the average selling price fell 15% to approximately $108,000 – the lowest of 2025.

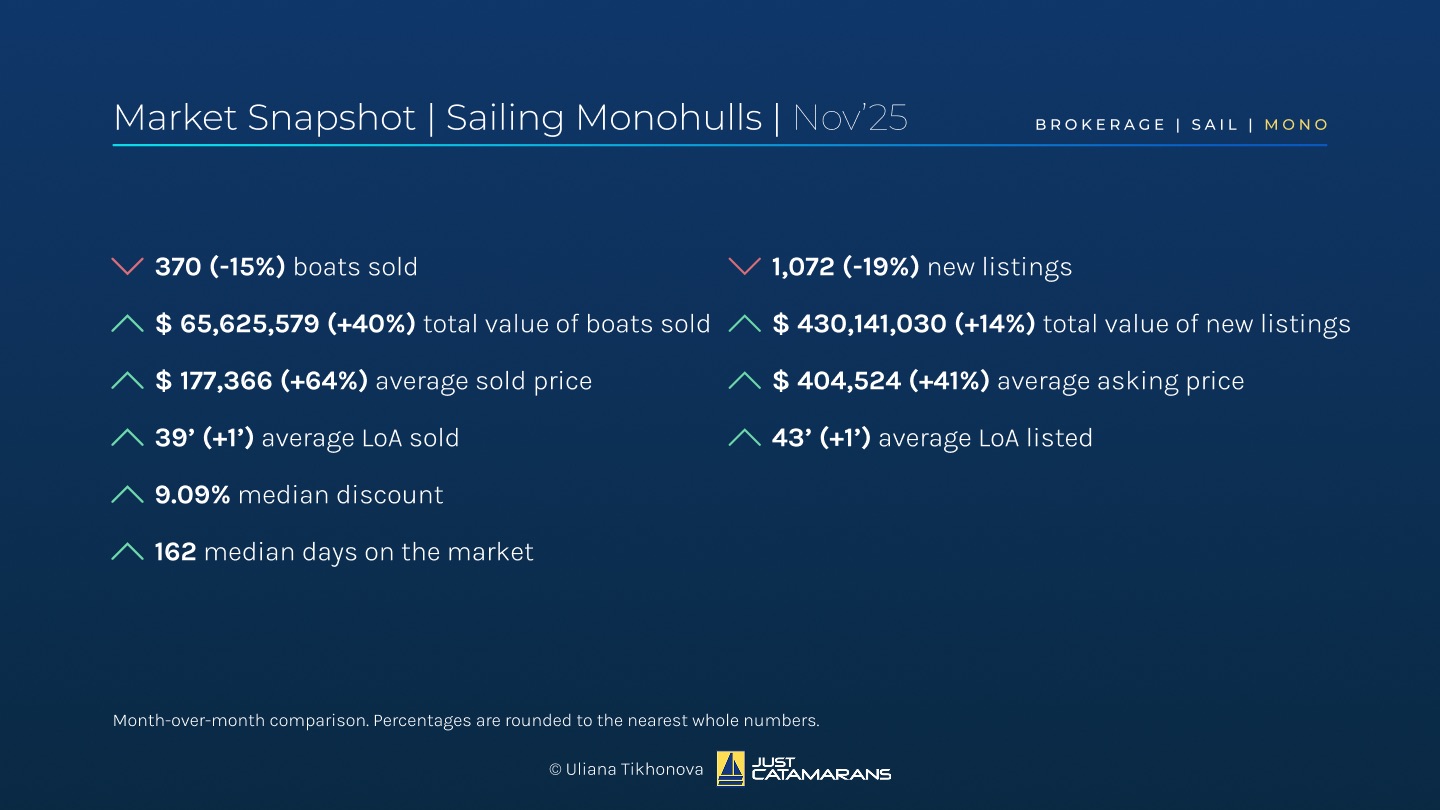

Sailing Monohull Market Overview, November 2025.

November indicators were affected by several elite vessels leaving and entering the market. Similar to multihulls, fewer transactions occurred in November, but both the total value and average sale price increased significantly – up 40% and 64%, respectively.

The median discount and time on the market continued to increase, indicating that monohull sellers are becoming more flexible. The median discount reached 9.09% (compared to the multihull median of 5.84%), but monohulls tend to spend one month less on the market than multihulls – 5,5 months.

Number of Sailing Monohulls Sold, 2021-2025.

Value of Sailing Monohulls Sold, 2021-2025.

