September in Numbers: Momentum Softens but Confidence Holds

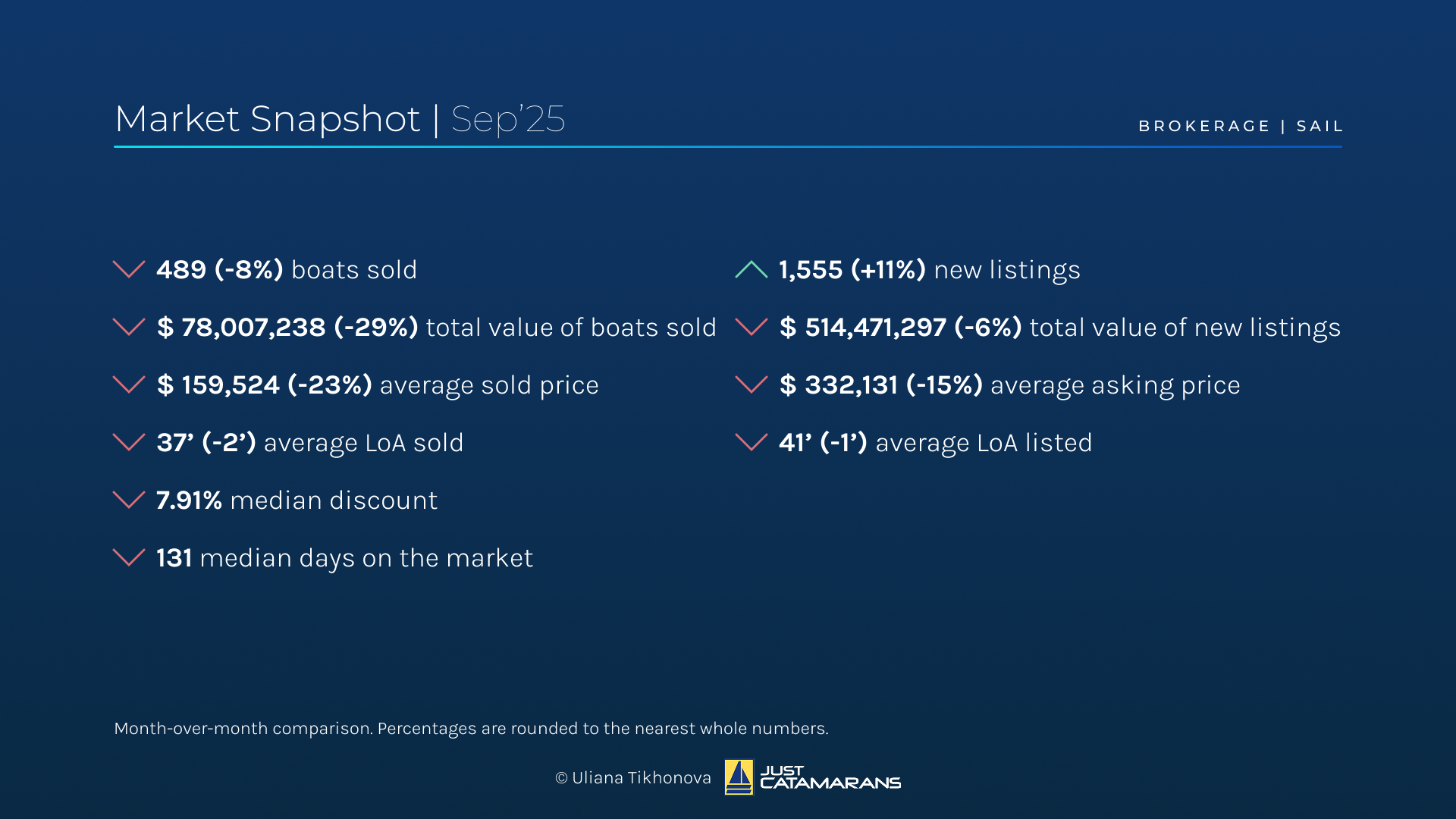

Sailing Yacht Brokerage Market Overview, September 2025

by Just Catamarans broker Uliana Tikhonova

After unusually active July and August, September was cooler than expected, with all indicators returning to their “2024 normal.” This was partly due to the absence of transactions among high-profile superyachts (24 meters, or 78 feet, and above).

Monohulls took the hit, while multihulls held better, confirming perceived buyer preferences. Smaller and less expensive boats were changing hands as the Mediterranean season wrapped up and the U.S. and Caribbean boating season began.

A decreased median discount and shorter time on the market suggest that inventory kept moving and buyers had to act decisively to secure desirable boats.

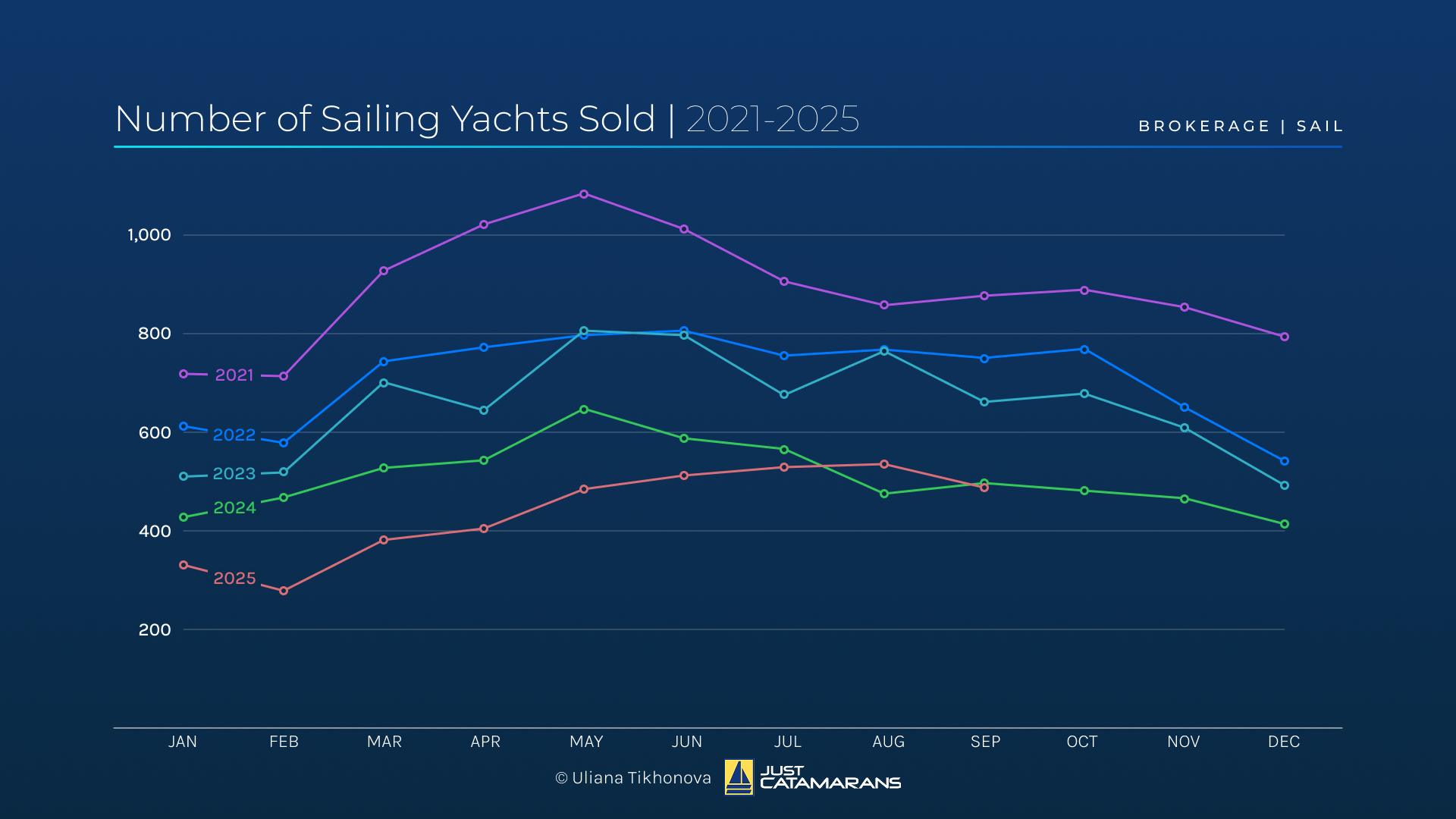

Number of Sailing Yachts Sold, 2021-2025.

