Solar Tax Credits Available for Catamaran Owners

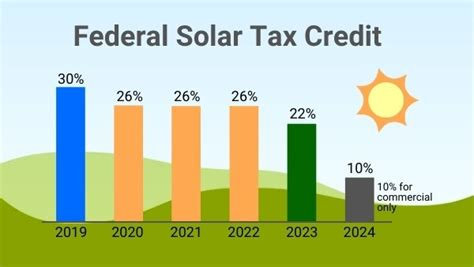

Claim your 26% Federal Solar Tax Credit This Year

Federal Solar Investment Tax Credit Extended!

The 2020 Federal Investment Tax Credit of 26% on the gross cost of a solar PV system has been extended 2023 will be THE FINAL YEAR for a residential tax credit on solar at rate of 22%. The Solar Tax Credits were set to drop to 22% at the start of 2021 and then completely expire at the start of 202 but now everyone has two more years receive 26% reductions on everything from solar panels to battery banks.

“If your boat is US registered, has a bunk, galley, and toilet, then you may qualify for a 26% credit on the ‘total system cost’ when you go solar. This is a HUGE bonus if you want to replace and upgrade to Lithium batteries.”

WHEN DO 26% SOLAR TAX CREDITS END?

Be warned; the 26% solar tax credits will expire at the end of 2022. From 2023, it will drop to 22% before dropping to 0% in 2024 (except for commercial properties that can receive 10% in 2024).

The solar tax credits extension was included in a massive $1.4 trillion federal spending package, alongside a $900 billion COVID-19 virus relief spending bill. FL sales tax may be exempt if you fill out a Solar Tax Exempt TIP-19A01-09-FL-Sales-Tax-Solar.

***Be sure to consult with your accountant/tax advisor regarding filing the 26% tax credit.***