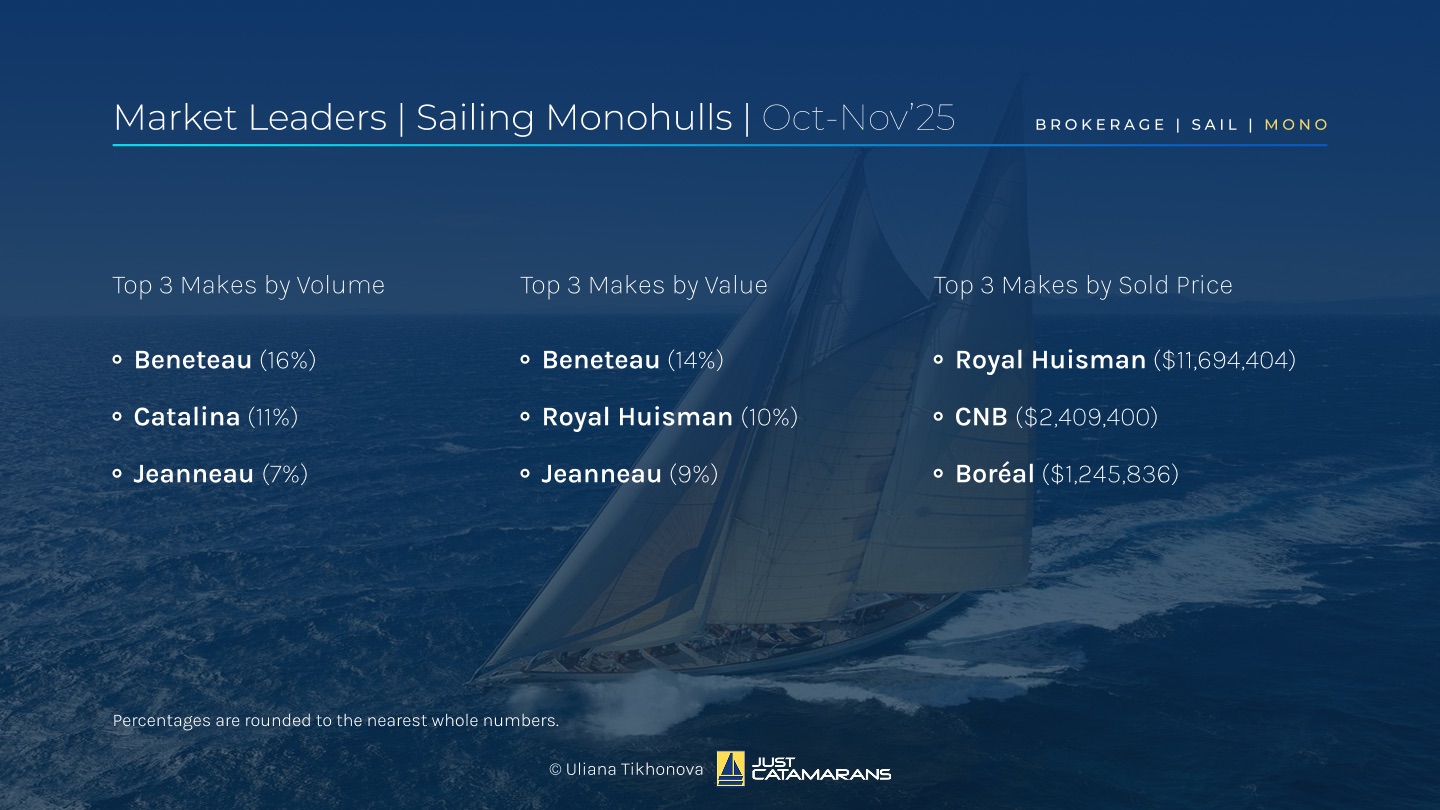

Beneteau and Catalina remained the top performers by volume, with Jeanneau and Hunter swapping spots again. In terms of value, Beneteau led, followed by Royal Huisman, which secured second place with just one deal, and Jeanneau.

The top three makes by average sold price might sound less familiar: Royal Huisman ranks first with around $11.7 million, followed by more accessible CNB at $2.4 million and Boréal at $1.2 million – one of the few aluminum makes.

Brokerage Market Leaders, Sailing Monohulls, October-November 2025. Background image: 165-foot Royal Huisman Schooner Borkumriff IV (2002), courtesy Camper & Nicholsons.

Notable deals included the classy 165-foot Royal Huisman Schooner Borkumriff IV (2002), sold for €9.95 million (about $11.7 million), and the CNB 66 Dream On (2021), sold for €2.05 million (roughly $12.4 million) – both in Europe.

Top left: 165-foot Royal Huisman Schooner Borkumriff IV (2002), courtesy Camper & Nicholsons. Bottom right: CNB 66 Dream On (2021), courtesy Northrop & Johnson.