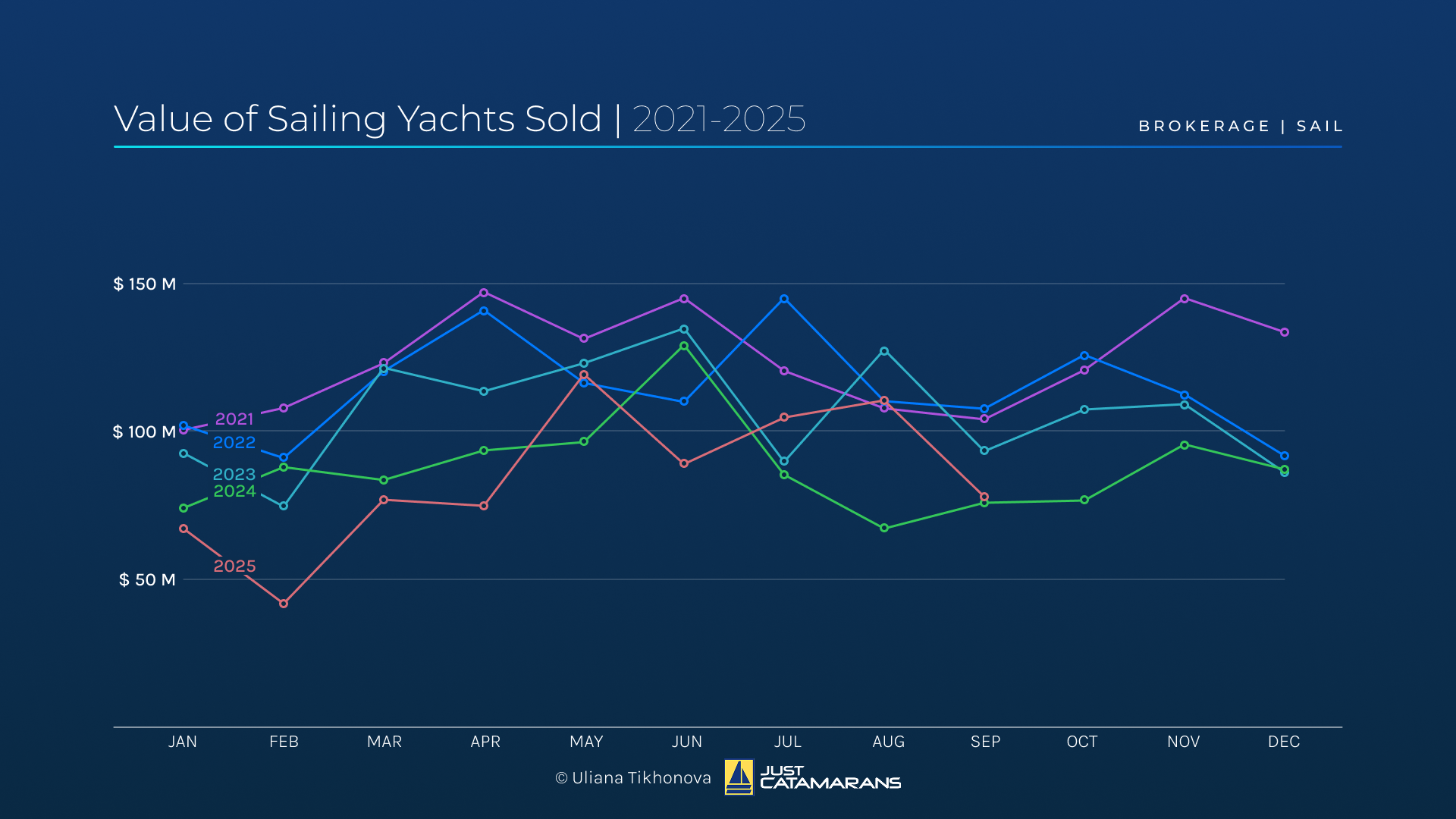

Value of Sailing Yachts Sold, 2021-2025.

Currently, around 13,800 sailboats are listed for sale. The number of new listings went up 11%, which – combined with the decrease in total value, average asking price, and length overall – indicates an inflow of more affordable vessels. The multihulls share decreased 2%, now representing 18% by volume, creating fewer opportunities for buyers.

Take a deeper dive into the sailing multi- and monohull, as well as power multihull segments below.

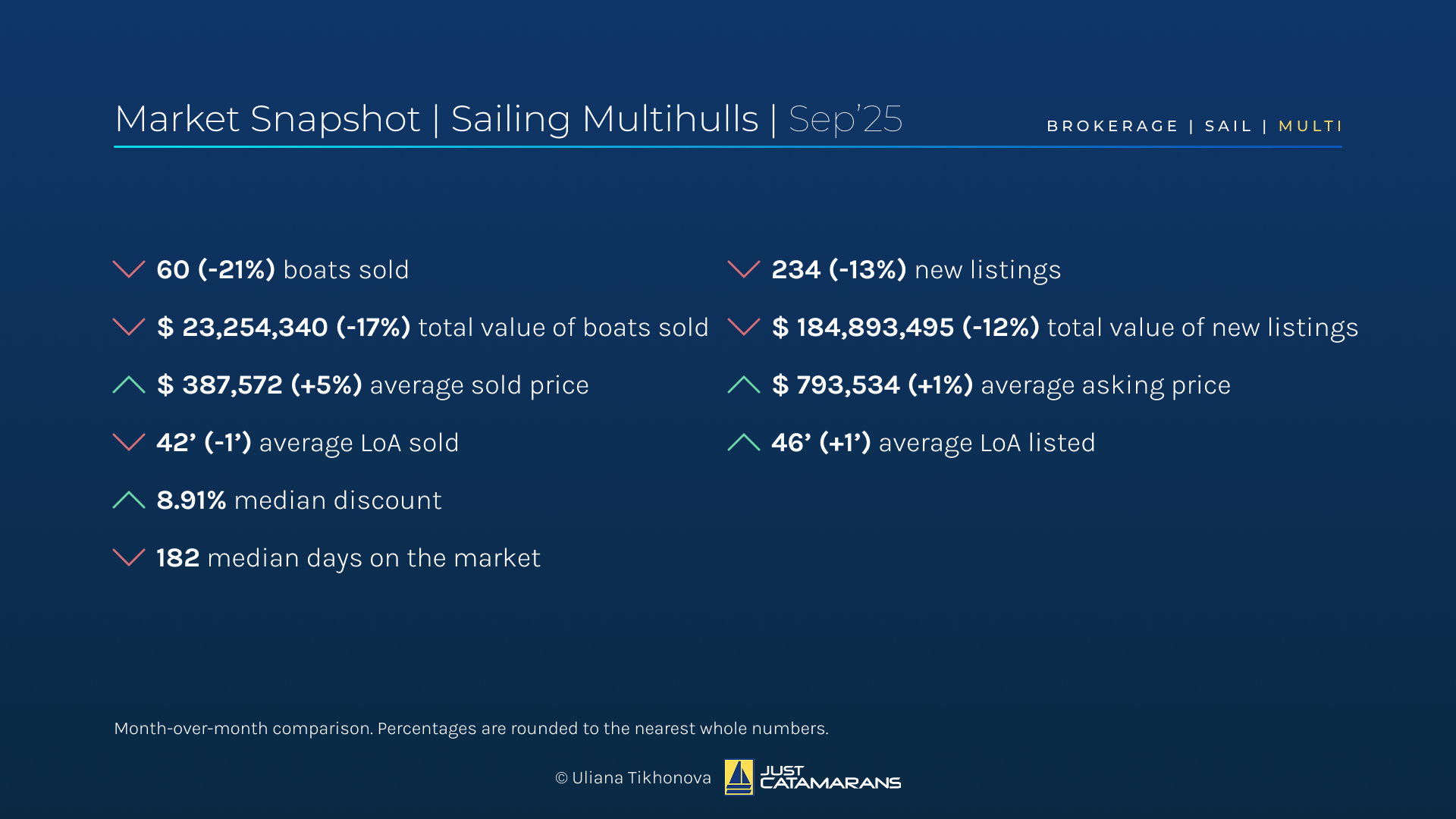

Sailing Multihulls: Holding Their Ground

Sailing Multihull Market Overview, September 2025.

Multihulls, despite loosing their positive trend, held better than monohulls. The total number and collective value sold in September dipped by 21% and 17%, respectively. However, the average sold price increased 5%, reaching around $379,000.

That said, key figures remained higher than in previous year, and decreasing time on the market signals to sellers that it’s not time to panic. With the North America’s share growing and Europe’s shrinking, this may actually mark a soft opener to the season in this part of the world.