Sailing Monohull Sales Geography

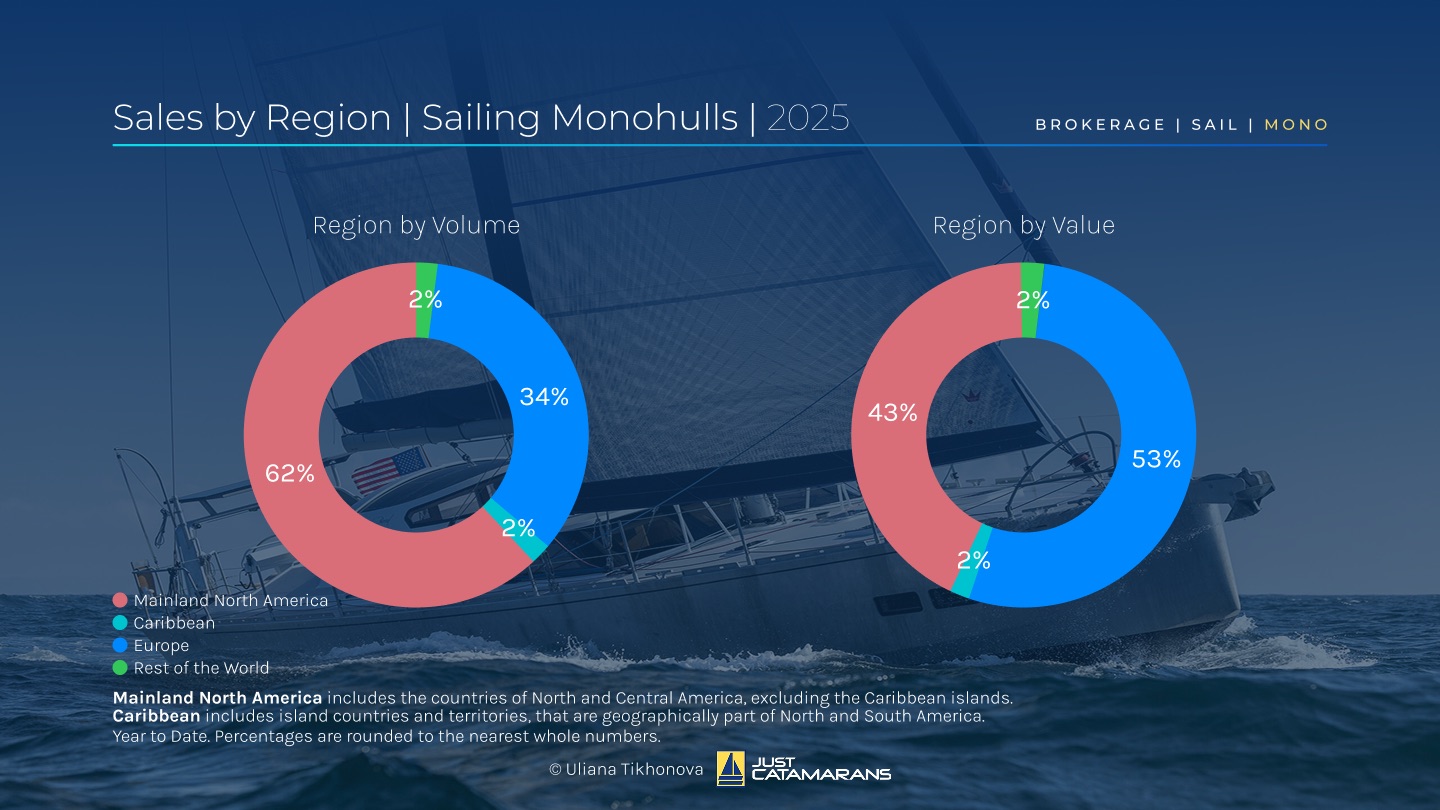

Sales by Region, Sailing Monohulls, 2025. Background image: Boréal 56, courtesy Boréal Yachts.

As a result of October and November transactions, North American share increased by 1% in both volume and value, at Europe’s expense. The Caribbean and the rest of the world’s shares remained unchanged at 2%.

Active Sailing Monohull Listings

New monohull listings saw a small 1% increase in October, then a larger 17% decline in November. Still, the total value and average asking price kept rising over the two months, reaching about $430 million and $405,000 in November, respectively, supporting a steady supply of higher-priced vessels.

New arrivals included the 92-foot custom carbon maxi-racer Wally Bullitt (2018), listed at €10.5 million (around $12.3 million), and the elegant Spirit Yachts R74 Spirit of Galatea (2014), asking €2.3 million (around $2.7 million).