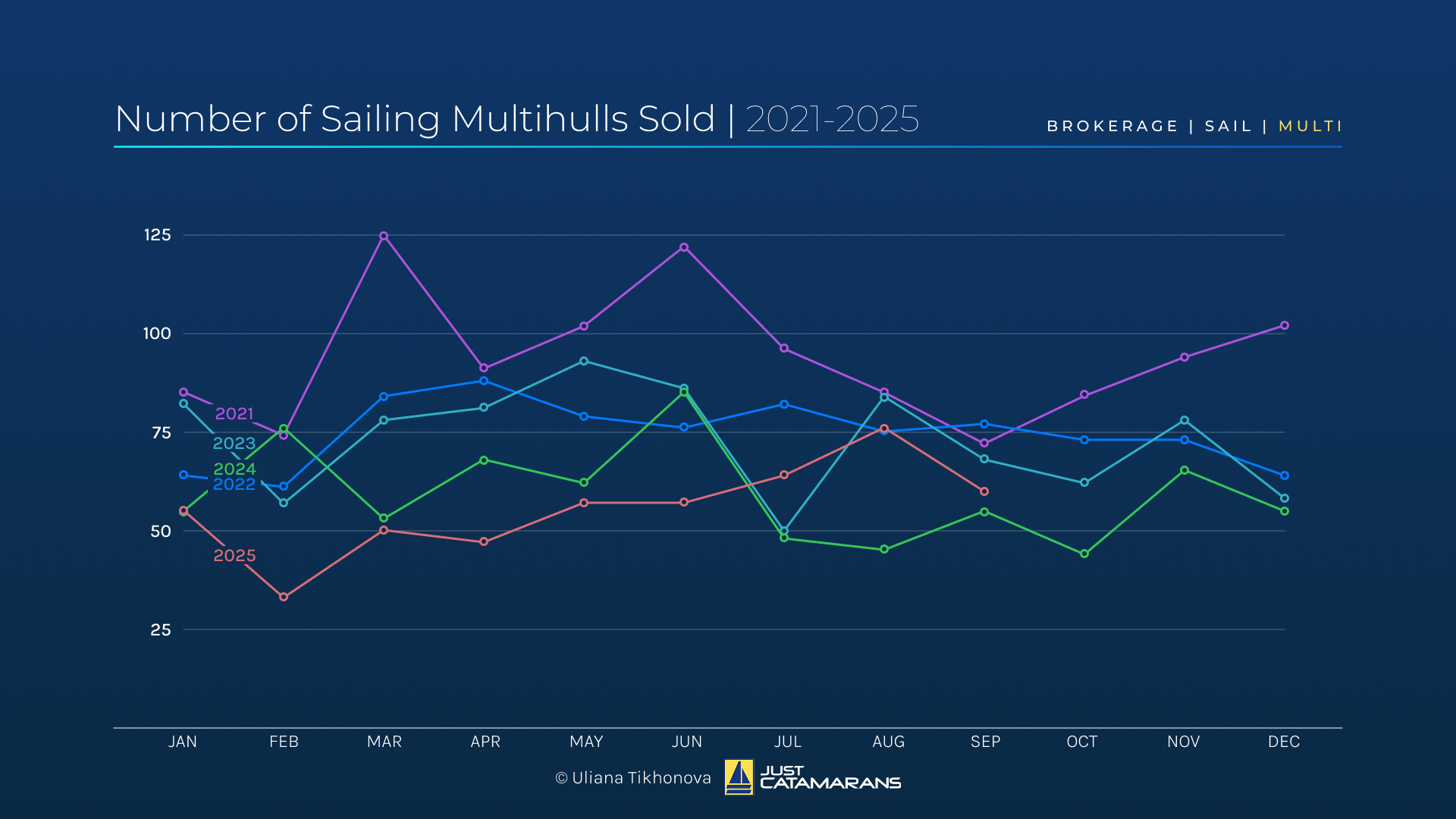

Number of Sailing Multihulls Sold, 2021-2025.

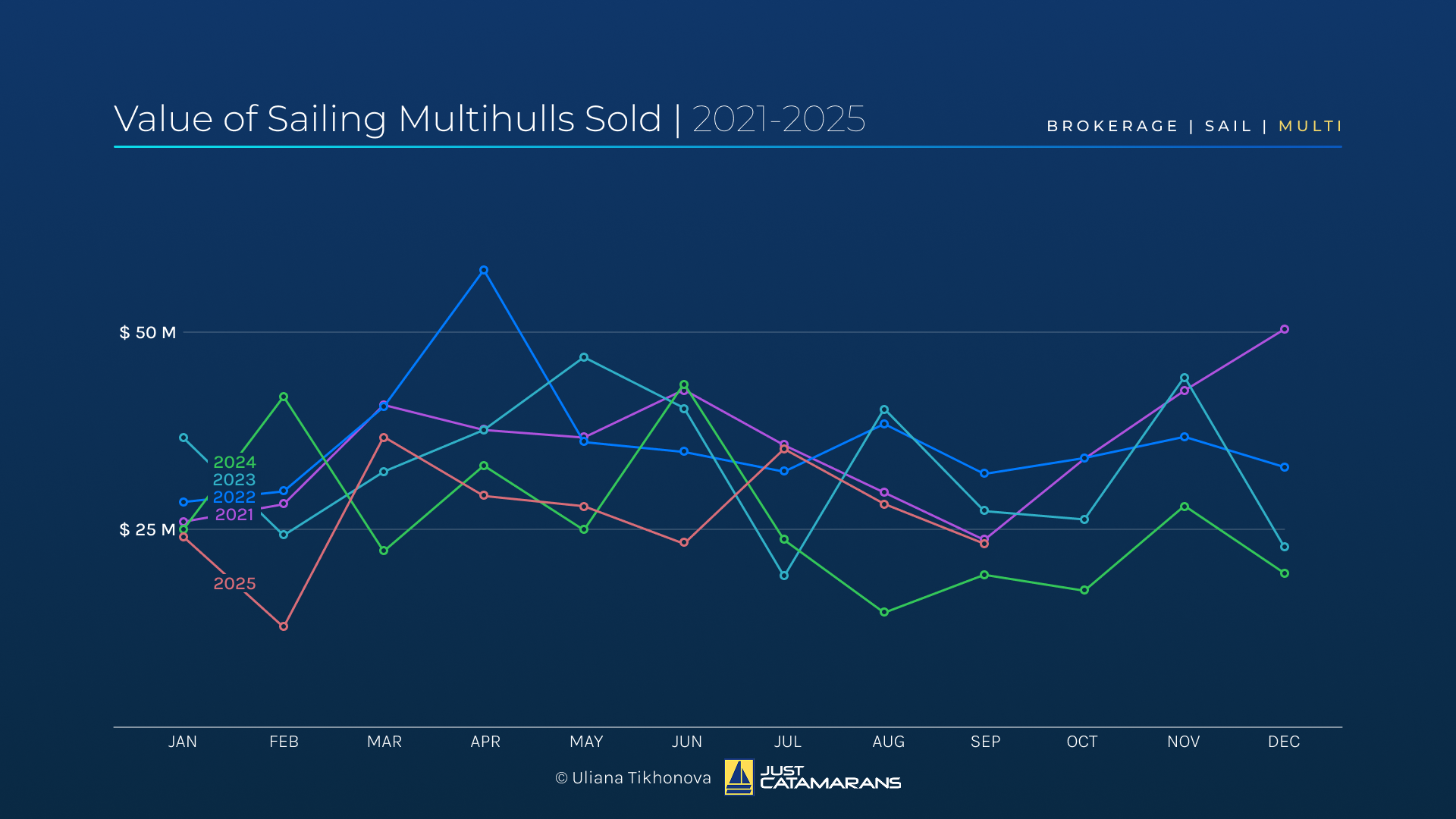

Value of Sailing Multihulls Sold, 2021-2025.

Among top brokerage performers, Lagoon kept its first place by both volume and value, growing around 10% in each category, followed by Fountaine Pajot and Leopard – just like last month.

Brokerage Market Leaders, Sailing Multihulls, September 2025. Background image: Lagoon Eighty 2, courtesy Lagoon Catamarans.

Notable transactions included the electric-powered Voyage 590e Summer Breez (2022), sold for $1.6 million, and performance-oriented Balance 442 Sage (2022), sold for $1 million.

Top left: Voyage 590e Summer Breez (2022), courtesy Voyage Yacht Sales. Bottom right: Balance 442 Sage (2022), courtesy Rapide Yacht Group.

If you’re not ready to compromise between performance and self-sufficiency, your search is over: Windelo, a true pioneer of performance eco-friendly vessels, has it all.

Drop me a line to discuss new builds and available brokerage options – they won’t stay on the market forever!

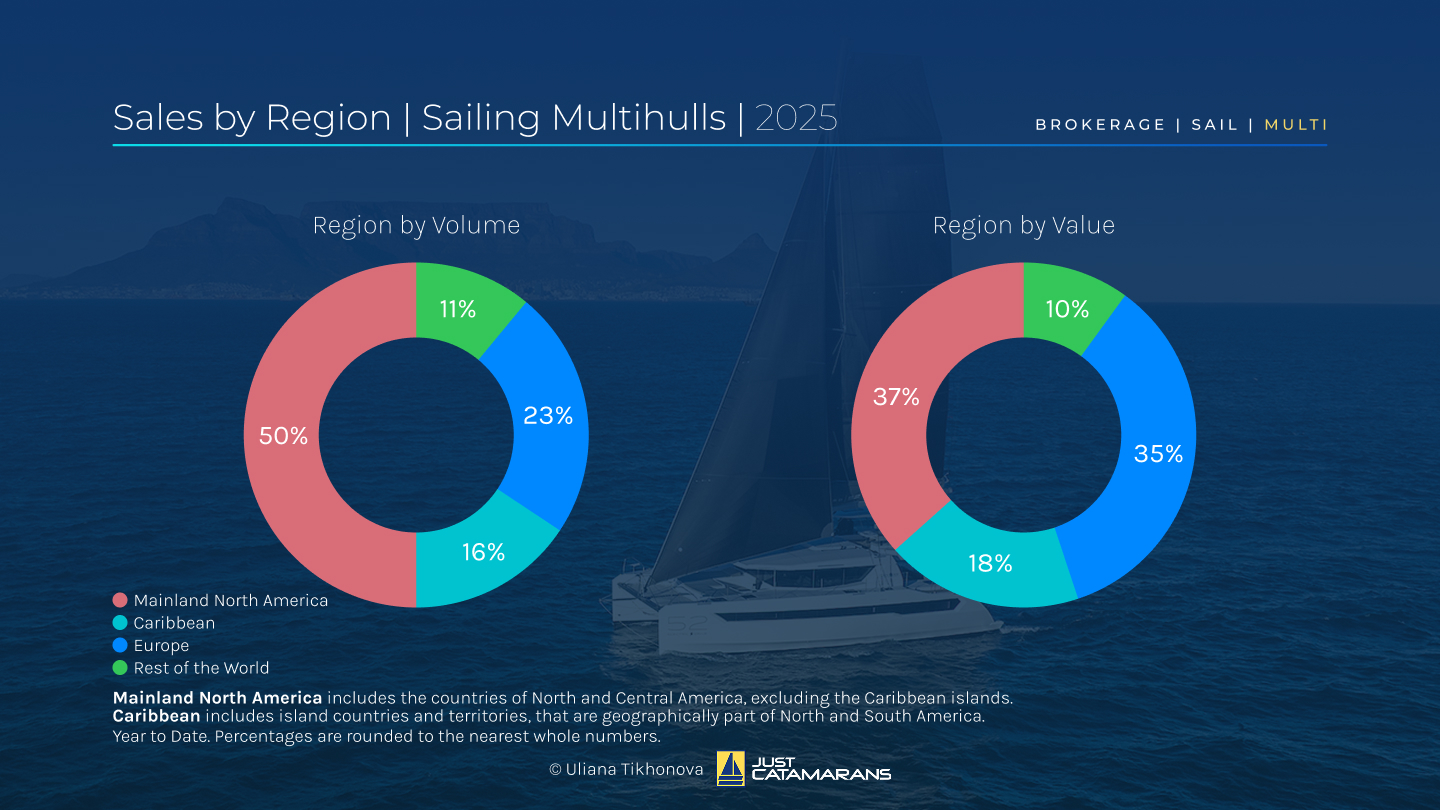

Sailing Multihull Sales Geography

Sales by Region, Sailing Multihulls, 2025. Background image: Leopard 52, courtesy Leopard Catamarans.