Top left: 92-foot custom Wally Bullitt (2018), courtesy Y.CO. Bottom right: Spirit Yachts R74 Spirit of Galatea (2014), courtesy Althaus Yachts.

Power Multihulls: Strong Demand Supports Rising Values

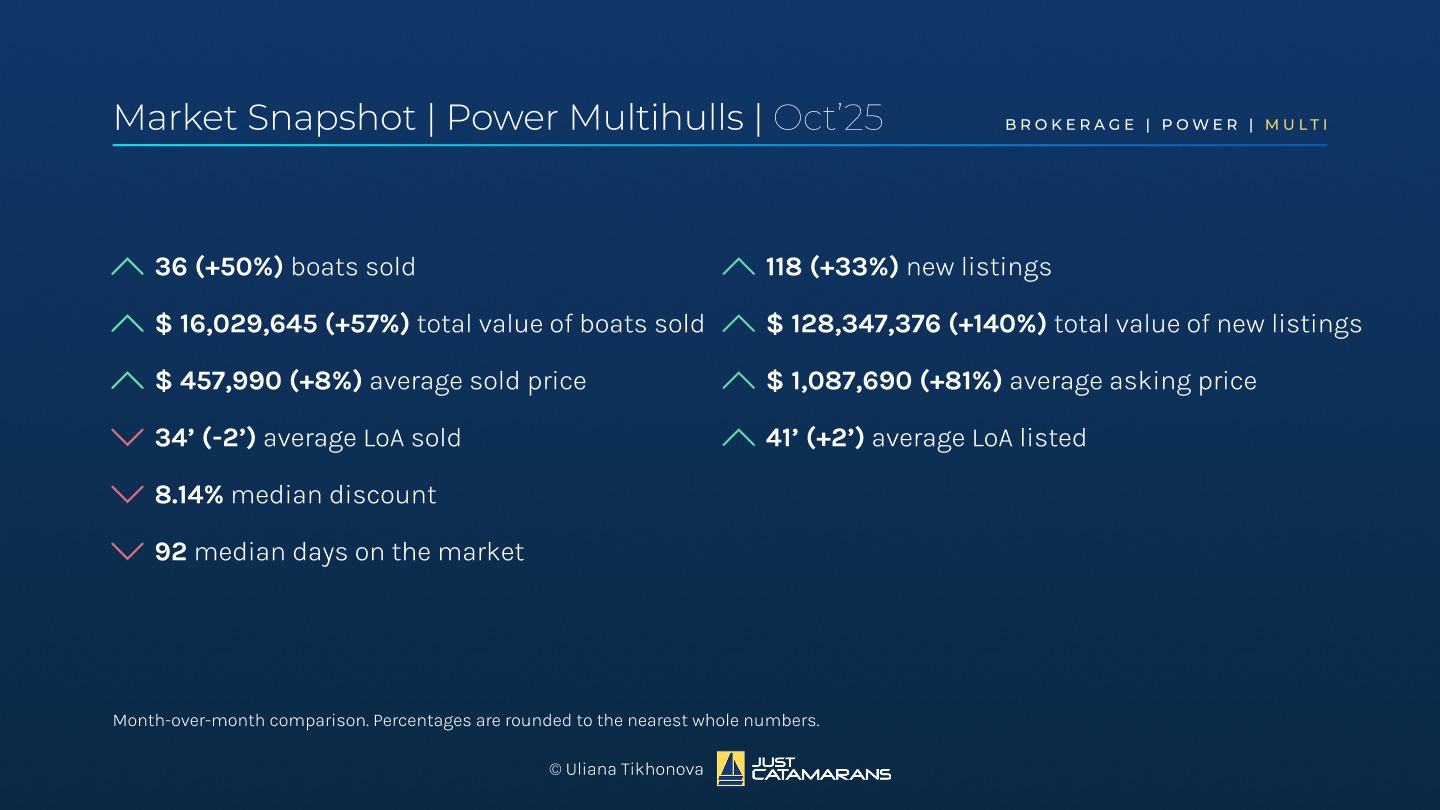

Power Multihull Market Overview, October 2025.

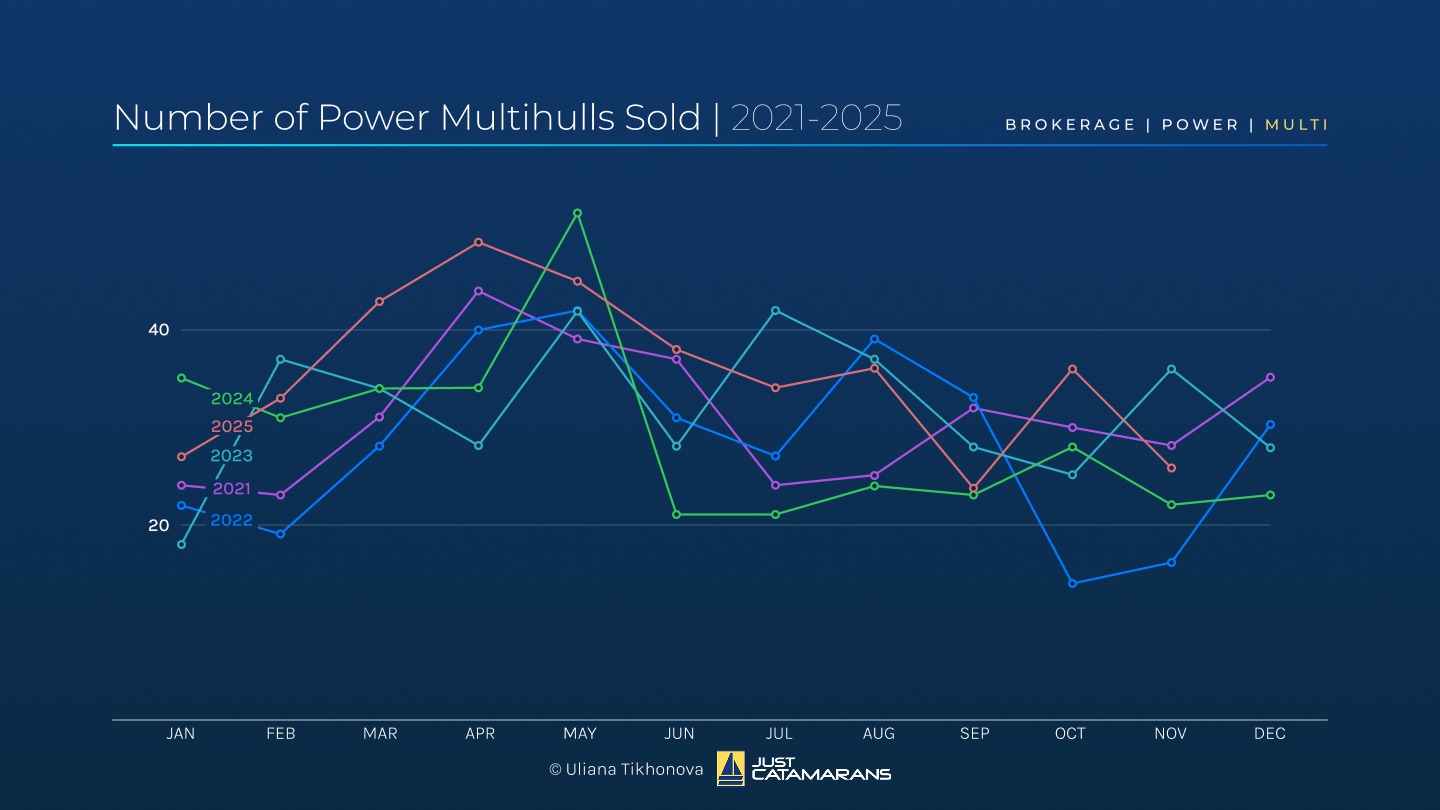

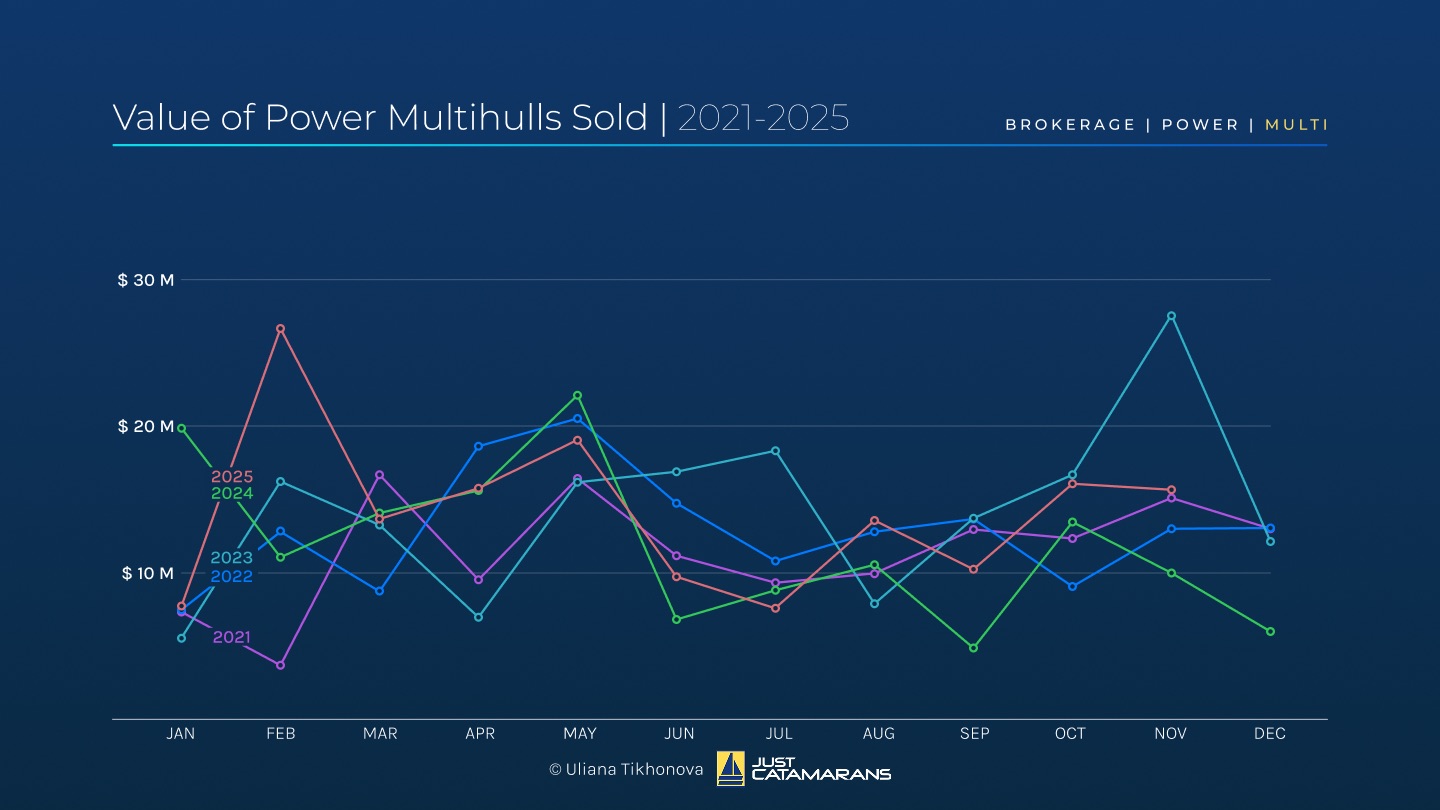

Power multihulls were riding high in October, increasing by 50% in volume and 57% in value compared to September. The average selling price also went up by 8%, reaching nearly $458,000, despite the length decreasing to an average of 34 feet. The median time on the market dropped to just three months, which, along with a lower median discount, confirmed higher demand for spacious floating vacation homes that don’t require handling lines and sails.