In September, North America’s year-to-date share continued to grow, adding 1% to its share by volume and 3% by value, reaching 50% and 37% respectively. Europe’s share decreased by 1% in volume and 3% in value. The Caribbean also dipped 1%, while the rest of the world gained 1% in both metrics.

The continued rise in North American share – alongside U.S. tariff policies, tax incentives, and approaching boating season – suggest that buyers are increasingly turning toward brokerage boats, especially those already imported into the U.S.

Active Sailing Multihull Listings

September saw fewer new multihull listings, down 13% in volume and 12% in value, totaling close to $185 million. Meanwhile, the average asking price rose to around $794,000. This created less opportunities for budget-cautious buyers and more for those ready to invest to get underway. There are currently 2,500 sailing multihulls available, catering to a wide range of use cases, requirements, and budgets.

Notable new arrivals included a heritage Lagoon Seventy 7 Manaia (2023), asking €6 million (around $7 million), and the aluminum explorer Squalt Marine CK70 (2023), asking €2.9 million (around $3.4 million).

Top left: Lagoon Seventy 7, courtesy Lagoon Catamarans. Bottom right: Squalt Marine CK70 (2023), courtesy Royal Yacht Brokers.

At the very top of the sailing multihull segment, the 145-foot custom Pendennis Hemisphere (2011) continues to lead with an asking price of €46 million (about $53.6 million). In the under-24-meter category, the Sunreef 70 Eco n+1 (2024) is currently the highest-priced yacht, listed at €6.5 million (about $7.6 million).

Top left: 145-foot custom Pendennis Hemisphere (2011), courtesy Burgess. Bottom right: Sunreef 70 Eco n+1 (2024), courtesy Ocean Sailing House.

Sailing Monohulls: Cooling After the Summer Peak

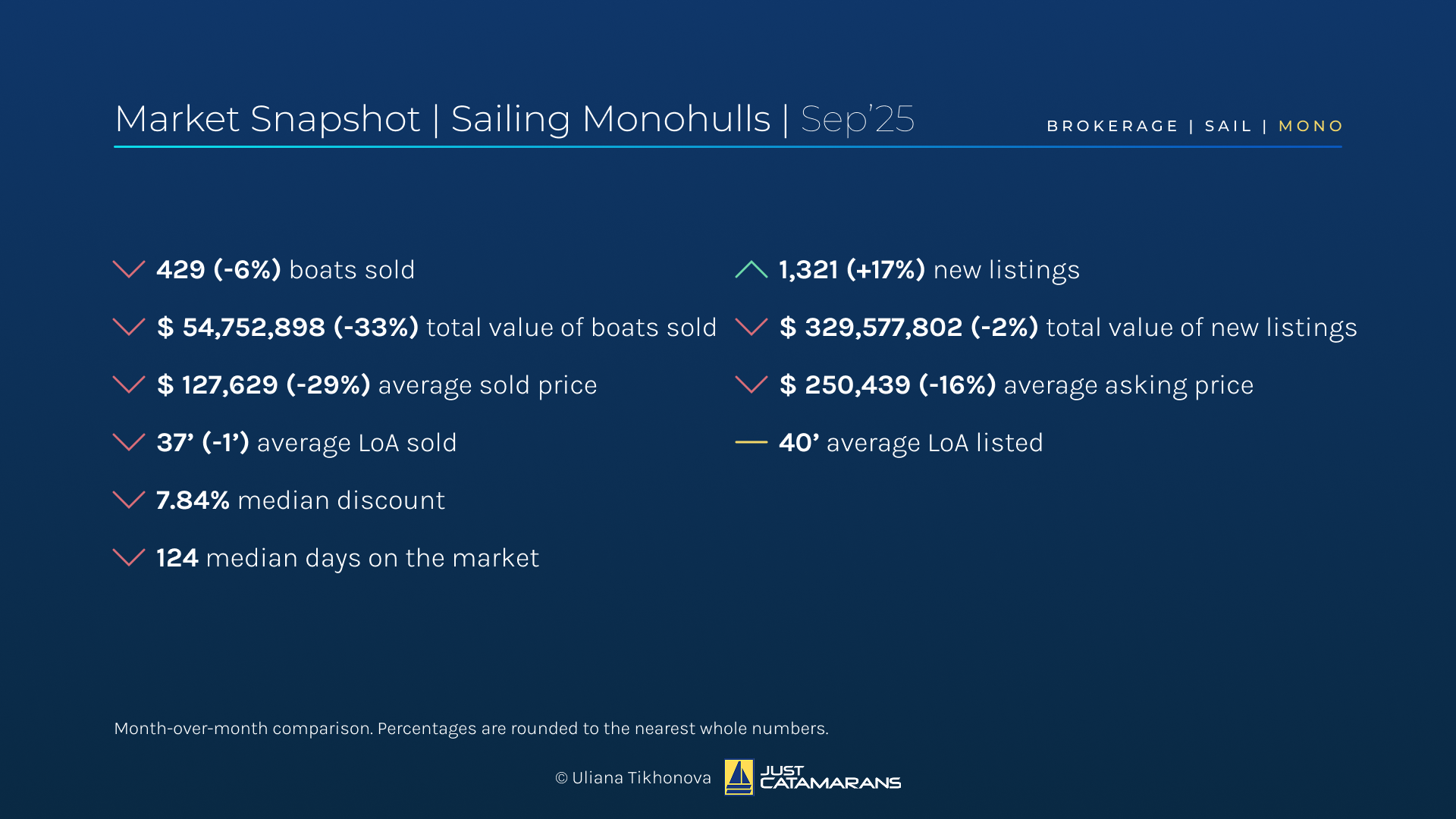

Sailing Monohull Market Overview, September 2025.