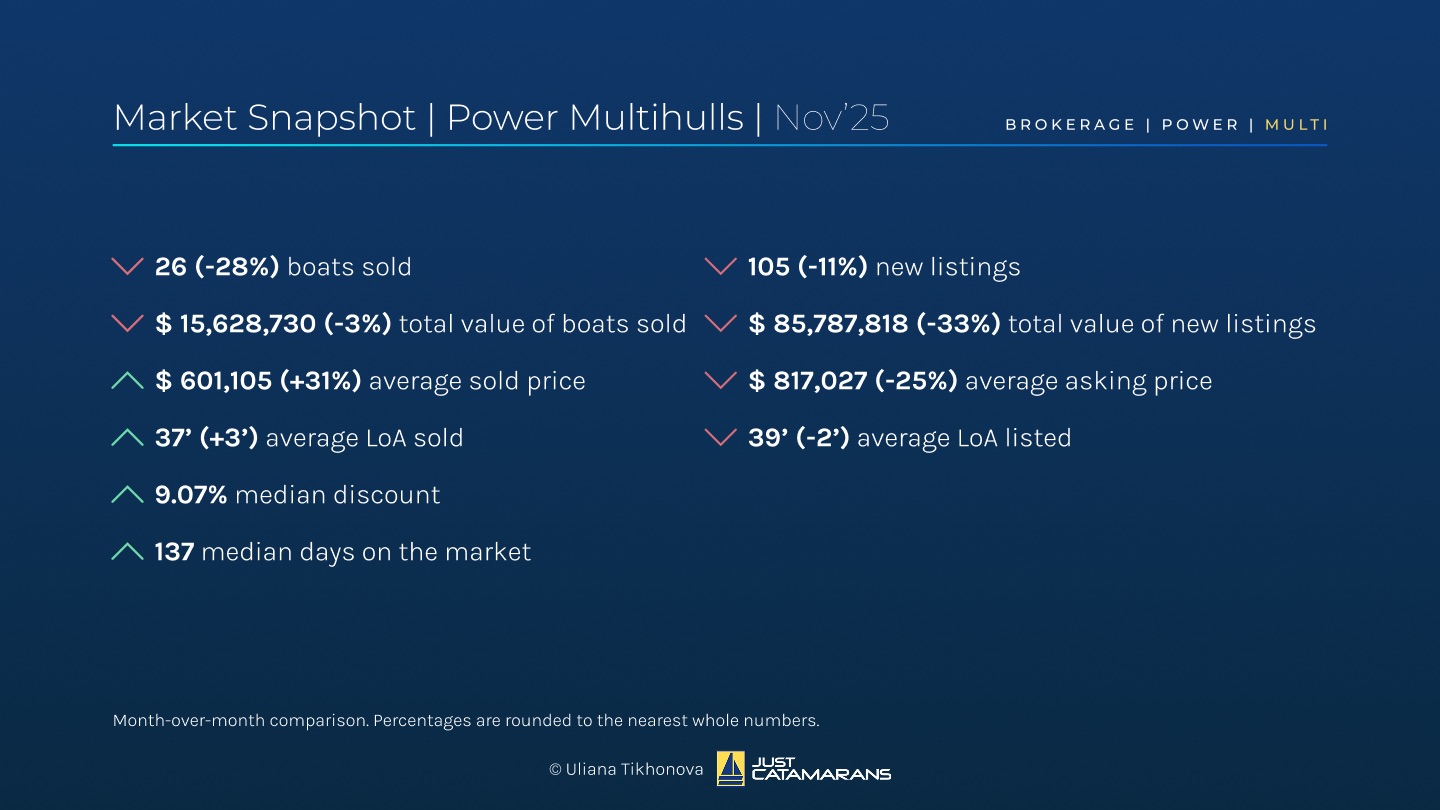

Power Multihull Market Overview, November 2025.

November cooled down a bit, closing with 28% fewer power multis sold. However, the minor 3% dip in the total value commanded the higher sold price, now averaging just above $600,000 – the highest not seen since February. The median discount and time on the market continued to rise, indicating sellers’ willingness to negotiate in order to move older inventory.

Number of Power Multihulls Sold, 2021-2025.

Value of Power Multihulls Sold, 2021-2025.

In October and November, World Cat continued to lead by volume, accounting for 16% of sales, followed by Glacier Bay and Aquila. By value, Horizon took the top spot, replacing Sunreef, followed by Aquila and MTI.

The highest dollar was paid for Horizon, averaging $2.105 million, ILIAD, selling for around $1.87 million, and Prestige at $1.5 million.

Brokerage Market Leaders, Power Multihulls, October-November 2025. Background image: Horizon PC74, courtesy Horizon Power Catamarans.

Key transactions included the Horizon PC65 Cellfish (2019), featuring warm wood interiors and sold for $3.015 million, and the nearly new ILIAD 53 Kailani (2024), carrying 3.2 kW of solar capable of covering most domestic needs, which changed hands for A$2.8 million (around $1.86 million).

Top left: Horizon PC65 Cellfish (2019), courtesy The Powercat Company. Bottom right: ILIAD 53 Kailani (2024), courtesy The Yacht Sales Co.

Power Multihull Sales Geography

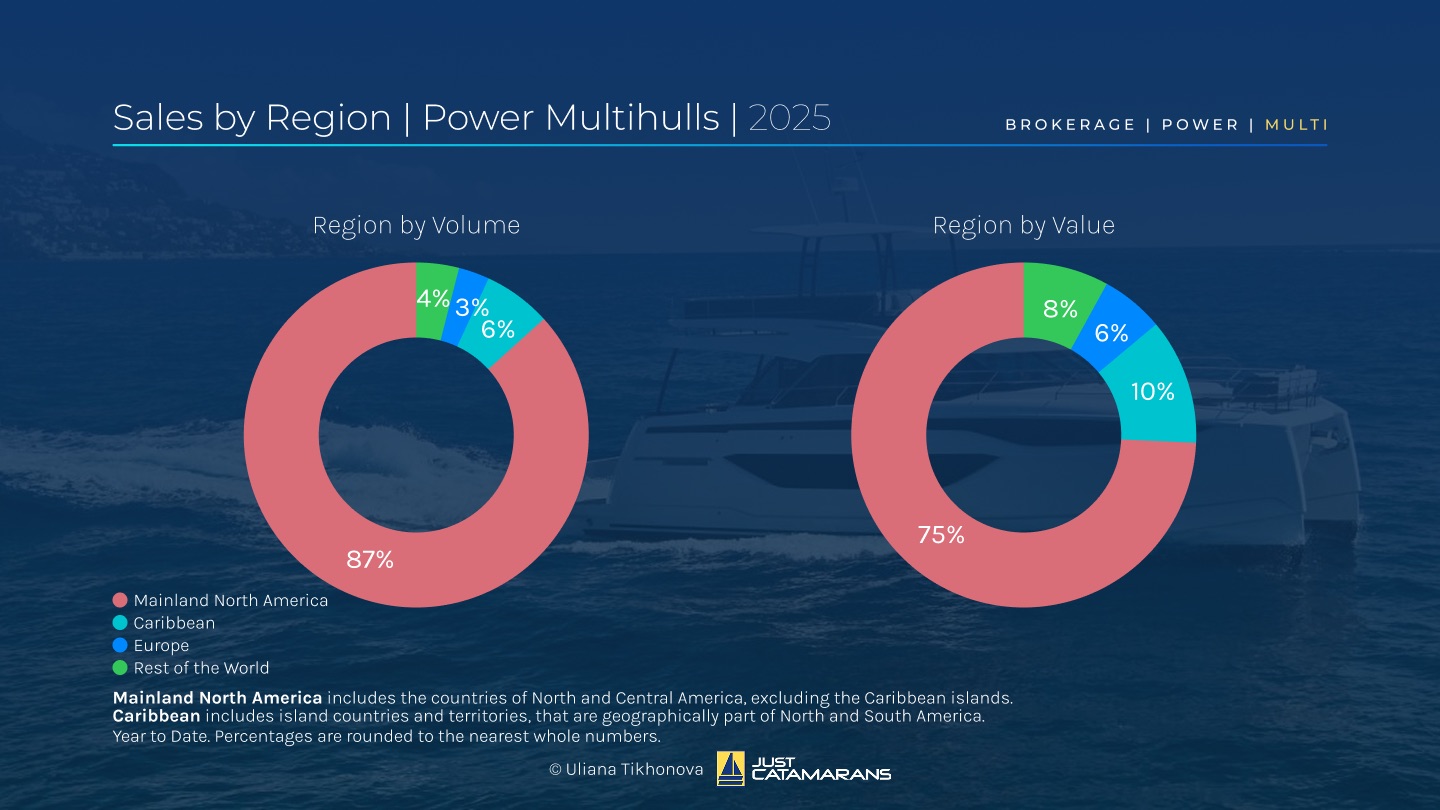

Sales by Region, Power Multihulls, 2025. Background image: Prestige M48, courtesy Prestige Yachts.

As a result of October and November transactions, North America continued to dominate global power multihull sales, accounting for 87% of total volume and increasing its share to 75% of the collective value year-to-date. The Caribbean and Europe shrank slightly by value, while the rest of the world remained unchanged.

Active Power Multihull Listings

October saw a 33% increase in new power multihull listings, with a 140% jump in total value and an 81% rise in the average asking price, reaching nearly $1.1 million. November slowed down, contributing 33% less to the brokerage fleet by value and closing with an average asking price of $817,000.

Notable additions included a superyacht Silver Yachts SilverCat 36M Reduce (2024), listed at €21.7 million (about $25.5 million), and the JFA Yachts Long Island 78 Power 4Ever (2021), asking €8.1 million (about $9.5 million).

Top left: JFA Yachts Long Island 78 Power 4Ever (2021), courtesy JFA Yachts. Bottom right: Silver Yachts SilverCat 36M Reduce (2024), courtesy Silver Yachts.

⸻

Next on the Horizon

The official season kickoff on this side of the Atlantic gave October a boost, though activity slowed somewhat in November. Several high-profile vessels changed hands or entered the brokerage market, driving average prices and values upward. Meanwhile, fewer new listings may help shift the market toward a more balanced buyer-seller dynamic, while U.S. tariffs continue to steer buyers toward brokerage options.

North America remains a global leader in both sailing mono- and multihull sales, and combined with the proximity of Caribbean cruising grounds, it offers unmatched diversity and pricing for boat buyers.

Let’s see what December brings!

⸻

If you’re in the market for a yacht – sail or power, new or pre-owned – feel free to connect with me. I’d be happy to assist in any way I can!

As always, I welcome and highly appreciate your feedback. This analysis is based on the available data, and actual numbers may differ. The analysis focuses on the brokerage market and does not reflect new builds. These are my opinions and conclusions, which may not align with yours.

Based on the available data, it appears that the actual total volume of sailboat sales is likely at least three times greater than what I use for my analysis. Still, this dataset offers a valuable opportunity to gain a representative snapshot of the brokerage market. A big shoutout to the brokers who take the time to record and report their sales – your efforts make this kind of market insight possible!

Data source: boatwizard.com.