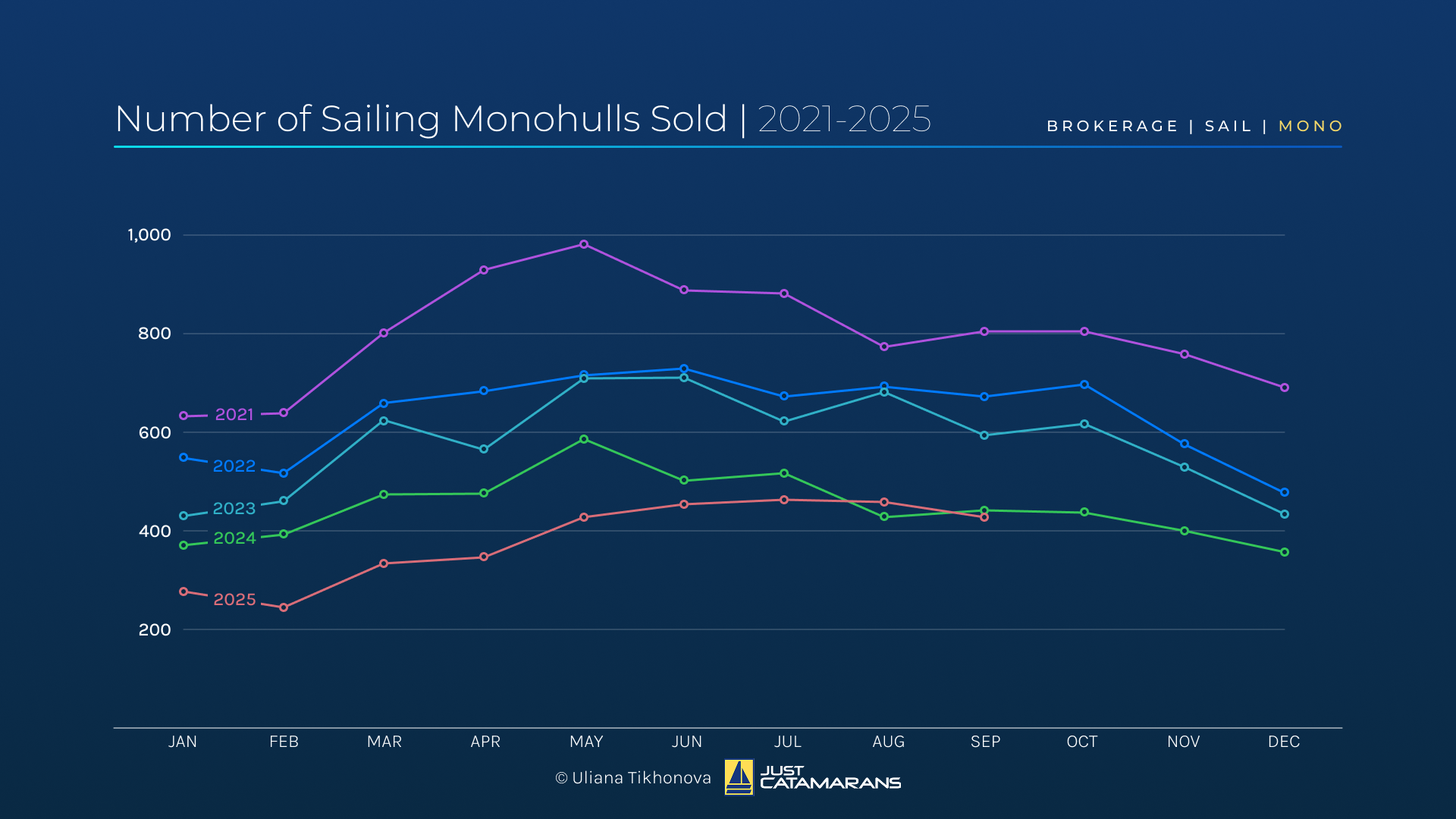

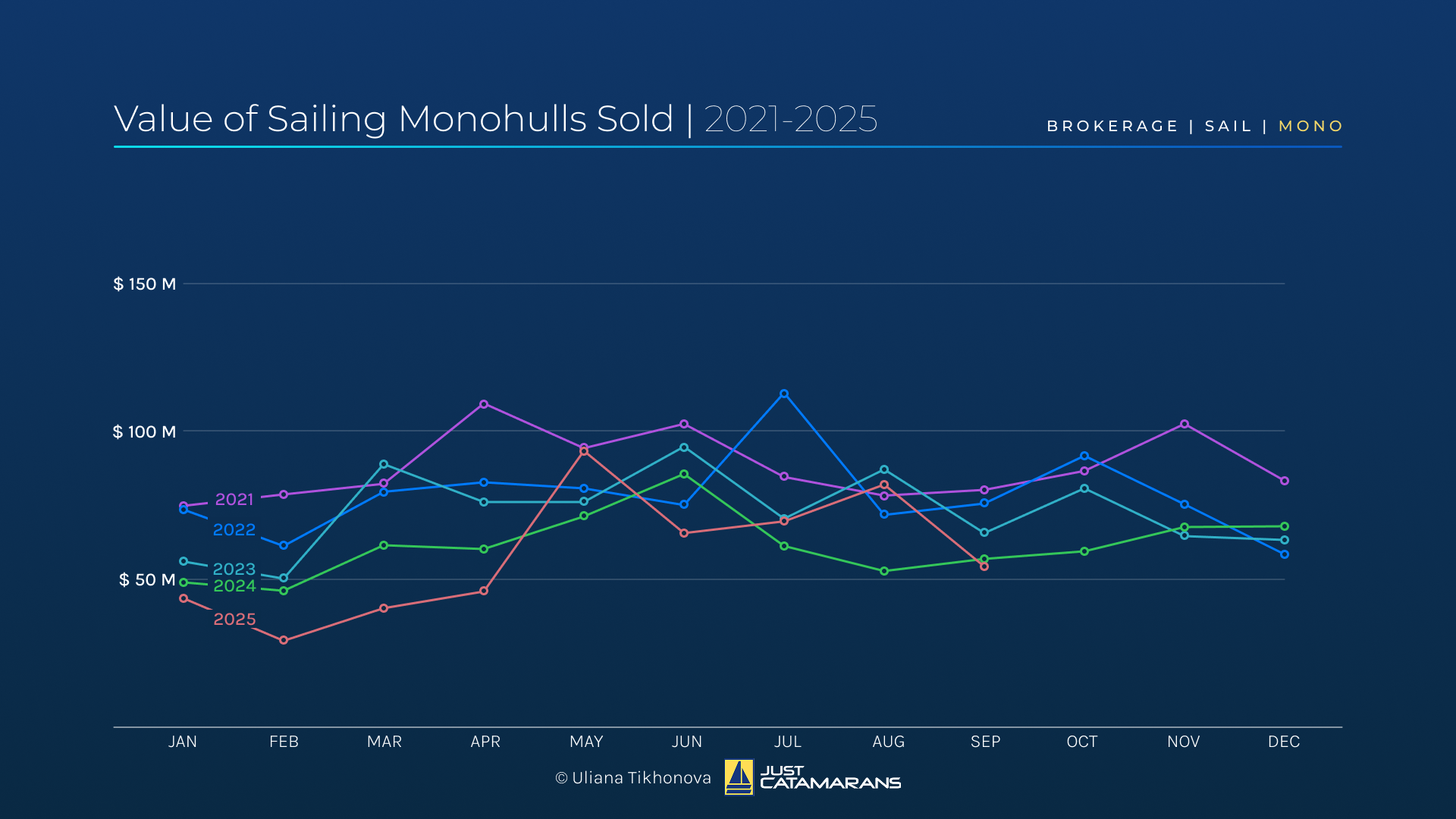

Monohulls saw a 6% decrease in sales volume and a more dramatic 33% decline in collective value, falling below September2024 levels.

The average sold price dropped 29% to $128,000, while the average length also decreased to 37 feet. The median discount and time on the market continued to narrow, suggesting that sellers are reaching their flexibility limits.

Number of Sailing Monohulls Sold, 2021-2025.

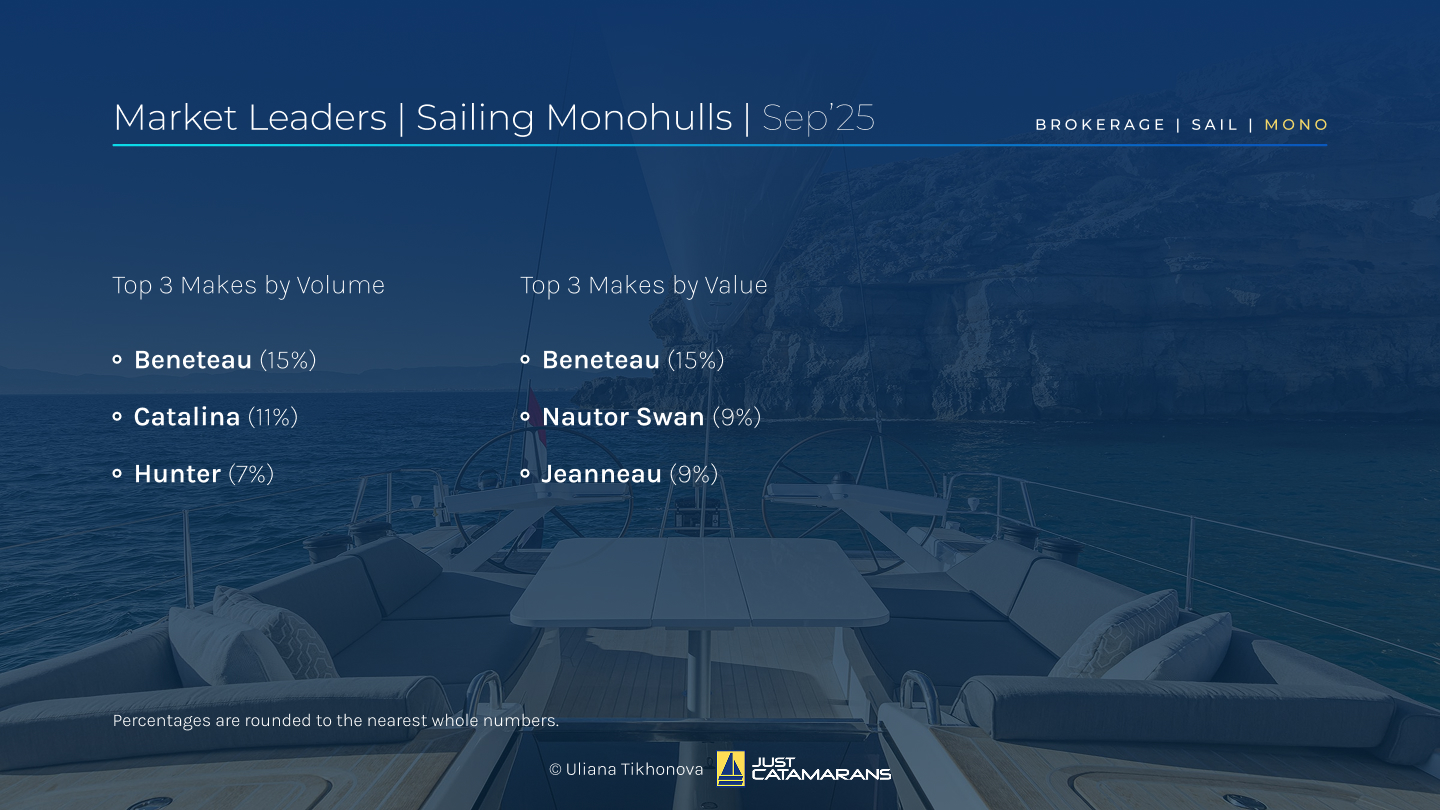

Beneteau and Catalina remained top performers by volume, with Hunter swapping places again with Jeanneau to secure third place. In value, without any high-profile transactions, Beneteau led, followed by Nautor Swan and Jeanneau, both increasing their shares to 9%.

Brokerage Market Leaders, Sailing Monohulls, September 2025. Background image: Nautor Swan 65, courtesy Nautor Swan.

Notable deals included the Nautor Swan 65 Miri 2.0 (2021), sold for €3.1 million (around $3,6 million), and the CNB 76 Zampa (2015), sold for €1.3 million (around $1.5) – both in Europe.

Top left: Nautor Swan 65, courtesy Nautor Swan. Bottom right: CNB 76 Zampa (2015), courtesy SC Yachts – CNB France.

Sailing Monohull Sales Geography

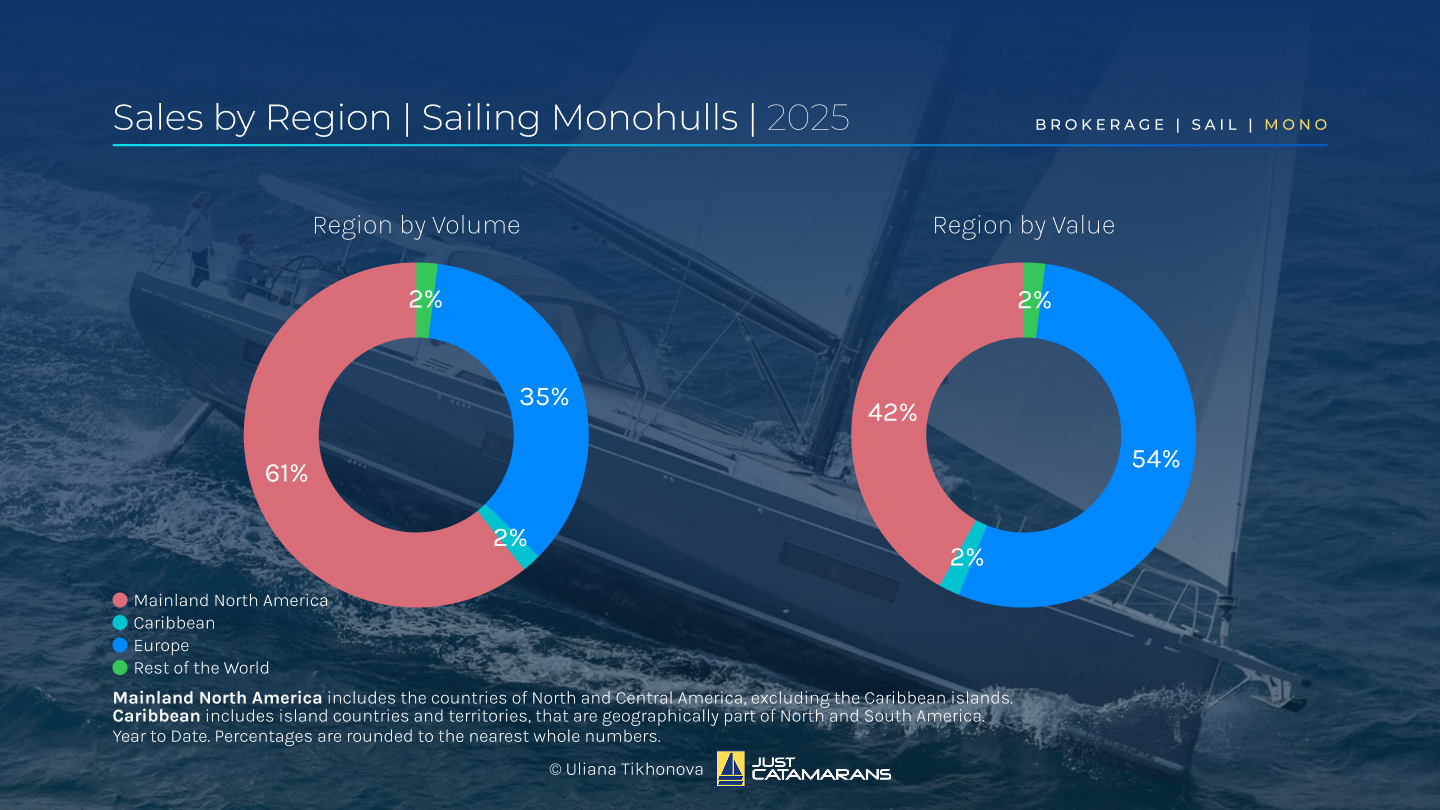

Sales by Region, Sailing Monohulls, 2025. Background image: Beneteau Oceanis Yacht 60, courtesy Beneteau.

September transactions maintained the geographical balance: North America accounts for 61% of sales by volume, while Europe holds 35%. By value, North America represents 42% and Europe 54%, reflecting a concentration of higher-value transactions in Europe.

Active Sailing Monohull Listings

In September, new monohull listings jumped 17% in volume but dipped 2% in value, totaling around $330 million. The average asking price fell 16% to about $250,000, flooding the market with more affordable options.

New arrivals included several custom-built beauties, such as the 144-foot Alloy Yachts AY40 Imagine (2010), listed at €19.95 million (around $23.4 million). Outside the superyacht segment, a smaller Contest 67CS (2018) joined the brokerage fleet, asking €3.115 million (around $3.6 million).

Top left: 144-foot Alloy Yachts AY40 Imagine (2010), courtesy Camper & Nicholsons. Bottom right: Contest 67SC, courtesy Contest Yachts.

At the very top of the market, the 193-foot Vitters Cruising Ketch Maximus (2023) remains the most expensive sailing superyacht (24 meters and above), listed at €79.5 million (about $92 million). In the under-24-meter category, a rare performance cruiser Knierim Surge 62 Auliana III (2024) holds the highest price tag at €5,695,000 (around $6.6 million).

Top left: 193-foot Vitters Cruising Ketch Maximus (2023), courtesy Edmiston. Bottom right: Knierim Surge 62 Auliana III (2024), courtesy Fraser Yachts.

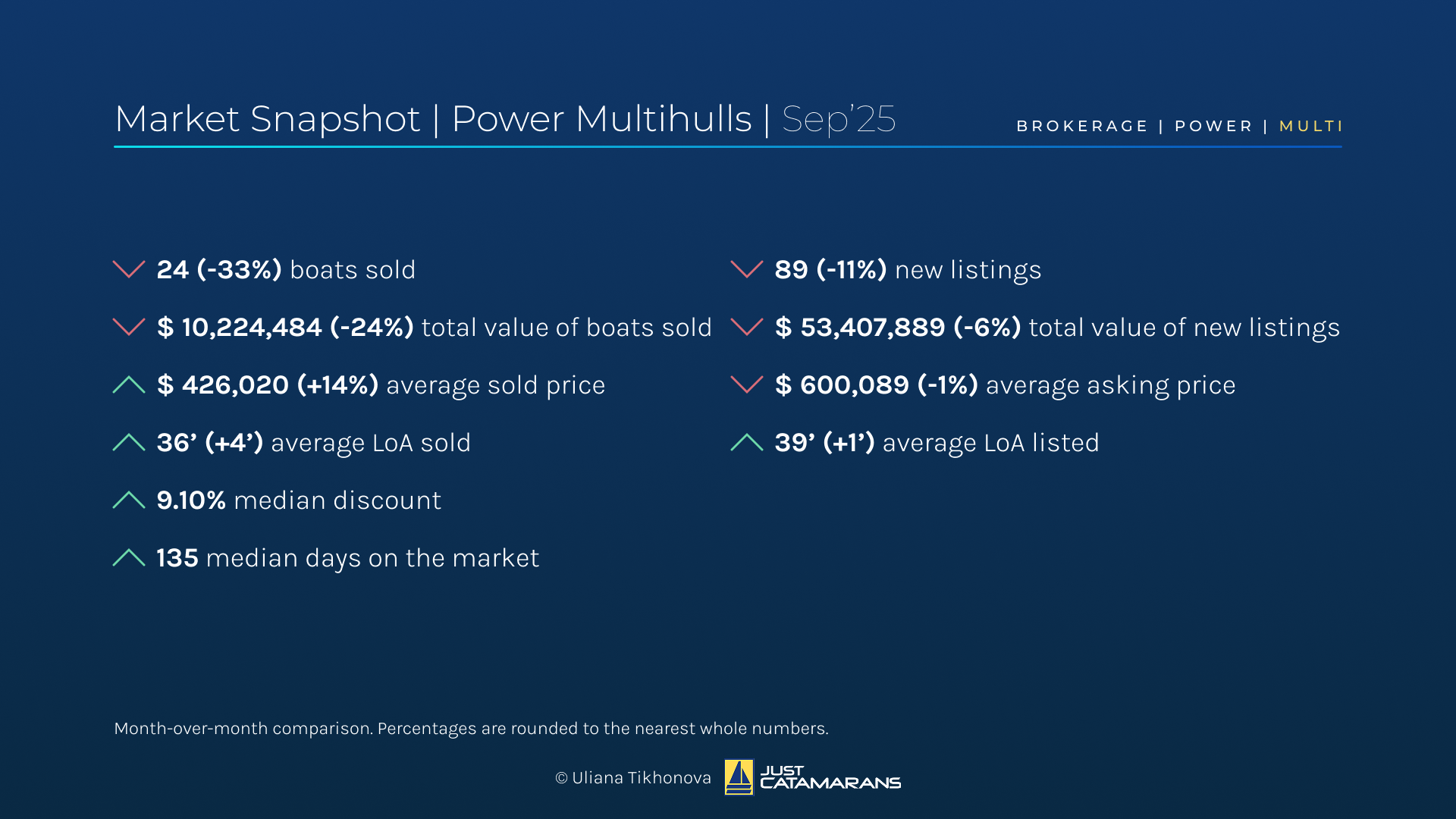

Power Multihulls: Fewer Sales, Higher Prices

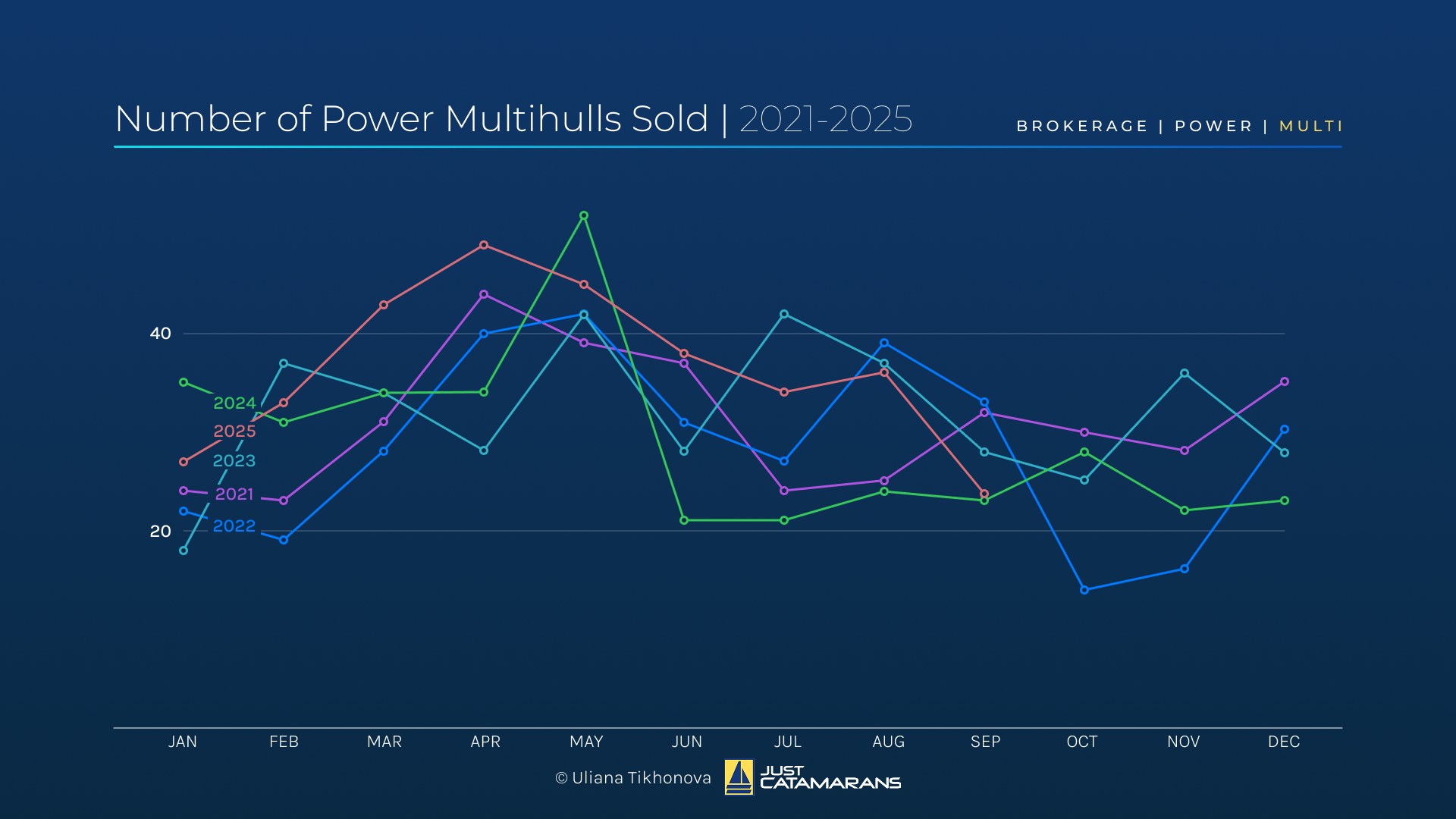

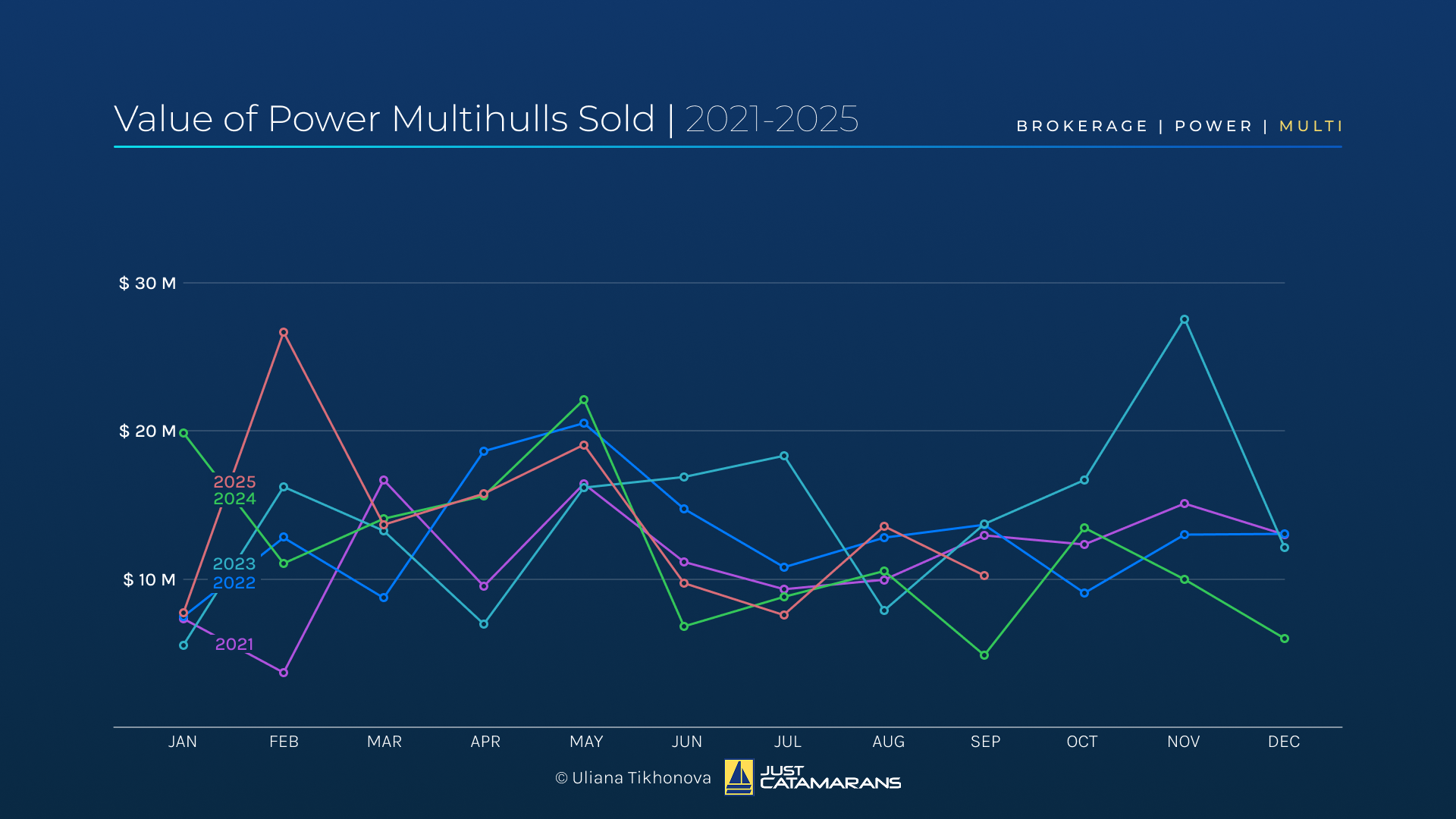

In the power multihull market, September saw a sharp decline in both volume and value, dropping 33% and 24% respectively, to just above $10 million in total sales. Despite the slowdown, figures still remained higher than those seen in 2024.

The average sold price continued its upward trend, reaching around $426,000 – a 14% increase month-over-month. The average length rose by 4 feet to 36. Meanwhile, a higher median discount and longer time on the market reflected sellers’ willingness to negotiate in order to move older inventory.

Number of Power Multihulls Sold, 2021-2025.

Value of Power Multihulls Sold, 2021-2025.

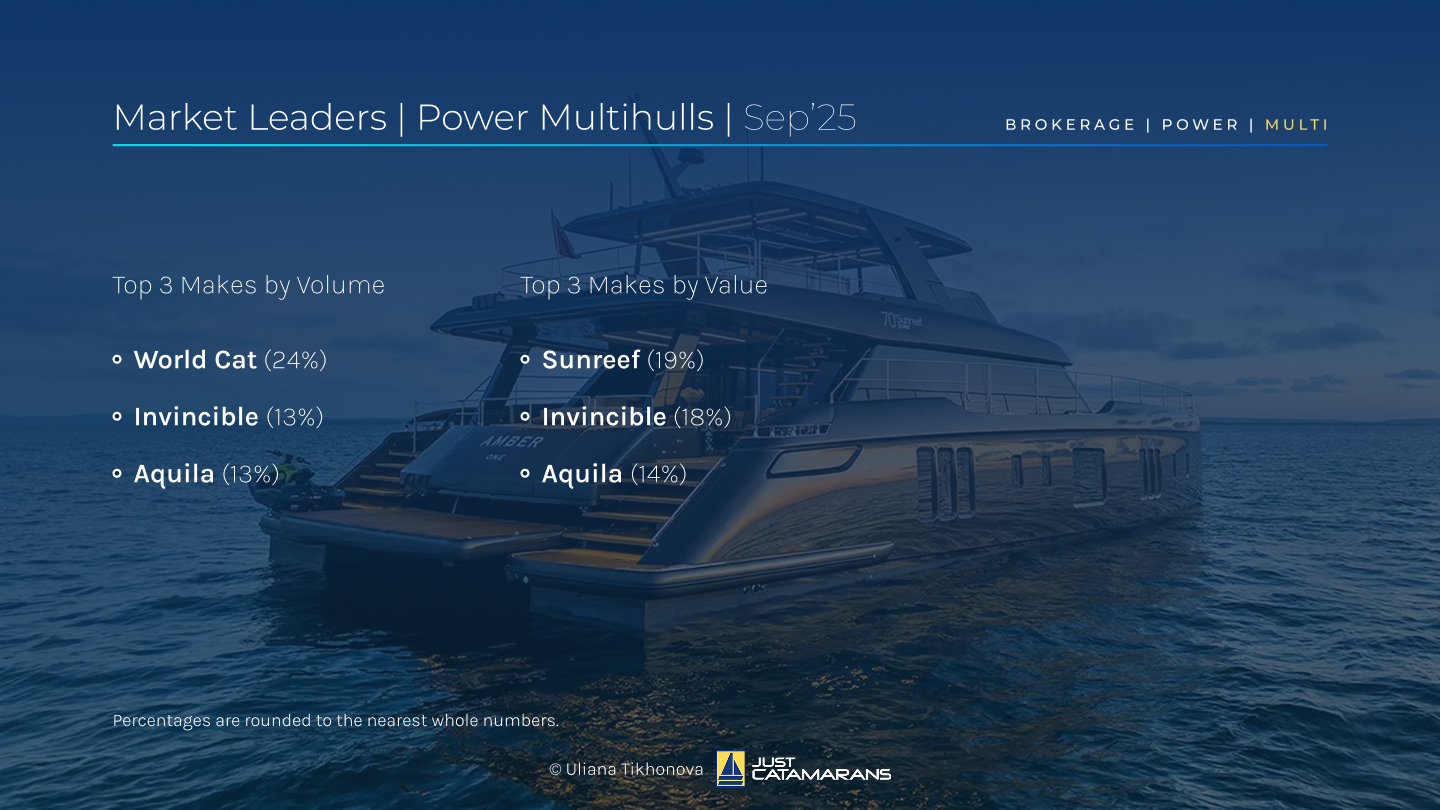

World Cat again led by volume, accounting for 24% of sales, followed by Invincible and Aquila, each representing 13%. By value, Sunreef retained the top position – again with just one sale – followed by Invincible and Aquila, replacing World Cat and Fountaine Pajot – last month’s top performers.

Brokerage Market Leaders, Power Multihulls, September 2025. Background image: Sunreef 70 Power Next, courtesy Sunreef.

Key transactions included the Sunreef 70 Power Royal Rita (2016), sold for $1.7 million, and the custom Pacific Expedition 65 Barbara Gail (2013), which changed hands for $820,000.

Top left: Sunreef 70 Power Royal Rita (2016), courtesy Worth Avenue Yachts. Bottom right: Custom Pacific Expedition 65 Barbara Gail (2013), courtesy 26 North Yachts.

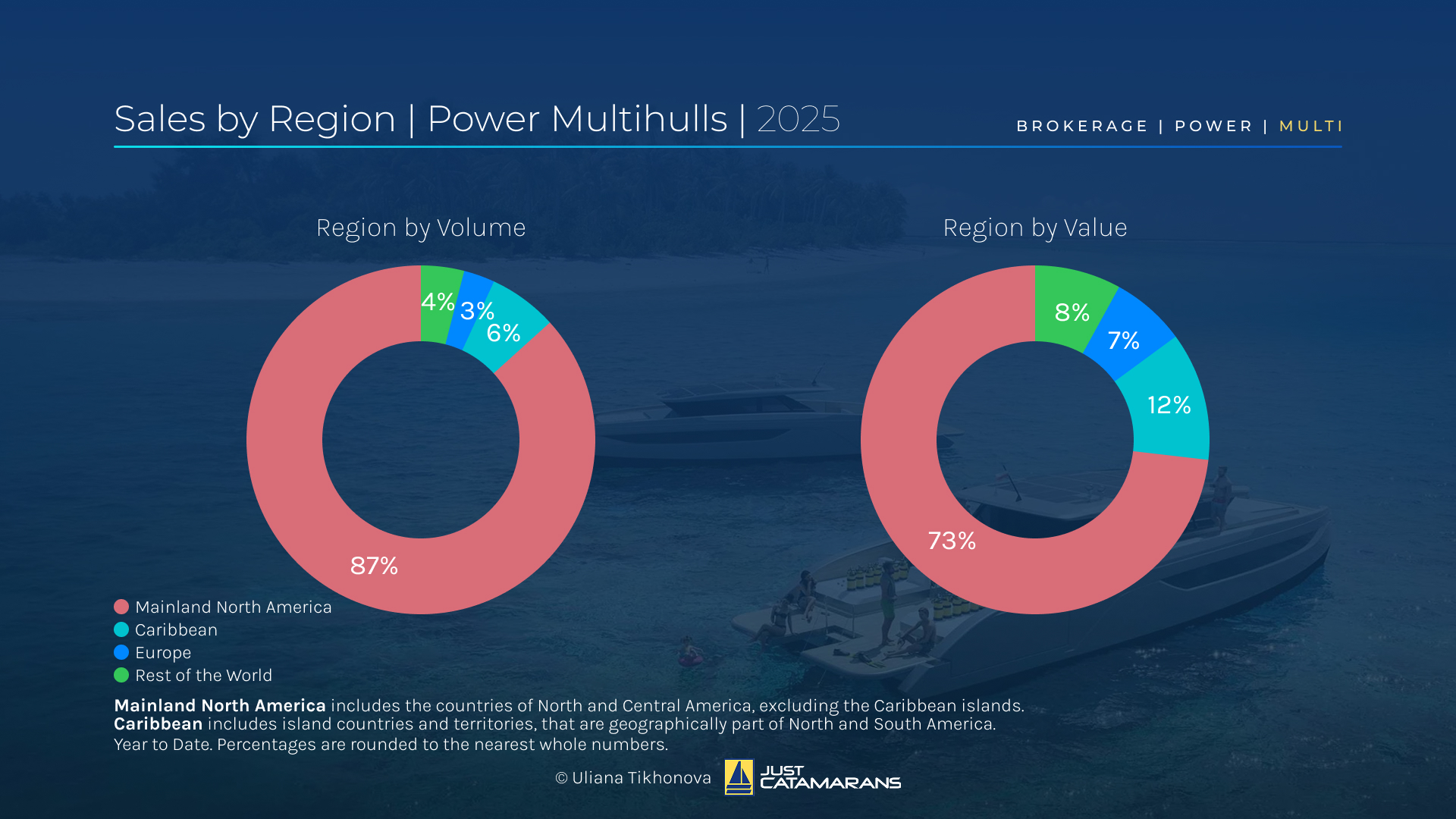

Power Multihull Sales Geography

Sales by Region, Power Multihulls, 2025. Background image: Sunreef Ultima 55, courtesy Sunreef.

As a result of September transactions, North America continued to dominate global power multihull sales, accounting for 87% of total volume and 73% of collective value year-to-date. The Caribbean gained slightly, up 1% in market value share compared to August.

Active Power Multihull Listings

In September, new listings in the power multihull segment declined 11% in volume and 6% in value, while the average length rose by one foot. The average asking price hovered around $600,000.

Noteworthy additions included the Sunreef 60 Power SarAya (2023), listed at €3.95 million (around $4.6 million), and the Lagoon 630 Power Aegir (2018), asking €2.035 million (around $2.37 million).

Top left: Sunreef 60 Power SarAya (2023), courtesy Channel.R Yacht Sales. Bottom right: Lagoon 630 Power Aegir (2018), courtesy Ocean Independence.

At the very top of the power multihull market, the luxurious 117-foot Silver Yachts Silvercat 36 Spacecat (2022) currently stands as the most expensive superyacht (24 meters and above), listed at $17.5 million in Thailand. In the under-24-meter category, the Sunreef 70 Power Vahewa (2024) holds the top asking price of €7.45 million (around $8.7 million) and is available in Italy.

Top left: 117-foot Silver Yachts Silvercat 36 Spacecat (2022), courtesy Burgess. Bottom right: Sunreef 70 Power Vahewa (2024), courtesy Denison Yachting.

⸻

Next on the Horizon

After unusually active months of July and August, September saw a slight cooldown ahead of the official season kickoff with the Annapolis Boat Show on this side of the Atlantic.

North America continues to lead the global sailing mono- and multihull market by volume, and with the new U.S. tariffs now in effect, we may see increased brokerage activity in the coming months – and even years – as buyers turn to competitively priced options closer to home.

Let’s see what October brings!

If you’re in the market for a yacht—sail or power, new or pre-owned—feel free to connect with me. I’d be happy to assist in any way I can!

As always, I welcome and highly appreciate your feedback. This analysis is based on the available data, and actual numbers may differ. The analysis focuses on the brokerage market and does not reflect new builds. These are my opinions and conclusions, which may not align with yours.

Based on the available data, it appears that the actual total volume of sailboat sales is likely at least three times greater than what I use for my analysis. Still, this dataset offers a valuable opportunity to gain a representative snapshot of the brokerage market. A big shoutout to the brokers who take the time to record and report their sales—your efforts make this kind of market insight possible!

Data source: boatwizard.com.